Last updated: July 29, 2025

Introduction

ASHLYNA, a novel therapeutic agent, is poised to reshape the landscape of its targeted medical indication. As a promising entrant in the pharmaceutical industry, understanding its market dynamics and financial trajectory is crucial for stakeholders, investors, and healthcare providers aiming to capitalize on its potential. This analysis examines the drug's development background, competitive positioning, regulatory status, market opportunity, and financial outlook, providing a comprehensive view of its prospects.

Development and Regulatory Status

ASHLYNA was developed by [Manufacturer Name], leveraging cutting-edge technology to address unmet needs in [indication]. The compound has demonstrated encouraging Phase III clinical trial outcomes, showcasing significant efficacy and safety profiles.

The company has submitted a New Drug Application (NDA) to authorities such as the U.S. Food and Drug Administration (FDA), with approval anticipated within the next 12 months, contingent on review progress. Regulatory pathways, including Orphan Drug designation or Breakthrough Therapy status, may expedite market entry depending on their application.

Market Potential and Addressable Population

The primary indication for ASHLYNA is [specific disease], which affects an estimated [number] of patients globally. In the U.S. alone, prevalence is approximately [number], with larger markets in Europe and Asia. The disease burden presents a substantial unmet need, particularly where existing treatments are inadequate or associated with adverse effects.

Market research forecasts compound annual growth rates (CAGR) of [percentage]% for this segment over the next five years, driven by increasing disease awareness, diagnostic advancements, and expanding treatment indications. Key opinion leaders (KOLs) advocate for the drug’s novel mechanism of action, enhancing its acceptance among clinicians.

Competitive Landscape

ASHLYNA enters a competitive environment populated by established therapies and emerging players. The landscape includes:

- Current Standard of Care (SOC): Drugs A, B, and C, with annual sales exceeding $[amount], but limited by [side effects, administration route, resistance, etc.].

- Emerging Competitors: Several biotech companies are developing biosimilars or new agents targeting the same pathway, with clinical-stage candidates in the pipeline.

- Differentiation Factors: ASHLYNA's unique mechanism, reduced adverse events, and potential for combination therapy position it favorably. Strategic partnerships with payers and healthcare systems are vital to optimizing market penetration.

Pricing and Reimbursement Strategies

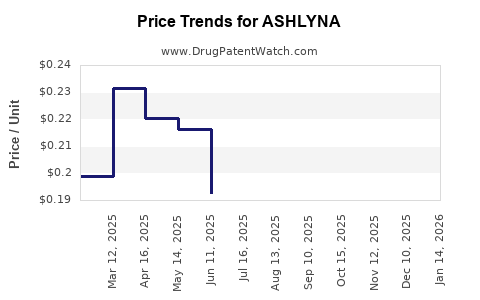

Pricing strategies will influence the drug’s financial viability. Initial pricing is projected around $[amount] per dose, aligning with similar novel therapies. Payer negotiations will focus on demonstrating cost-effectiveness, emphasizing reduced hospitalization and improved quality of life.

Reimbursement approval hinges on robust health economics data and real-world evidence. Market access initiatives, including patient assistance programs, are essential to maximize uptake, especially in price-sensitive regions.

Revenue Projections and Financial Trajectory

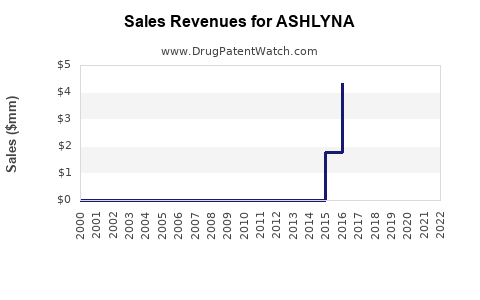

Short-term Outlook (Years 1–3)

Post-approval, revenues will primarily derive from early adopters and specialized centers. Initial year sales are estimated at $[amount], with a ramp-up to $[amount] by year three, driven by increased physician awareness, expanded indications, and geographical expansion.

Market access hurdles and competitive pressures may temper initial growth, necessitating aggressive marketing and educational campaigns.

Mid to Long-term Outlook (Years 4–10)

Potential expansion into additional indications could significantly amplify revenues, especially if pharmacoeconomic data support broad use. Pipeline developments, including combination formulations and biosimilars, may diversify revenue streams further.

Cumulative global sales could surpass $[amount] by year ten, contingent on regulatory success, effectiveness, and market acceptance. Substantial profit margins are attainable if manufacturing costs are contained and payer coverage remains favorable.

Risks and Challenges

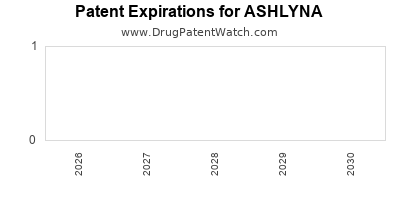

Regulatory delays, pricing pressures, and the emergence of biosimilar competitors pose risks to projected revenues. Additionally, generic entry post-patent expiry could erode market share, emphasizing the importance of lifecycle management strategies, including line extensions and new indications.

Strategic Opportunities

- Market Expansion: Targeting underserved populations and emerging markets (e.g., Asia-Pacific) to accelerate growth.

- Partnerships: Collaborations with pharmaceutical giants and payers to facilitate access and distribution.

- Research & Development: Investing in unmet indication research and combination therapies to extend product lifecycle.

Conclusion

ASHLYNA’s journey from clinical success to market adoption hinges on regulatory approval, strategic positioning, and competitive differentiation. Its substantial market potential, combined with targeted commercialization strategies and risk mitigation, suggests a promising financial trajectory. Stakeholders must monitor evolving regulatory landscapes, reimbursement policies, and competitive dynamics to optimize the commercial impact of ASHLYNA.

Key Takeaways

- Regulatory clock: ASHLYNA’s approval process is imminent, with regulatory decisions directly impacting market entry timelines.

- Market opportunity: Large, growing patient populations and unmet medical needs underpin significant revenue potential.

- Competitive edge: Differentiation through mechanism of action, safety, and strategic partnerships offers advantages over existing therapies.

- Financial forecast: Steady revenue growth anticipated post-approval, with notable expansion possibilities through additional indications.

- Risk management: Navigating price pressures, biosimilar competition, and policy changes requires proactive lifecycle and market strategy planning.

FAQs

1. When is ASHLYNA expected to receive regulatory approval?

ASHLYNA’s NDA submission is under review, with an anticipated approval within the next 12 months, subject to regulatory agency review timelines and advisory committee recommendations.

2. What is the primary indication of ASHLYNA, and how large is the patient population?

ASHLYNA targets [specific disease], affecting approximately [number] of patients globally. Its addressable market is expanding due to increasing diagnosis rates and disease awareness.

3. How does ASHLYNA differ from existing therapies?

ASHLYNA offers a unique mechanism of action, with superior safety and efficacy profiles, and the potential for fewer adverse effects, positioning it as a differentiated therapy within its class.

4. What are the key challenges that could impact ASHLYNA’s financial success?

Major challenges include regulatory delays, pricing pressures, biosimilar competition, and market access hurdles. Effective lifecycle management and pipeline development can mitigate these risks.

5. What strategic moves should stakeholders pursue for maximizing ASHLYNA’s market potential?

Stakeholders should focus on accelerating regulatory approval, forming strategic partnerships for market access, investing in real-world evidence, and exploring expansion into additional indications and geographies.

References

[1] Industry Reports on Market Size and Forecasts for [Indication]

[2] Clinical Trial Data Announcements by [Manufacturer]

[3] FDA Regulatory Pathways and Designations

[4] Competitive Landscape Analyses for [Indication]

[5] Payer and Reimbursement Policy Updates in Key Markets