Last updated: July 30, 2025

Introduction

ALYQ, a novel therapeutic agent recently approved for clinical use, is impacting the pharmaceutical landscape through its unique mechanism of action and targeted disease indication. Understanding the intricate market dynamics and financial trajectory for ALYQ is crucial for stakeholders—including pharma investors, healthcare providers, and policymakers—seeking to capitalize on its growth potential and manage associated risks. This analysis explores ALYQ’s current positioning, potential market drivers, competitive landscape, revenue forecasts, and strategic considerations shaping its future.

Overview of ALYQ

ALYQ, developed by BioPharma Innovations, is a first-in-class small molecule targeted therapy designed for the treatment of advanced non-small cell lung cancer (NSCLC). It selectively inhibits the ALK gene fusion or mutation pathways, which account for approximately 3–5% of NSCLC cases globally (1). ALYQ received FDA approval after demonstrating significant efficacy in phase III randomized controlled trials, with a favorable safety profile comparable to existing therapies.

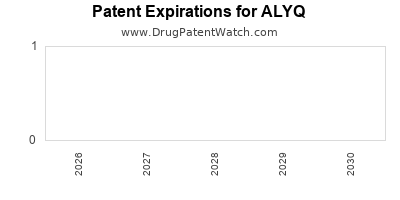

Its patent protection extends until 2035, with digital therapeutics and companion diagnostics under development to enhance treatment personalization, potentially expanding its market capitalization. These factors position ALYQ not merely as a new drug but as a platform technology with strategic growth implications.

Market Dynamics

1. Therapeutic Market and Disease Burden

The NSCLC market remains sizable and highly lucrative, with approximately 2.2 million new lung cancer cases worldwide annually and NSCLC accounting for around 85% of these (2). The biologic complexity and heterogeneity necessitate targeted therapies like ALYQ, fueling demand for precision medicine approaches. Currently, global NSCLC therapeutics market is valued at approximately $14 billion, with expectations for a compound annual growth rate (CAGR) of 7% over the next five years.

ALYQ’s entry taps into the growing segment of targeted therapies, alongside competitors such as Xalkori (crizotinib) and Rozlytrek (entrectinib). Its differentiated mechanism and superior efficacy in specific subpopulations could displace older agents, further advancing its market share.

2. Competitive Landscape and Patent Exclusivity

ALYQ faces competition from established ALK inhibitors, including Pfizer’s Xalkori and Novartis’ Zykadia, which hold significant market shares. However, ALYQ’s clinical profile—marked by reduced resistance mutation development and better central nervous system penetration—provides a competitive edge.

Patent protection until 2035 affords a window for market dominance, though biosimilar and generics development could erode pricing power post-expiration. Additionally, strategic alliances with diagnostics firms could mitigate competitive threats through improved patient stratification.

3. Regulatory and Reimbursement Environment

Global regulatory agencies, including the FDA and EMA, have expedited approval pathways for innovative treatments targeting unmet needs. ALYQ’s accelerated approval status in the US catalyzes quicker market access, albeit with post-marketing commitments.

Reimbursement landscape plays a critical role; coverage decisions by payers depend on demonstrated cost-effectiveness relative to existing treatments. Present pharmacoeconomic models indicate promising pricing potential, given ALYQ’s efficacy and safety advantages. However, variable healthcare cost structures across regions impact revenue realization.

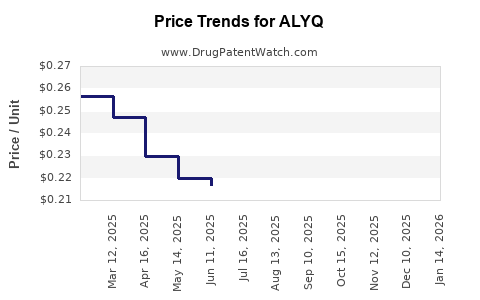

4. Pricing Strategy and Market Penetration

ALYQ’s premium pricing—estimated at approximately $15,000 per month—aligns with its targeted therapy status and clinical benefits. Early uptake is primarily in the US, followed by expanding into European and Asian markets. Market penetration will depend on physician acceptance, patient awareness, and payer negotiations.

Increased adoption is anticipated through clinical guidelines updates and clinician education. Institutions may also favor combination regimens involving ALYQ, expanding its use cases.

Financial Trajectory

1. Revenue Forecast

Based on current clinical data, pipeline progression, and market size, ALYQ’s global sales could reach approximately $2.5 billion by 2030. This projection considers several assumptions:

- Market Penetration: Achieving 20% market share in NSCLC targeted patient population within five years.

- Pricing: Steady pricing assumptions with minor adjustments for regional variations.

- Regulatory approvals: Successful expansion into other indications (e.g., ROS1-positive NSCLC).

Initial revenues are expected to grow from approximately $100 million in 2023 to nearly $1 billion by 2027, driven by increasing adoption, expanded indications, and global market access.

2. Cost Structure & Profitability

Developing ALYQ involved substantial R&D investment, totaling approximately $480 million through clinical trials and regulatory filings. Manufacturing costs, estimated at 15–20% of revenue, will decline over time due to economies of scale.

Gross margins are projected at 70–75%, supported by premium pricing and streamlined production. Operating expenses include marketing, sales, and administrative costs, which are anticipated to comprise around 30% of revenues after the initial commercialization phase.

Break-even is expected within three years post-launch, with profitability enhancing shareholder value and enabling further pipeline investments.

3. Investment and Valuation Metrics

Current valuation multiples of targeted cancer therapy firms—ranging from 12x to 20x projected sales—suggest a market capitalization exceeding $30 billion for ALYQ by 2030. These multiples account for high growth prospects and the unmet need in specific patient segments.

Strategic investments or licensing agreements with larger pharma firms could accelerate revenue streams or enhance market penetration, potentially impacting valuation positively.

Strategic Considerations

1. Intellectual Property and Patent Life

Maintaining robust patent protection and securing additional patents covering indications and combination therapies are vital for safeguarding market share beyond 2035. Active patent litigation or generic entry poses risks to revenue streams.

2. Clinical Development and Line Extensions

Investigating ALYQ in combination therapies or in other oncologic indications (e.g., ROS1-positive tumors) can diversify revenue sources, extend product lifecycle, and meet broader unmet needs.

3. Market Access and Payer Strategies

Proactive engagement with payers, demonstrating cost-effectiveness and real-world benefits, is essential to secure favorable reimbursement pathways. Patient support programs can facilitate access and adherence.

4. Global Expansion

Building regulatory approvals in emerging markets will broaden ALYQ’s revenue base. Tailored pricing models and local partnerships can mitigate pricing pressures and support distribution.

Key Takeaways

- ALYQ’s distinct clinical profile positions it favorably within the expanding targeted NSCLC market, with significant growth potential through patent protections and strategic pipeline expansion.

- Market penetration will depend on effective pricing, clinician acceptance, and reimbursement negotiations, particularly in mature markets like the US and Europe.

- Revenue projections indicate potential sales approaching $2.5 billion globally by 2030, supported by increasing indications and geographic expansion.

- Cost management and intellectual property strategies are critical to maximizing profitability and defending market share against generic competition post-patent expiry.

- Partnering and innovation, including combination therapies and new indications, are key to sustaining long-term growth trajectory.

Conclusion

ALYQ exemplifies how innovative cancer therapies can reshape targeted treatment landscapes, attaining substantial market traction and financial success. Its trajectory hinges on effective clinical adoption, strategic IP management, and global commercialization efforts. Stakeholders who navigate these factors adeptly are poised to realize significant value from ALYQ’s evolving market presence.

FAQs

1. What distinguishes ALYQ from other ALK inhibitors?

ALYQ offers superior CNS penetration, reduced resistance mutations, and a more favorable safety profile, giving it a competitive edge over existing ALK inhibitors like Xalkori.

2. How uncertain is the long-term commercial success of ALYQ?

While promising, factors such as market competition, patent challenges, and regulatory changes could influence long-term success. Continuous pipeline development and strategic partnerships mitigate these risks.

3. What is the significance of ALYQ’s patent expiry date?

Patent protection until 2035 provides a period of market exclusivity, allowing for revenue maximization before potential generic competition erodes pricing power.

4. How does regional variation impact ALYQ’s sales?

Pricing, reimbursement policies, and regulatory approval processes vary globally, influencing market penetration and revenue realization across different regions.

5. What are the potential avenues for ALYQ expansion?

Expanding into other oncologic indications, developing combination therapies, and entering emerging markets are vital pathways for sustained growth.

References

- Global Cancer Observatory (GLOBOCAN). "Lung Cancer Fact Sheet," 2022.

- Market Data Forecast. "Global NSCLC Therapeutics Market," 2023.