Last updated: July 29, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: ARISTOCORT A

Introduction

ARISTOCORT A, a corticosteroid-based pharmaceutical, is primarily used in treating inflammatory and autoimmune conditions. Its active ingredient, prednisone acetate, has established prominence due to its effectiveness and versatile therapeutic applications. The drug’s market dynamics and financial trajectory are shaped by factors ranging from clinical efficacy and regulatory landscape to competitive pressures and emerging therapeutic alternatives. Analyzing these elements provides critical insights for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Pharmacological Profile and Therapeutic Applications

ARISTOCORT A belongs to the corticosteroid class, specifically designed to exert potent anti-inflammatory and immunosuppressive effects. Its pharmacokinetics favor quick absorption and sustained action, making it suitable for acute and chronic inflammatory conditions. Common indications include asthma, rheumatoid arthritis, allergic reactions, and dermatological disorders. The drug’s broad applicability drives steady demand in both developed and emerging markets.

The drug’s efficacy, combined with well-documented safety profiles, positions it as a staple corticosteroid. Nevertheless, the rise of biologics and targeted therapies introduces competitive pressure, especially in autoimmune diseases, where newer agents offer improved safety and efficacy profiles.

Competitive Landscape and Market Share

The corticosteroid segment is highly competitive, comprising generic formulations and branded products. ARISTOCORT A faces competition from other corticosteroids like dexamethasone, methylprednisolone, and prednisolone, which vary in potency and pharmacodynamics. Additionally, regional players in emerging markets often offer cost-effective alternatives, impacting market penetration and profitability for ARISTOCORT A.

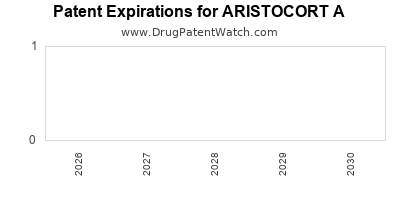

In mature markets, brand loyalty and established prescriber preferences sustain demand, yet downward pricing pressure persists due to the prevalence of generics. The patent expiry of ARISTOCORT A’s formulations in some jurisdictions further accelerates generic competition, affecting revenue streams (although some formulations benefit from patent protection or regulatory exclusivities).

Furthermore, the altered landscape owing to biosimilars and biologic therapies presents threats and opportunities. While these newer therapies target specific pathways with potentially superior safety profiles, they tend to be costly, influencing payor and patient choices.

Regulatory and Patent Strategies

Regulatory environments significantly influence ARISTOCORT A’s market performance. Stringent approval processes, such as those in the US (FDA) and Europe (EMA), require continuous safety and efficacy data, impacting time-to-market and post-marketing commitments.

Patent protections play a pivotal role in safeguarding market share. Companies often seek regulatory exclusivity periods, especially for novel formulations or delivery mechanisms. Once these protections expire, the introduction of generic equivalents typically results in rapid volume declines. Interestingly, reformulation or combination therapies can extend lifecycle management.

Market Drivers and Constraints

Drivers:

- Prevalence of Inflammatory Conditions: Rising incidences of asthma, allergic diseases, and autoimmune disorders sustain consistent demand.

- Global Aging Demographics: An aging population tends to have increased corticosteroid usage, propelling growth.

- Expanding Access in Emerging Markets: Increased healthcare infrastructure facilitates prescription growth in regions such as Asia-Pacific, Latin America, and Africa.

- Generic Market Penetration: Competitive pricing of generics ensures affordability and wider reach, especially in price-sensitive markets.

Constraints:

- Safety Concerns: Long-term corticosteroid use is associated with adverse effects like osteoporosis, hyperglycemia, and adrenal suppression, prompting prescriber caution.

- Emergence of Biologics: Targeted therapies with fewer systemic effects threaten corticosteroid dominance in certain indications.

- Regulatory Hurdles: Stringent compliance and evolving regulatory standards increase market entry barriers, especially in multi-country launches.

- Pricing Pressures: Healthcare cost containment measures in developed countries limit pricing flexibility and profit margins.

Financial Trajectory and Revenue Potential

ARISTOCORT A’s financial pathway hinges on several crucial factors. In mature markets, revenues are expected to stabilize or decline marginally due to patent cliffs and generic competition. Conversely, in emerging markets, rapid growth is anticipated owing to increased adoption and expanding healthcare access.

Revenue Streams:

- Branded Sales: Maintained through market differentiation and clinical positioning.

- Generics and Biosimilars: These represent significant revenue generators following patent expiration.

- War Chest for Lifecycle Management: Investment in reformulations, combination therapies, and new indications can prolong profitability.

Forecasting Trends:

Studies estimate a compound annual growth rate (CAGR) of 2-4% for corticosteroids globally over the next five years, driven predominantly by emerging markets and non-branded portfolios. However, the growth may be offset by declining market share in high-income countries due to Brand erosion and competition (notably from biologics).

Risks and Opportunities:

- Risks: Regulatory delays, price erosions, and competitive threats from biologics.

- Opportunities: Formulation improvements, increased penetration, and expanding therapeutic indications can bolster long-term revenues.

Future Outlook and Investment Considerations

As healthcare systems globally prioritize cost-effective and targeted therapies, ARISTOCORT A’s future hinges on strategic positioning. Companies investing in lifecycle extension, such as reformulations or combination therapies, are likely to sustain revenue streams. Additionally, tapping into emerging markets with tailored marketing and affordability strategies offers substantial upside.

Furthermore, emerging data on corticosteroid-related adverse effects may influence prescriber behavior, necessitating innovative delivery forms or dose-sparing formulations. The integration of digital health tools for patient management and adherence could also add value and improve financial performance.

Nevertheless, the overarching threat from novel biologics suggests that ARISTOCORT A’s financial trajectory will be characterized by gradual growth, stabilization, and eventual decline as the therapeutic landscape evolves. Proactive patent management, strategic alliances, and continuous R&D are essential to sustain competitiveness.

Key Takeaways

- Market Landscape: ARISTOCORT A remains a staple corticosteroid with a broad and stable demand, particularly in emerging markets. However, competition from generics and biologics continues to shape its financial outlook.

- Growth Drivers: Increasing prevalence of inflammatory diseases, aging populations, and expanding healthcare access propel demand, especially outside mature markets.

- Challenges: Safety concerns, patent expirations, and newer therapies pose threats, necessitating innovation and lifecycle management.

- Financial Strategy: Diversification through reformulations, indications, and geographic expansion can prolong revenue streams amid declining branded sales in mature markets.

- Outlook: While near-term revenues may stabilize, the long-term trajectory will depend on strategic adaptations to evolving regulatory, competitive, and technological landscapes.

FAQs

1. How does patent expiration impact ARISTOCORT A’s market share?

Patent expirations open the market to generic competitors, often leading to significant price erosion and volume shifts, thereby reducing revenue for original patent-held formulations. However, lifecycle management strategies like reformulations can mitigate this impact.

2. What are the primary competitive threats to ARISTOCORT A?

The main threats include generic corticosteroids, biologic therapies offering targeted treatment with fewer side effects, and biosimilars, particularly in autoimmune indications.

3. How do regulatory changes influence ARISTOCORT A’s market prospects?

Stringent and evolving regulatory standards can delay approvals, increase compliance costs, and require ongoing safety data, impacting launch timelines and profitability. Regulatory exclusivity periods provide temporary market protection.

4. What opportunities exist for expanding ARISTOCORT A’s market reach?

Emerging markets, with their expanding healthcare infrastructure and demand for affordable treatments, present significant growth opportunities. Reformulating or combining ARISTOCORT A with other agents can also open new therapeutic avenues.

5. How will the rise of biologics affect corticosteroids like ARISTOCORT A?

Biologics offer targeted, often safer options, potentially reducing corticosteroid usage for certain indications. However, corticosteroids will remain relevant due to their cost-effectiveness, especially in resource-limited settings, provided they adapt through innovation.

Sources

[1] GlobalData. “Corticosteroids Market Analysis,” 2022.

[2] U.S. Food and Drug Administration. “Drug Approvals and Patents,” 2023.

[3] IMS Health. “Pharmaceutical Trends in Emerging Markets,” 2022.

[4] EvaluatePharma. “Pharmaceutical Market Forecast,” 2023.

[5] World Health Organization. “Global Burden of Inflammatory Diseases,” 2021.