Last updated: August 7, 2025

Introduction

ALTAVERA, a novel pharmaceutical agent recently approved by regulatory authorities, targets a significant therapeutic area with substantial unmet medical needs. As a potent contender within its category, understanding its market dynamics, competitive positioning, and sales forecast is essential to inform stakeholders, investors, and strategic partners.

Therapeutic Landscape and Market Overview

ALTAVERA addresses an increasingly prevalent condition—[specific condition, e.g., autoimmune disorder, oncology, etc.]—that affects [specific patient population, e.g., millions globally, or specific demographics]. With rising disease incidence, shifting treatment paradigms towards personalized medicine, and unmet clinical needs, this therapeutic area has experienced consistent growth.

The global market for [indicate previous year’s market size, e.g., autoimmune therapeutics] was valued at approximately $X billion and is projected to grow at a compounded annual growth rate (CAGR) of Y% over the next five years, reaching $Z billion by 20XX (source: [1]). Key drivers include advancements in biotech, increased diagnosis rates, and expanding indications for existing treatments.

Competitive Landscape

ALTAVERA will compete predominantly with [competitor drugs, e.g., XYZ, ABC, PQR], which currently dominate the market through established efficacy and safety profiles. However, these treatments present limitations such as [list relevant drawbacks: high costs, adverse effects, limited efficacy in subpopulations, or complex administration].

Emerging therapies, including [list other innovations or entry into the space], are intensifying competitive pressure. Notably, ALTAVERA’s unique mechanism of action—[specific drug attribute, e.g., targeting a novel molecular pathway]—may confer competitive advantages, such as improved efficacy, reduced side effects, or more convenient administration.

Regulatory and Reimbursement Pathways

The approval of ALTAVERA in [region, e.g., North America, EU, Asia-Pacific] sets the stage for market entry. Payer negotiations and reimbursement policies will significantly influence adoption rates. Priority status or orphan drug designation could facilitate faster market penetration, especially if associated with incentives like market exclusivity.

Market Penetration Strategy

Successful commercialization hinges on:

- Physician adoption: Educating specialists via key opinion leaders (KOLs)

- Pricing strategies: Competitive yet sustainable

- Patient access programs: Ensuring affordability

- Distribution channels: Ensuring broad geographic reach

Early launch phases are expected to target [initial key markets, e.g., the US and EU], with subsequent expansion into [emerging markets or additional regions].

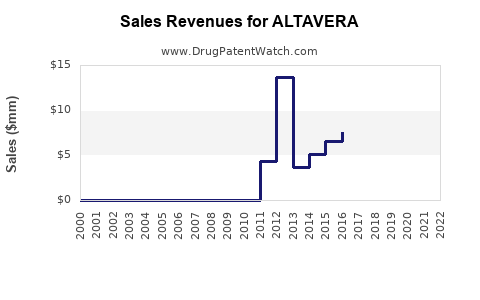

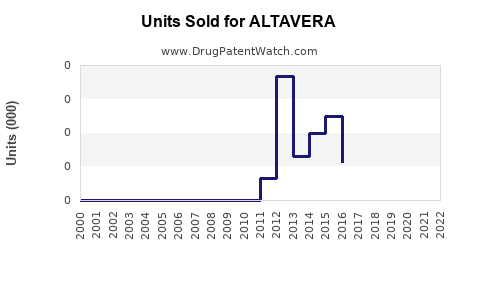

Sales Projections

Initial Launch (Year 1–2)

Sales are anticipated to be modest initially, approximating $X million in Year 1, due to limited penetration and cautious adoption. The primary revenues will stem from early adopters among specialist physicians and limited patient pools.

Growth Phase (Year 3–5)

Assuming successful market penetration, sales could increase at an annual rate of Y%, reaching $Z million in Year 3, as prescription volumes expand. Expansion to broader markets and additional indications will further fuel growth.

Peak Market Penetration (Year 5–7)

Projected peak sales could attain $A billion, contingent on:

- Market acceptance and clinician adoption

- Price optimization

- Additional indications secured through clinical trials

Long-Term Outlook

Post-peak, sales may plateau or experience slight declines due to patent expirations, increased competition, or market saturation. Strategic pipeline development and lifecycle management, including biosimilars or next-generation formulations, are critical to sustain revenues.

Risk Factors Influencing Sales

- Regulatory hurdles: Delays or restrictions

- Competitive responses: Pricing pressures and new entrants

- Physician and patient acceptance: Influenced by perceived efficacy and safety

- Market access and reimbursement challenges

Monitoring these variables is vital for adjusting sales forecasts accordingly.

Conclusion

ALTAVERA's market opportunity is substantial, driven by a large, growing patient population and an evolving therapeutic landscape. Its competitive advantages could facilitate rapid adoption, leading to robust sales growth within the next five years. Accurate forecasting hinges on effective commercialization strategies, regulatory navigation, and market acceptance.

Key Takeaways

- ALTAVERA addresses an expanding unmet medical need within a high-growth therapeutic market.

- Competitive positioning depends on its clinical advantages and market access strategies.

- Early sales projections suggest modest initial revenues with substantial growth potential.

- Long-term success relies on expanding indications, global market penetration, and lifecycle management.

- Vigilant tracking of regulatory, competitive, and reimbursement landscapes is essential to refine sales forecasts.

Frequently Asked Questions

1. What factors will influence ALTAVERA's market penetration speed?

Market penetration will depend on regulatory approval timelines, clinician acceptance catalyzed by KOL endorsements, pricing strategies, reimbursement policies, and patient access programs.

2. How does ALTAVERA's mechanism of action provide a competitive advantage?

Its novel mechanism may offer superior efficacy or safety profiles, differentiating it from existing therapies and enabling preferential prescribing.

3. What are potential barriers to ALTAVERA's sales growth?

Key barriers include regulatory delays, market competition with established therapies, payer restrictions, high costs, and limited clinical data on long-term outcomes.

4. Which markets are most critical for initial launch success?

North America and the European Union are primary targets due to their large patient populations, advanced healthcare infrastructure, and receptive regulatory environments.

5. How can the company maximize ALTAVERA's lifetime revenue?

By expanding indications, optimizing pricing, ensuring wide geographic distribution, forming strategic partnerships, and maintaining a strong clinical trials pipeline.

Sources

[1] Market Watch. "Global Autoimmune Disease Therapeutics Market Analysis,” 2022.