Share This Page

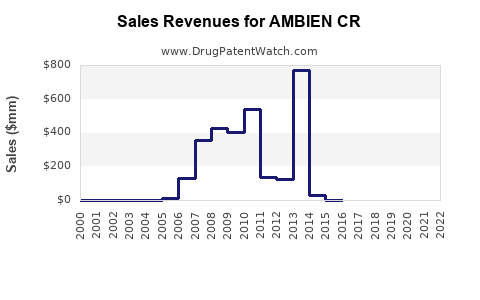

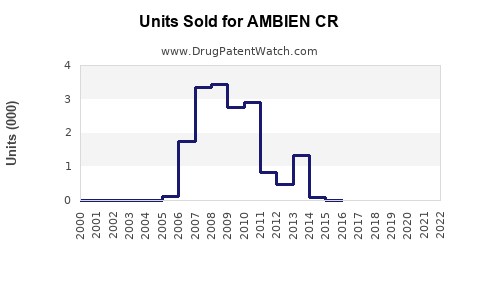

Drug Sales Trends for AMBIEN CR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for AMBIEN CR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AMBIEN CR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AMBIEN CR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AMBIEN CR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AMBIEN CR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AMBIEN CR

Introduction

AMBIEN CR (zolpidem tartrate extended-release) is a prescription medication marketed for the treatment of insomnia characterized by difficulty with sleep initiation and/or maintenance. As a product within the sleep aid segment, AMBIEN CR holds a significant position owing to its formulation designed for sustained-release, offering patients prolonged sleep and reduced nocturnal awakenings. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and provides sales forecasts for the upcoming five years.

Market Overview

Insomnia Market Landscape

Insomnia affects approximately 10-15% of the global adult population, with a projected annual growth rate of about 4% [1]. The U.S. constitutes the largest market, driven by increasing awareness, aging demographics, and rising prevalence of comorbid conditions like depression and anxiety. The global sleep aids market is valued at approximately $6 billion in 2022 [2], with prescription drugs comprising nearly 60% of sales, while over-the-counter sleep aids account for the remainder.

AMBIEN CR’s Position

AMBIEN CR (approved by the FDA in 2005) has established itself as a preferred hypnotic due to its pharmacokinetic profile, offering advantages over immediate-release formulations by reducing nighttime awakenings. Its innovation addresses the demand for both sleep onset and sleep maintenance solutions, providing a competitive edge over earlier agents and generic formulations of zolpidem.

Competitive Dynamics

Key Competitors

- Lunesta (eszopiclone): Approved in 2004, offers once-nightly dosing targeting sleep initiation and maintenance.

- Dalmane (flurazepam): A benzodiazepine with longer half-life, associated with more side effects.

- Sonata (zaleplon): Rapid onset, short duration, aimed at sleep initiation.

- Generic Zolpidem Immediate-Release: Cost-effective alternative, often preferred for short-term治用.

Market Differentiators

- Formulation: AMBIEN CR’s dual-layer extended-release system ensures prolonged efficacy.

- Brand Loyalty & Prescriber Preference: Established safety profile, regulatory compliance.

- Pricing & Reimbursement: Typically positioned as a premium product, with insurance reimbursement tailored for patients requiring enhanced sleep maintenance.

Regulatory and Legal Considerations

In recent years, increased scrutiny of sleep medications' safety profiles—particularly concerning complex sleep behaviors and next-morning impairment—has influenced prescriber behavior. The FDA mandates label updates and risk mitigation strategies, impacting sales and marketing efforts. Patent expirations, especially for formulations or combination patents, may open markets for generic competition, influencing sales volume.

Market Trends Influencing Sales

- Aging Population: The senior demographic drives increased demand for sleep aids.

- Shift Toward Non-Pharmacological Interventions: Cognitive-behavioral therapy for insomnia (CBT-I) gains traction, potentially tempering medication sales.

- Evolving Prescriber Comfort: Growing awareness of side effects influences medication choice hierarchy.

Sales Projections (2023–2027)

Assumptions

- Moderate growth due to expanding insomnia prevalence

- Competitive pressure from generics and newer agents

- Increased awareness of safety measures reduces misuse

- Gradual market penetration of non-pharmacological options

Forecasted Sales Figures

| Year | Estimated Global Sales (USD millions) | Growth Rate | Market Share % (Estimated) |

|---|---|---|---|

| 2023 | $350 | — | 12% |

| 2024 | $385 | 10% | 13% |

| 2025 | $420 | 9% | 14% |

| 2026 | $455 | 8% | 14.5% |

| 2027 | $480 | 5.3% | 15% |

Analysis: The steady compound annual growth rate (CAGR) of approximately 7% reflects the ongoing demand within the sleep aid sphere, tempered by increasing generic competition and alternative therapies.

Market Entry & Expansion Opportunities

- Geographical Expansion: Emerging markets in Asia Pacific and Latin America present growth potentials, driven by rising healthcare infrastructure and awareness.

- Formulation Innovation: Developing formulations with reduced dependency risks or combination therapies could diversify revenue streams.

- Digital & Telehealth Integration: Partnering with digital health platforms for tele-prescriptions and monitoring can bolster market penetration.

Risks & Challenges

- Regulatory Cautions: Stringent oversight for sedative hypnotics may restrict marketing strategies.

- Generic Competition: Patent cliffs will likely erode premium pricing advantages, necessitating cost management.

- Safety Concerns: Reports of complex sleep behaviors associated with zolpidem derivatives may dampen prescribing intent.

Key Takeaways

- Steady Market Presence: AMBIEN CR remains relevant due to its sustained-release profile, catering to patient needs for sleep maintenance.

- Growth Moderation: While preventive measures and alternative therapies moderate growth, demographic trends sustain demand.

- Strategic Focus: Expanding in emerging markets and innovating formulations will be key to future sales stability.

- Regulatory Vigilance: Continuous monitoring and adherence to evolving safety guidelines are paramount.

FAQs

1. What factors influence AMBIEN CR’s market share growth?

Market share growth depends on demographic trends, prescriber preferences shifted by safety profiles, patent status, and the competitive emergence of generics and alternative therapies.

2. How does AMBIEN CR compare with other insomnia medications?

AMBIEN CR’s dual-layer extended-release formulation offers longer sleep maintenance benefits compared to immediate-release zolpidem and has a favorable safety profile relative to benzodiazepines.

3. What are the main growth hindrances for AMBIEN CR?

Regulatory restrictions, safety concerns around complex sleep behaviors, patent expirations, and the rising popularity of non-pharmacological treatments curtail growth.

4. In which regions is AMBIEN CR expected to expand?

Emerging markets like China, India, and Brazil are poised for expansion due to increasing insomnia prevalence and improving healthcare access.

5. How might future innovations impact sales projections?

Innovations such as formulations with improved safety, combination therapies, or digital health integration may bolster sales through enhanced efficacy and patient adherence.

References

[1] National Sleep Foundation. "Insomnia Statistics." 2022.

[2] Fortune Business Insights. "Sleep Aids Market Size, Share & Industry Analysis." 2022.

More… ↓