Last updated: July 28, 2025

Introduction

ARESTIN (minocycline hydrochloride) represents a prominent localized antibiotic designed for the treatment of periodontal disease. Approved by the FDA in 1998, this sustained-release gel is administered as a subgingival implant, offering targeted therapy for periodontal infections. As the dental pharmaceutical market evolves amidst increasing periodontal disease prevalence and expanding dental therapeutics, understanding ARESTIN's market dynamics and financial trajectories becomes crucial for stakeholders. This comprehensive analysis examines current market forces, competitive landscape, regulatory factors, and future growth prospects shaping ARESTIN's financial outlook.

Market Overview and Demand Drivers

The global periodontal market, projected to reach approximately USD 8 billion by 2027, underpins the demand for adjunctive therapies such as ARESTIN. Rising awareness about oral hygiene, increasing periodontal disease prevalence—estimated to affect over 47% of adults worldwide—and aging populations drive sustained demand for localized antimicrobial treatments.

Key Demand Drivers Include:

-

Prevalence of Periodontal Disease: Epidemiological data indicates increasing cases globally, especially among elderly populations, propelling the need for effective antimicrobial interventions like ARESTIN.

-

Adoption of Minimally Invasive Dental Procedures: The shift toward minimally invasive therapy enhances the appeal of localized drug delivery systems over systemic antibiotics, emphasizing ARESTIN's niche.

-

Growing Dental Practice Adoption: An increase in dental visits and periodontal interventions directly correlates with increased prescriptions of ARESTIN, especially as adjunct therapy to scaling and root planing (SRP).

-

Regulatory Emphasis on Antibiotic Stewardship: Stringent regulations around systemic antibiotic use favor localized treatment, positioning ARESTIN as an advantageous option.

Competitive Landscape

Direct Competitors: The periodontal drug market features several alternatives, including other local delivery systems and systemic antibiotics. Key competitors encompass:

- PerioChip (chlorhexidine gluconate implant): Offers antimicrobial activity with a different formulation.

- Elyzol (metronidazole gel): Another localized antimicrobial.

- Advancements in Laser Therapy: Increasingly used for periodontal treatment, potentially competing with drug-based interventions.

Indirect competitors include systemic antibiotics like doxycycline and amoxicillin, though their use is constrained by rising antibiotic resistance concerns and regulatory pressures.

Market positioning: ARESTIN's sustained-release formulation provides advantages in targeted efficacy, reduced systemic side effects, and compliance, which are critical in its competitive positioning.

Regulatory and Reimbursement Factors

The regulatory environment influences ARESTIN’s market trajectory significantly. The FDA approval process for localized antibiotics is streamlined compared to systemic drugs, but evolving guidelines on antibiotic stewardship pose challenges. Efforts to demonstrate efficacy and safety through post-marketing surveillance remain crucial.

Reimbursement policies also shape its financial trajectory. Insurance coverage varies regionally, with USA-based dental insurers providing partial coverage for periodontal interventions, including adjunctive drug therapies. Cost-effectiveness analyses favor ARESTIN owing to improved clinical outcomes and reduced need for repeat procedures.

Market Penetration and Adoption Trends

Despite being approved for over two decades, ARESTIN's market penetration remains moderate, constrained by factors such as:

- Limited Awareness: Among general dentists unfamiliar with localized antimicrobials.

- Provider Preference: Preference for traditional mechanical therapies or laser adjuncts.

- Pricing and Reimbursement Challenges: Affecting adoption rates.

However, recent trends indicate increased adoption driven by evidence-based guidelines endorsing adjunctive antimicrobial therapy and evolving clinical protocols.

Key strategies to boost uptake include:

- Educational Campaigns: Targeting dental professionals to highlight clinical benefits.

- Integration into Clinical Guidelines: Partnering with professional associations to promote evidence-backed usage.

- Product Innovation: Developing formulations with enhanced ease of application or broader spectrum activity.

Financial Trajectory: Revenue Trends and Growth Opportunities

Historical Revenue Performance:

In the early 2000s, ARESTIN achieved robust sales within the US dental market, with peak revenues surpassing USD 200 million annually. However, sales plateaued due to market saturation, generic competition, and shifting clinician preferences.

Current Financial Outlook:

Recent years show modest growth prompted by incremental adoption in emerging markets and strategic partnership endeavors. The global dental antibiotics market is expected to grow at a CAGR of approximately 6% (2022–2027)[1], which will influence ARESTIN's revenues accordingly.

Growth Drivers:

- Expansion into Emerging Markets: Increasing healthcare spending and improving dental infrastructure present opportunities.

- New Indication Approvals: Potential expansion into other localized oral infections could unlock additional revenue streams.

- Product Portfolio Diversification: Developing combination therapies or integrating into broader periodontal treatment kits.

Challenges to Revenue Growth:

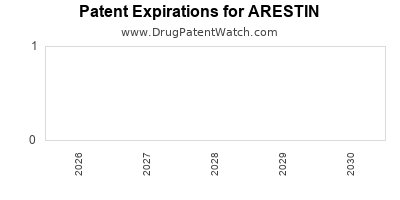

- Patent Expiry and Generic Competition: Although ARESTIN enjoyed exclusivity, existing patents have approached expiration, leading to potential generic manufacturing.

- Market Saturation: US and European markets are nearing maturity, necessitating penetration into growth markets for sustained revenue.

Forecast:

Analysts project a compound annual growth rate (CAGR) of 3–4% over the next five years, assuming successful market expansion and routine clinical adoption. Revenue streams are expected to stabilize absent significant innovation or pipeline diversification.

Intellectual Property and Patent Considerations

The original patents protecting ARESTIN expired in the late 2000s, prompting generic manufacturers to introduce comparable formulations, thereby pressuring pricing and margins. Companies maintaining exclusivity through secondary patents and formulation innovations can sustain profitability longer.

Recently, initiatives to develop next-generation sustained-release delivery systems or combination therapies could extend lifecycle value. Patent litigation and licensing agreements require ongoing attention for strategic advantage.

Future Outlook and Market Opportunities

Emerging opportunities include:

- Integration with Digital Dentistry: Connecting localized treatments with digital diagnostics for targeted therapy.

- Personalized Periodontal Therapy: Utilization of microbiome profiling could tailor antimicrobial therapies, elevating ARESTIN’s relevance.

- Combined Therapeutics: Development of formulations combining minocycline with other agents, such as anti-inflammatory compounds, broadens potential markets.

- Regulatory Advances: Navigating approval pathways for adjunct indications could expand addressable patient populations.

The COVID-19 pandemic temporarily hindered dental procedures, but recovery phases are likely to catalyze renewed demand for effective localized therapies, positioning ARESTIN favorably if backed by strong marketing and clinical evidence.

Conclusion

Market dynamics for ARESTIN reflect a mature yet evolving landscape characterized by incremental growth, competitive pressure, and regulatory challenges. The drug’s financial trajectory hinges on strategic market expansion, pipeline innovation, and clinician education. With periodontal disease prevalence projected to rise alongside dental industry shifts toward minimally invasive therapy, ARESTIN’s role as a targeted antimicrobial remains relevant. However, sustained profitability will depend on navigating patent expiries, fostering adoption, and leveraging emerging technological integrations.

Key Takeaways

- Growing Demand: Increasing incidence of periodontal disease and preference for minimally invasive therapies support continued relevance.

- Competitive Positioning: While facing generic competition, ARESTIN’s sustained-release formulation offers clinical advantages.

- Market Challenges: Patent expiries and limited dental professional awareness constrain growth; strategic marketing is essential.

- Revenue Outlook: Moderate growth anticipated, contingent on market expansion into emerging regions and pipeline innovation.

- Strategic Opportunities: Product diversification, regional expansion, and integration with digital technologies can unlock future growth.

FAQs

1. What factors primarily influence ARESTIN’s market share?

Market share depends on clinician awareness, reimbursement policies, patent status, competitive alternatives, and clinical guideline endorsements.

2. How does patent expiration affect ARESTIN’s financial prospects?

Patent expiry opens the market to generics, which typically reduce prices and margins. Maintaining rights through secondary patents and innovation becomes essential.

3. Are there upcoming regulations that could impact ARESTIN’s sales?

Yes. Increasing emphasis on antibiotic stewardship and regulatory scrutiny over antimicrobial use could hinder sales if not aligned with new guidelines.

4. What growth strategies can enhance ARESTIN’s market penetration?

Targeted marketing, clinician education, expanding indications, and entering emerging markets are effective tactics.

5. What role does pipeline innovation play for ARESTIN’s future?

Developing combination therapies, improved formulations, and novel delivery systems is critical for extending product lifecycle and expanding therapeutic applications.

References

[1] MarketsandMarkets. "Dental Consumables & Equipment Market by Product, Application, and Region – Global Forecast to 2027."