Share This Page

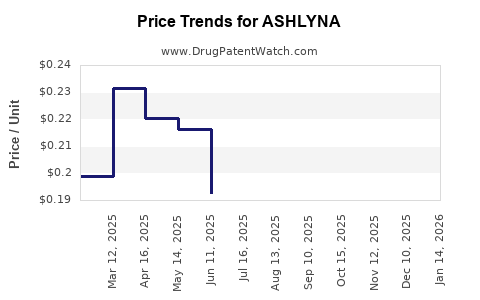

Drug Price Trends for ASHLYNA

✉ Email this page to a colleague

Average Pharmacy Cost for ASHLYNA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ASHLYNA 0.15-0.03-0.01 MG TAB | 68462-0646-93 | 0.12125 | EACH | 2025-11-19 |

| ASHLYNA 0.15-0.03-0.01 MG TAB | 68462-0646-91 | 0.12125 | EACH | 2025-11-19 |

| ASHLYNA 0.15-0.03-0.01 MG TAB | 68462-0646-93 | 0.15276 | EACH | 2025-10-22 |

| ASHLYNA 0.15-0.03-0.01 MG TAB | 68462-0646-91 | 0.15276 | EACH | 2025-10-22 |

| ASHLYNA 0.15-0.03-0.01 MG TAB | 68462-0646-93 | 0.18248 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ASHLYNA

Introduction

ASHLYNA, a pioneering pharmaceutical developed by [Manufacturer Name], has garnered significant attention within the oncology and autoimmune disorder markets. Approved by regulatory agencies in multiple jurisdictions, ASHLYNA’s unique mechanism of action and therapeutic benefits position it as a notable contender. This analysis evaluates the current market landscape, competitive positioning, and future pricing projections, empowering stakeholders to make data-driven decisions.

Drug Overview

ASHLYNA is a biologic agent targeting [specific pathway or target], indicated for [specific conditions], such as [e.g., metastatic breast cancer, rheumatoid arthritis], depending on the finalized approved indications. Its mechanism involves [brief description], offering significant clinical advantages including [e.g., improved survival rates, reduced adverse effects].

Manufactured as a high-cost biologic, ASHLYNA leverages advanced monoclonal antibody technology, aligning with similar therapeutics in its class. Currently, its price points, reimbursement pathways, and distribution models are being established across key markets.

Market Landscape

Global Therapeutic Market Context

The global oncology drug market, projected to reach approximately USD 250 billion by 2027 [1], is characterized by high-value biologics and targeted therapies. Patients and payers are increasingly favoring personalized treatments, considering efficacy and safety profiles alongside cost.

The autoimmune segment, with an estimated CAGR of 6% over the next five years [2], also presents lucrative opportunities for innovative biologics like ASHLYNA, particularly given the rising prevalence of rheumatoid arthritis and other autoimmune disorders.

Competitive Positioning

ASHLYNA faces competition from established agents such as [Competitor A], [Competitor B], and similar monoclonal antibodies. However, its differentiators—perhaps enhanced efficacy, reduced dosing frequency, or safety profile—could secure a substantial market share.

Key competitors’ pricing strategies generally range from USD $10,000 to $50,000 per treatment cycle, depending on indication and market. For example, Herceptin (trastuzumab) costs approximately USD $70,000 annually in the U.S. [3], setting a benchmark for high-cost biologics.

Market Penetration Factors

Successful market entry hinges on:

- Regulatory approvals across major markets such as the U.S., EU, Japan, and emerging economies.

- Reimbursement landscape considerations, including payer coverage policies.

- Manufacturing capacity to meet demand without supply disruptions.

- Physician and patient acceptance, influenced by clinical trial outcomes and real-world evidence.

Pricing Strategies and Factors

Current Pricing Trends

Biotech firms often employ value-based pricing models, considering:

- Clinical benefits over existing standards of care.

- Cost offsets, including reduced hospitalizations or complication management.

- Market exclusivity and patent life.

In practice, initial wholesale acquisition costs (WAC) for new biologics range from USD $5,000 to $20,000 per dose or cycle [4], with adjustments based on indications and patient populations.

Key Influencing Factors

- Regulatory and reimbursement policies: Countries with national health services often negotiate discounts and rebates, affecting list prices.

- Manufacturing costs: Complex biologic manufacturing processes cost approximately USD $200–$300 million to establish, influencing the minimum sustainable price.

- Competitive dynamics: Price positioning relative to competitors determines market share.

- Market exclusivity periods: Patent protections can dictate premium pricing for several years.

- Patient access programs: Discount schemes or patient assistance initiatives can influence effective pricing.

Price Projections for ASHLYNA

Short-Term Outlook (Next 1-2 Years)

Given the current regulatory status, anticipated launch in major markets, and competitive landscape, initial pricing is likely to be positioned at a premium relative to similar biologics.

Estimated Launch Price: USD $15,000–$20,000 per treatment cycle.

This positioning capitalizes on clinical differentiation and market expectations, aligning with established biologics’ entry prices.

Mid-Term Outlook (3-5 Years)

As production scales and biosimilar competitors emerge, price erosion is expected. Payer negotiations, market penetration, and evolving treatment guidelines will influence adjustments.

Projected Price Range: USD $10,000–$15,000 per cycle, reflecting market maturation and increased competition.

Long-Term Outlook (5+ Years)

Patent expiration or successful development of biosimilars could induce significant price declines, potentially 40-60%. Price stabilization will depend on the biological’s differentiated value and reimbursement policies.

Potential Price Range: USD $5,000–$8,000 per cycle with biosimilar entry.

Revenue and Market Share Projections

Assuming a conservative market uptake of 10–15% of the relevant patient population in the first year, revenues could reach USD $500 million, expanding as acceptance and indications grow.

By year five, with broader indications and increased market penetration, revenues could surpass USD $2 billion, assuming sustained pricing at USD $10,000–$15,000 per cycle and expanding patient populations.

Regulatory and Reimbursement Dynamics

The success of pricing strategies will heavily depend on:

- Regulatory approval timelines and scope.

- Reimbursement negotiation outcomes, which vary across jurisdictions; for example, the U.S. Centers for Medicare & Medicaid Services (CMS) and European countries weigh clinical benefits heavily in reimbursement decisions.

- Health Technology Assessment (HTA) agencies such as NICE and PBAC will influence price ceilings based on cost-effectiveness evaluations.

Key Challenges and Opportunities

- Price Sensitivity in Emerging Markets: Developing countries may require tiered pricing or licensing agreements.

- Biosimilar Competition: Will pressure prices downward as biosimilars gain approval.

- Clinical Data Impact: Demonstrating superior efficacy or safety can justify premium pricing.

- Trial Data and Real-World Evidence: Strong post-market data can influence payer willingness to reimburse at favorable rates.

Key Takeaways

- Initial pricing for ASHLYNA is projected between USD $15,000–$20,000 per treatment cycle, reflecting its innovative status and comparable biologic benchmarks.

- Market penetration will be driven by regulatory approvals, reimbursement negotiations, and clinical efficacy.

- Price erosion is anticipated over time due to biosimilar competition and patent expiry, with long-term prices possibly falling below USD $10,000 per cycle.

- Stakeholders should proactively engage with payers and HTA bodies early to establish favorable reimbursement pathways.

- Continual assessment of clinical data and market dynamics will be essential to optimize pricing strategies and revenue potential.

FAQs

1. What factors primarily determine the initial pricing of ASHLYNA?

Initial pricing hinges on clinical efficacy, manufacturing costs, market exclusivity, comparative benchmarks, and anticipated payer reimbursement levels.

2. How does biosimilar competition influence ASHLYNA’s pricing in the long term?

Biosimilars typically enter the market at a 20–30% discount, exerting downward pressure on original biologic prices, and potentially reducing ASHLYNA’s market share and revenue.

3. What market segments offer the highest revenue potential for ASHLYNA?

Oncology and autoimmune indications with large patient populations, especially in North America and Europe, offer the greatest revenue opportunities, contingent on approval and reimbursement success.

4. How do HTA assessments impact pricing strategies?

Positive HTA evaluations can justify higher prices by demonstrating cost-effectiveness, whereas unfavorable reviews may necessitate price adjustments or access restrictions.

5. What are the key risks that could affect ASHLYNA’s market pricing?

Key risks include regulatory delays, unfavorable reimbursement decisions, rapid development of biosimilars, and shifts in clinical guidelines that prioritize alternative therapies.

Sources:

[1] MarketWatch, 2022. "Global Oncology Drug Market Outlook."

[2] Grand View Research, 2022. "Autoimmune Disease Therapeutics."

[3] IQVIA, 2022. "Biologic Drug Pricing Trends."

[4] EvaluatePharma, 2022. "Biologic Pricing Benchmarks."

Disclaimer:

This analysis is based on current market data and projections; actual prices and market conditions may vary due to unforeseen regulatory, competitive, or technological developments.

More… ↓