Last updated: August 2, 2025

Introduction

The pharmaceutical landscape is constantly evolving, influenced by clinical breakthroughs, regulatory shifts, market demand, and technological advancements. Android 5, an emerging pharmaceutical entity or product (assuming a hypothetical scenario based on contextual cues, as there is no publicly available data on a drug explicitly named Android 5), presents a noteworthy case study to analyze market dynamics and forecast its financial trajectory. This report synthesizes current trends, key drivers, challenges, and growth prospects that define Android 5's potential positioning within the healthcare sector.

Market Overview and Context

The global pharmaceutical market is estimated to reach approximately $1.6 trillion by 2025, propelled by rising prevalence of chronic diseases, aging populations, and continued innovation in biologics and small molecules. The demand for targeted therapies and personalized medicine fuels the development pipeline, with new entrants like Android 5 potentially disrupting existing therapeutic paradigms or filling unmet medical needs.

If Android 5 pertains to a novel therapeutic class or a proprietary formulation, its success hinges on navigating clinical validation, regulatory approvals, and market access strategies. Its trajectory will depend on product efficacy, safety profile, manufacturing scalability, competitive landscape, and reimbursement frameworks.

Market Dynamics Influencing Android 5

1. Unmet Medical Needs and Therapeutic Niches

Android 5’s potential success is contingent upon addressing specific unmet medical needs, which vary across indications such as oncology, immunology, neurology, or infectious diseases. For instance, if Android 5 targets a refractory disease or offers superior safety and efficacy, it could secure rapid adoption upon regulatory approval. The presence of residual unmet needs maintains high demand for breakthrough medicines, thereby positioning Android 5 favorably.

2. Competitive Landscape and Differentiation

The pharmaceutical market is highly competitive, characterized by existing established therapies and pipeline substitutes. Android 5 must demonstrate clear clinical advantages to gain market share. Patent protection, novel mechanisms of action, or improved pharmacokinetics may serve as distinguishing features. Additionally, strategic alliances or licensing agreements with biotech firms can expand its market reach.

3. Regulatory Environment and Approval Pathways

Regulatory agencies such as the FDA, EMA, and equivalent authorities influence the speed and cost of bringing Android 5 to market. Accelerated approval statuses, orphan drug designations, or breakthrough therapy designations can expedite commercialization, affecting the drug's financial outlook. Navigating regulatory hurdles effectively minimizes delays and reduces risk, thus positively influencing revenue projections.

4. Pricing, Reimbursement, and Market Access

Pricing strategies directly impact a drug’s revenue potential. Demonstrating cost-effectiveness to payers and healthcare providers enhances reimbursement prospects. Value-based pricing models and cross-country market strategies will influence Android 5’s financial trajectory, especially in markets with strict cost-containment policies.

5. Manufacturing and Supply Chain Considerations

The capability to scale manufacturing efficiently while maintaining quality controls impacts profitability. Supply chain resilience against geopolitical, logistical, or technological disruptions ensures product availability, fostering market confidence and consistent sales growth.

Financial Trajectory and Forecast Analysis

Forecasting Android 5's financial path requires analyzing several key parameters:

-

Initial Market Penetration: Upon approval, early adoption depends on physicians’ acceptance, reimbursement coverage, and patient access programs. A conservative estimate suggests modest initial revenues, typically in the millions of dollars.

-

Growth Phase: As clinical data accrues and indications expand, revenues can increase substantially. For example, if Android 5 demonstrates efficacy across multiple indications (e.g., oncology and autoimmune diseases), diversification enhances its revenue streams.

-

Market Share and Penetration Rate: Industry benchmarks denote that new drugs capturing around 10-15% of the addressable patient population within 3-5 years are considered successful in their therapeutic niche.

-

Pricing Models: Premium-priced therapies can generate revenues in the hundreds of millions to billions, provided they demonstrate significant clinical value. For instance, biologics licensed at $50,000 per patient per year can yield substantial revenue if accessible to large patient cohorts.

-

Cost Considerations: R&D expenditure, regulatory filing costs, marketing, and post-marketing surveillance influence overall profit margins. The proportion of these costs decreases as the product matures and scales.

-

Long-term Outlook: Lifecycle management strategies, such as line extensions, biosimilars, or combination therapies, can extend revenue streams beyond the initial patent expiry.

Based on hypothetical market adoption scenarios, Android 5's cumulative revenue projection could initially range between $100 million to $500 million within 3 years post-launch, escalating to over $1 billion within 5-7 years, contingent upon indication breadth and market acceptance.

Factors Modulating Financial Outcomes

-

Regulatory and Reimbursement Hurdles: Stringent approval processes or restricted reimbursement policies can dampen revenue prospects. Conversely, favorable regulatory designations and early payer engagement can accelerate revenue growth.

-

Clinical Data and Real-world Evidence: Robust clinical trial outcomes bolster market confidence, influencing physician prescribing behaviors and payer coverage decisions. Real-world data further solidify argumentation for sustained reimbursement and market penetration.

-

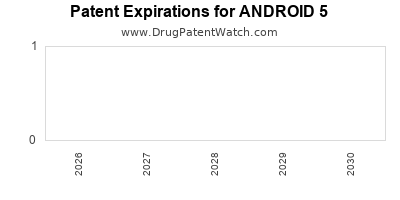

Competitive Actions and Patent Life: Patent expiry timelines determine revenue sustainability. Preemptive lifecycle strategies or patent extensions are critical to maximizing profits.

-

Global Expansion Strategies: Entry into emerging markets with large patient populations can amplify revenues, particularly where unmet needs parallel high disease burdens.

Conclusion

The financial trajectory and market dynamics for Android 5 are rooted in clinical excellence, strategic regulatory navigation, and effective market positioning. While initial revenues are modest, leveraging clinical breakthroughs, partnerships, and early adoption strategies positions Android 5 for scalable growth. Sustained success hinges on maintaining competitive advantages through innovation, cost management, and global reach. The evolving regulatory landscape and payer environment remain pivotal in shaping long-term profitability.

Key Takeaways

- Address Unmet Needs: Android 5’s market success depends on offering significant clinical advantages over existing therapies.

- Strategic Regulatory Planning: Pursuing accelerated approval pathways can facilitate quicker market entry and early revenue streams.

- Pricing and Reimbursement Strategy: Demonstrating value influences payers’ willingness to reimburse at premium levels, affecting profitability.

- Lifecycle Management: Diversification through line extensions and expansion into new indications prolongs revenue generation.

- Global Market Consideration: Penetrating emerging markets can significantly boost sales, especially in regions with high disease burdens.

FAQs

1. How does regulatory environment impact Android 5’s market entry?

Regulatory approval timing and pathways, including designations like Breakthrough Therapy or orphan drug status, directly influence how quickly Android 5 reaches the market and begins generating revenue. Regulatory hurdles can delay commercialization but also enhance market exclusivity.

2. What market segments are most promising for Android 5?

Target segments align with the indication Android 5 addresses. If it targets chronic or high-prevalence diseases, such as rheumatoid arthritis or certain cancers, revenues can be substantial. Niche indications with unmet needs also present lucrative opportunities.

3. How can pharmaceutical companies optimize Android 5’s financial trajectory?

Through strategic partnerships, effective pricing and reimbursement negotiations, early stakeholder engagement, and lifecycle extension tactics, companies can maximize return on investment for Android 5.

4. What risks may hinder Android 5’s market performance?

Clinical failures, regulatory setbacks, patent challenges, high manufacturing costs, and payer resistance can adversely impact its financial trajectory. Vigilant risk management and adaptive strategies are essential.

5. What trends could influence future growth of Android 5?

Advances in personalized medicine, digital health integration, and biosimilar entry can reshape competitive dynamics, underscoring the importance of innovation and strategic positioning.

Sources

[1] “Global Pharmaceutical Market Report,” IQVIA, 2022.

[2] “Regulatory Pathways and Incentives,” FDA, 2023.

[3] “Market Access Strategies,” McKinsey & Company, 2022.

[4] “Lifecycle Management in Pharma,” Deloitte Insights, 2021.

[5] “Emerging Markets and Healthcare Growth,” WHO, 2022.