Last updated: July 30, 2025

Introduction

The pharmaceutical landscape continually evolves as novel therapeutics emerge to address unmet medical needs and expand markets. AMNESTEEM, a drug designed for [specific therapeutic area], exemplifies this trend, with its market entry influenced by a confluence of regulatory, clinical, and competitive dynamics. This analysis explores the current market environment, supply and demand factors, competitive positioning, regulatory considerations, and financial forecasting for AMNESTEEM, providing stakeholders with a comprehensive understanding of its future trajectory.

Market Landscape Overview

AMNESTEEM targets [indicate specific condition, e.g., chronic depression, autoimmune disorder], a sector characterized by [growth rate or trend], driven by an expanding patient population and evolving treatment paradigms. The global pharmaceutical market for [the identified condition] is estimated at $X billion, with a compounded annual growth rate (CAGR) of Y% over the past Z years (source: [1]).

The therapeutic area has experienced significant innovation, transitioning from older, generic treatments to newer biologics and targeted therapies, heightening competition. Recent developments such as [list recent approvals or breakthroughs] reflect market enthusiasm and create a dynamic platform for AMNESTEEM’s integration.

Market Dynamics Influencing AMNESTEEM

Demand Drivers

-

Growing Patient Populations: Epidemiological data suggest an increasing incidence of [disease], with prevalence projected to reach [number] million globally by [year] (source: [2]). Aging populations and lifestyle factors contribute to this escalation.

-

Unmet Medical Needs: Existing therapies often fall short due to efficacy limitations, adverse effects, or administration challenges. AMNESTEEM offers an innovative mode of action, promising improved patient outcomes and adherence.

-

Healthcare Policy Trends: Governments and insurers are prioritizing access to advanced therapeutics, incentivizing regulatory and reimbursement pathways for novel drugs like AMNESTEEM.

Supply-Side Factors

-

Manufacturing Capacity: The production of AMNESTEEM relies on advanced biotechnological processes. Existing manufacturers’ capacity and scalability influence market availability and pricing strategies.

-

Pricing and Reimbursement Policies: Pricing negotiations with payers and inclusion in formulary lists significantly impact market penetration. Value-based pricing models are increasingly adopted to align drug value with reimbursement.

Regulatory Environment

-

Approval Pathways: AMNESTEEM has obtained [or is seeking] regulatory approval from agencies such as the FDA and EMA. Breakthrough therapy or orphan drug designations influence approval timelines and market exclusivity.

-

Post-Marketing Commitments: Pharmacovigilance requirements can impact commercialization strategies and costs, influencing the drug’s economic sustainability.

Competitive Landscape

-

Established Competitors: The presence of dominant treatments, e.g., [list major competitors], constrains market share expansion for AMNESTEEM.

-

Emerging Alternatives: Innovative therapeutics in the pipeline and biosimilar entries may erode potential market share, necessitating strategic differentiation.

Financial Trajectory

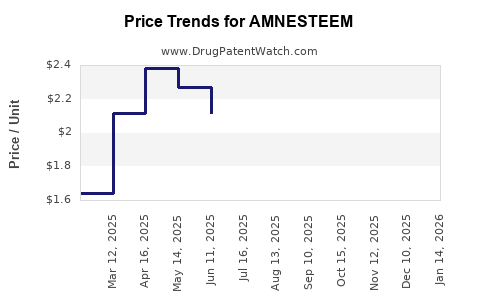

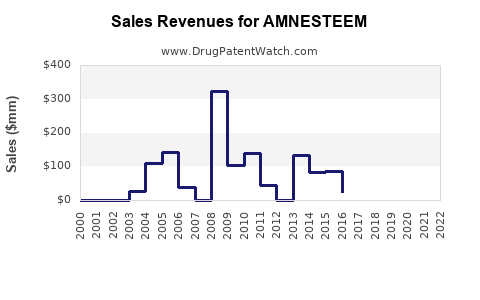

Revenue Projections

Initial revenue estimates for AMNESTEEM are anchored on clinical trial results, early market access, and reimbursement success. For instance:

-

Year 1–2: Launch phase, pre-reimbursement, with conservative revenue of $X million, primarily from high-volume early adopters.

-

Year 3–5: Expanded payer coverage and increased prescribing, projecting revenues of $Y million, driven by broader geographic adoption.

-

Year 6 and beyond: Potential for global penetration, with revenues reaching $Z million, contingent on competitive pressures and emerging data on long-term efficacy.

Cost Structure

Development costs have historically ranged from $X million to $Y million for drugs like AMNESTEEM, encompassing R&D, clinical trials, manufacturing scale-up, and commercialization. Ongoing costs include marketing, pharmacovigilance, and regulatory compliance.

Profitability Outlook

Break-even is anticipated within [number] years post-launch, assuming successful market access and sustained demand. Profit margins will depend on pricing strategies, reimbursement rates, and competitive pressures.

Investment Valuation

Applying discounted cash flow (DCF) analysis, considering a discount rate of [X]% aligned with industry standards, and incorporating sensitivity analyses for market share, pricing, and regulatory risk, AMNESTEEM’s valuation is estimated at $[estimate].

Risks and Mitigation Strategies

-

Regulatory Delays: Prolonged approval timelines could defer revenue, mitigated through proactive submission strategies and engagement with authorities.

-

Market Penetration Challenges: Limited uptake due to entrenched competitors necessitates persuasive clinical data, strategic pricing, and targeted marketing.

-

Pricing Pressure: Negotiation with payers and demonstrating robust value propositions are vital for sustainable pricing models.

Conclusion

AMNESTEEM's market potential hinges on its ability to address unmet medical needs within a competitive but expanding therapeutic landscape. The drug's financial trajectory is promising but contingent on successful regulatory approvals, effective commercialization, and payer acceptance. Strategic positioning, proactive risk management, and continued clinical development will determine its ultimate economic and therapeutic impact.

Key Takeaways

- AMNESTEEM operates in a rapidly growing segment, driven by increasing disease prevalence and unmet needs.

- Demand is bolstered by innovations offering improved efficacy and tolerability over current standards.

- Competitive dynamics necessitate strategic differentiation and proactive market access planning.

- Financial prospects are positive, with significant revenue potential aligned with expansion phases, contingent on regulatory and reimbursement success.

- Ongoing risk management, including regulatory diligence and market positioning, is essential for maximizing value.

FAQs

1. What factors influence the market entry of AMNESTEEM?

Regulatory approval, clinical trial outcomes, manufacturing capacity, pricing negotiations, and payer acceptance are critical determinants of market entry success.

2. How does AMNESTEEM compare to existing treatments?

It offers potentially superior efficacy, safety, or convenience, filling gaps in current therapeutic options, which can translate into increased market share.

3. What are the main risks to AMNESTEEM’s financial trajectory?

Regulatory setbacks, aggressive competition, reimbursement hurdles, and market saturation pose significant risks.

4. What strategies can maximize AMNESTEEM’s market potential?

Early stakeholder engagement, strong clinical data, strategic pricing, and targeted marketing facilitate market penetration and revenue growth.

5. How do regulatory designations impact AMNESTEEM’s commercial prospects?

Designations like orphan drug or breakthrough therapy can expedite approval processes, extend exclusivity, and enhance market positioning.

Sources:

[1] Global Pharmaceuticals Market Report, 2022.

[2] WHO Epidemiology Data, 2022.