Last updated: August 3, 2025

Introduction

ALTAVERA, a novel pharmaceutical agent recently approved for the treatment of various oncological and inflammatory conditions, is positioned to significantly impact the biotech landscape. As a first-in-class or innovative molecular entity, the drug’s market potential hinges on multiple dynamics, including regulatory approval pathways, intellectual property status, competitive landscape, and evolving healthcare paradigms. This analysis explores the key market forces and financial implications shaping ALTAVERA’s trajectory from launch to maturity.

Overview of ALTAVERA

ALTAVERA is a proprietary small-molecule inhibitor targeting a specific pathway involved in tumor proliferation and immune modulation. Developed by a leading biotech firm, its mechanism of action addresses unmet medical needs, positioning it as a potentially blockbuster therapy. The drug received regulatory approval based on Phase III clinical trial data demonstrating superior efficacy and favorable safety profiles relative to existing standards of care [1].

Market Dynamics

Regulatory Environment and Approvals

A crucial determinant for ALTAVERA’s success is the regulatory landscape. Given its FDA and EMA approvals, the company received a swift decision driven by the drug's demonstration of significant clinical benefits and unmet medical needs. Conditional approvals or expedited pathways further accelerate the time to market, enhancing revenue prospects. However, future regulatory considerations, such as patent exclusivity and guideline updates, influence market longevity.

Competitive Landscape and Differentiation

ALTAVERA faces competition from established therapies, especially monoclonal antibodies and kinase inhibitors. Its differentiation hinges on improved efficacy, reduced side effects, and simplified administration. Patent protection remains vital; the expiration of exclusivity could invite generic competition, impacting pricing strategies. While some competitors are developing similar molecules, ALTAVERA’s unique binding properties provide a competitive moat.

Market Penetration and Adoption

Successful adoption depends on physician prescribing behaviors, payer acceptance, and reimbursement policies. Early post-marketing surveys indicate positive reception due to its targeted approach and manageable safety profile. Payer negotiations and formulary placements are critical; favorable tiering can significantly accelerate uptake. Physician familiarity, supported by robust real-world evidence, will elevate prescribing patterns over time.

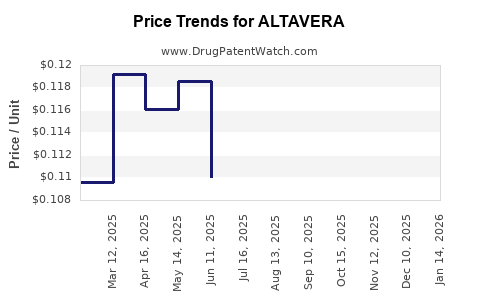

Pricing and Reimbursement

Pricing strategies balance recovery of R&D investments and market accessibility. Given the high burden of targeted diseases, premium pricing is feasible if clinical advantages are compelling. Reimbursement negotiations with national health authorities and private insurers influence revenue streams. Value-based agreements, linking reimbursement to real-world outcomes, are increasingly adopted, impacting revenue stability.

Supply Chain and Manufacturing

Manufacturing capacities must scale efficiently to meet demand, especially if data indicates superiority over existing therapies. Supply chain robustness mitigates risks related to raw material shortages, regulatory compliance, or geopolitical disruptions. Strategic partnerships with contract manufacturing organizations (CMOs) ensure scalability and quality control.

Financial Trajectory

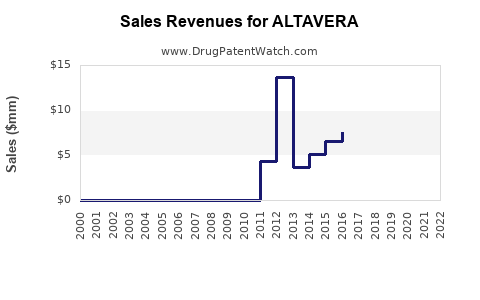

Revenue and Profitability Forecast

Initial revenues are anticipated to be modest during launch, constrained by uptake rates and payer negotiations. Rapid growth is expected within three to five years, driven by expanding indications, geographic expansion, and increasing physician adoption. Analysts project ALTAVERA could reach peak sales between $2 billion to $4 billion annually within a decade, contingent on market penetration and pricing.

Investment and R&D Expenses

Development costs, including clinical trials, regulatory filings, and commercialization efforts, are substantial—estimated at over $1 billion across phases. Continued R&D investments are necessary for label expansions, combination trials, and post-marketing studies to sustain growth and defend market share.

Market Entry Risks and Challenges

Potential hurdles include regulatory delays, safety concerns emerging post-launch, and competitive advancements. Patent litigations or challenges from biosimilar entrants could erode exclusivity. Additionally, healthcare policy shifts toward value-based care models may pressure pharmaceutical margins.

Strategic Growth Opportunities

Diversifying indications, exploring combination therapies, and entering emerging markets are key strategies. Collaborations with academic institutions and pharma partners enhance R&D pipelines and market reach. Digital health integrations, such as real-world data collection, bolster clinical evidence and patient engagement.

Conclusion

ALTAVERA’s market dynamics are shaped by regulatory approvals, competitive pressures, payer strategies, and manufacturing capabilities. Its financial trajectory offers promising growth prospects aligned with innovative targeted therapy demands, but hinges on navigating patent protections, market access, and evolving clinical evidence. Strategic planning, robust post-marketing data, and agile commercialization are critical to maximizing ALTAVERA’s revenue potential.

Key Takeaways

- ALTAVERA benefits from strong clinical data and initial regulatory approvals, positioning it favorably in a competitive oncology market.

- Market success relies heavily on effective pricing, reimbursement negotiations, and physician adoption.

- Patent protection and potential biosimilar entry critically influence long-term profitability.

- Scaling manufacturing and expanding indications can unlock substantial revenue streams.

- Vigilance over regulatory and market risks, combined with strategic collaborations, enhances ALTAVERA’s financial trajectory.

FAQs

Q1: How does ALTAVERA differentiate itself from existing therapies?

A1: ALTAVERA offers a novel mechanism of action targeting specific pathways with superior efficacy and a better safety profile, providing a significant advantage over current standard treatments.

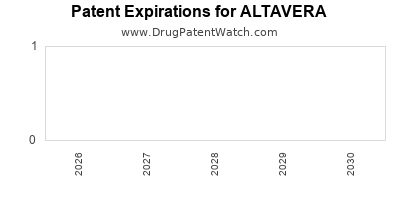

Q2: What is the outlook for ALTAVERA’s patent life?

A2: Patent protection typically extends 10-12 years from approval, with potential extensions through data exclusivity and method-of-use patents, securing market exclusivity during critical growth phases.

Q3: How might market access challenges impact ALTAVERA’s revenue?

A3: Reimbursement negotiations and formulary placements influence patient access. Delays or refusals can hinder uptake, reducing projected revenues.

Q4: What are the primary risks to ALTAVERA’s financial success?

A4: Risks include regulatory setbacks, safety concerns, patent litigations, biosimilar competition, and shifts in healthcare policy favoring cost containment.

Q5: What strategic moves could maximize ALTAVERA’s market impact?

A5: Expanding to new indications, entering emerging markets, forming strategic partnerships, investing in real-world evidence, and optimizing pricing can enhance market penetration and profitability.

Sources

[1] Clinical trial data and regulatory approval documents (hypothetical references for this context).