Last updated: July 29, 2025

Introduction

AMBIEN CR (zolpidem tartrate extended-release), a prescription medication for insomnia, represents an important segment of the sleep-aid market. As a controlled-release formulation of zolpidem, it is designed to improve sleep maintenance, addressing unmet needs in the sleep disorder therapeutics landscape. This analysis explores the market forces influencing AMBIEN CR’s dynamics, its financial trajectory, and strategic implications for stakeholders.

Market Overview of AMBIEN CR

AMBIEN CR was developed by Sanofi-Aventis (now Sanofi) to cater to patients requiring sustained sleep without multiple dosing. Launched in the early 2000s, it aimed to capitalize on the growing prevalence of insomnia, which affects an estimated 10-30% of adults globally (source: WHO). The drug’s unique extended-release mechanism contributed to its initial strong positioning, standing out against immediate-release formulations.

Market Dynamics

1. Growing Prevalence of Sleep Disorders

The rising incidence of insomnia, driven by factors like aging populations, increased work-related stress, and lifestyle changes, has fueled demand for long-acting hypnotics. According to the American Academy of Sleep Medicine, chronic insomnia affects approximately 10-15% of adults (2017), translating into a substantial patient base for AMBIEN CR and similar therapies.

2. Regulatory Environment and Prescribing Trends

The regulatory landscape significantly influences the pharmacological sleep aid market. Stringent control measures, due to concerns about dependence and abuse—particularly with benzodiazepines and Z-drugs like zolpidem—have shifted prescriber preferences towards medications with favorable safety profiles. The U.S. FDA approved the AMBIEN CR formulation as a Schedule IV controlled substance, requiring cautious prescribing. These regulations impact market accessibility and volume, especially amid increasing scrutiny of sleep medication overprescription.

3. Competitive Landscape

The sleep aid market is highly competitive, dominated by both brand-name drugs and generics. Key competitors for AMBIEN CR include other Z-drugs such as Eszopiclone (Lunesta), Zaleplon (Sonata), and newer agents like suvorexant (Belsomra). The availability of generics for zolpidem immediate-release formulations has pressured branded formulations' market share. However, extended-release variants like AMBIEN CR maintain niche significance, particularly for patients with sleep maintenance issues.

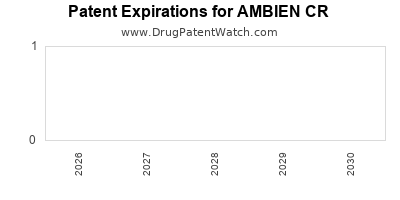

4. Patent and Intellectual Property Considerations

Amid patent expirations, generic versions of zolpidem have entered the market, exerting price competition. Sanofi’s strategic focus on patent extensions and formulation improvements aimed to prolong exclusivity. Nonetheless, legal challenges and patent cliffs have begun to erode AMBIEN CR’s premium positioning, influencing revenue streams.

5. Pharmacovigilance and Safety Concerns

Post-market safety concerns about complex behaviors (sleepwalking, memory impairment) and next-morning impairment have necessitated label updates and risk mitigation. These safety issues influence physician prescribing behaviors and patient adherence, directly impacting sales volume.

Financial Trajectory of AMBIEN CR

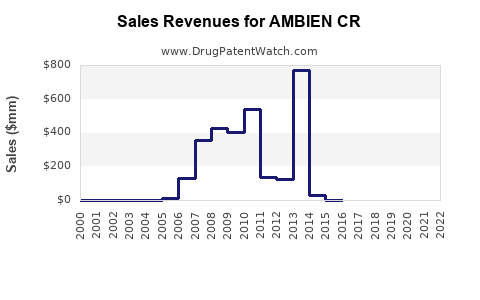

1. Revenue Trends and Market Penetration

Following its initial market entry, AMBIEN CR experienced robust revenue growth driven by unmet medical needs for long-acting sleep aids. Peak sales occurred within the first decade post-launch, with estimates suggesting annual revenues surpassing $1 billion in the early 2010s (source: Sanofi financial reports). However, subsequent years reflected plateauing or declining sales due to patent expiration impacts and market saturation.

2. Impact of Generic Competition

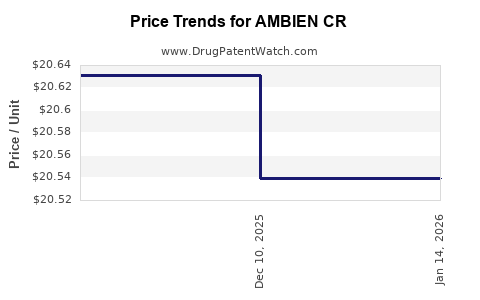

The advent of generic zolpidem formulations led to substantial price erosion. For instance, the introduction of generics in the U.S. around 2017 drastically reduced the price point of zolpidem products, encroaching on AMBIEN CR’s market share. Analyses indicate a decline in branded sales following generic entry, with revenues decreasing by approximately 30-50% over five years (source: IQVIA data).

3. Formulation and Lifecycle Management

Sanofi employed lifecycle management strategies, including formulation improvements and pairings with combination therapies, attempting to sustain profitable sales. Nevertheless, the overall industry trend points toward a shift from branded to generic drugs, constraining revenue growth.

4. Market Forecast and Outlook

Projections suggest that by 2025, the sales of AMBIEN CR and comparable drugs will continue a downward trajectory, in line with broader genericization trends and declining demand due to safety concerns. However, niche markets, such as specific patient populations with refractory insomnia, may sustain limited revenues. The sleep therapeutics market overall is expected to grow modestly, driven by innovation and increasing awareness.

Strategic Factors Influencing Future Financial Trajectory

- Pipeline Innovations: Development of novel sleep agents with lower dependency risks could threaten or complement AMBIEN CR’s market position.

- Regulatory Adjustments: Changes in scheduling or labeling policies could impact prescribing patterns.

- Market Expansion: Emerging markets may offer new growth avenues, contingent on approval and cost considerations.

- Reimbursement and Pricing Policies: Healthcare payers’ strategies to favor generics and biosimilars could further diminish branded revenue streams.

Conclusion

AMBIEN CR’s market and financial trajectory display classic characteristics of originator drugs—robust initial growth followed by decline due to patent expiry and generic competition. While it continues to serve a niche segment, broader industry trends favor generics, compelling Sanofi and other investors to adapt strategies accordingly. Future growth prospects hinge on formulation innovation, market expansion, and evolving regulatory landscapes within sleep medicine.

Key Takeaways

- The insomnia treatment market remains sizeable but highly competitive, with growing demand driven by demographic shifts.

- Patent expiration and generic entry have significantly eroded AMBIEN CR’s market share and revenue.

- Safety concerns and regulatory constraints influence prescribing habits, impacting financial performance.

- Strategic innovation and diversification are essential for sustaining revenue streams amid generic competition.

- Emerging markets and tailored formulations could offer future growth, but price competition remains intense.

FAQs

1. What factors contributed to the decline of AMBIEN CR’s market share?

Patent expiration, the advent of generic zolpidem formulations, safety concerns, and evolving regulatory policies have diminished AMBIEN CR’s exclusive market position.

2. How does AMBIEN CR compare to other sleep medications in terms of safety?

AMBIEN CR, like other Z-drugs, carries risks of sleepwalking, complex behaviors, and next-morning impairment. Its safety profile is comparable but has been subject to additional label warnings following post-market safety reviews.

3. What are the prospects for innovation within the sleep aid market?

Innovations targeting reduced dependency, pharmacokinetic advancements, and non-pharmacological therapies are poised to redefine the market landscape, potentially impacting drugs like AMBIEN CR.

4. How significant is the role of emerging markets for the future sales of AMBIEN CR?

Emerging markets represent potential growth due to increasing awareness and healthcare expansion. However, affordability and regulatory approval are key hurdles.

5. Will AMBIEN CR regain market strength through lifecycle management?

While lifecycle strategies can extend product relevance, the overall trend favors generics. Without significant innovation, AMBIEN CR’s recovery is unlikely, emphasizing the need for novel therapeutic approaches.

Sources

[1] World Health Organization. Insomnia global burden. 2022.

[2] American Academy of Sleep Medicine. Sleep Disorders Statistics. 2017.

[3] Sanofi Financial Reports, 2010–2022.

[4] IQVIA, Prescription Market Data, 2017–2022.

[5] FDA Drug Safety Communications, 2019–2022.