Last updated: July 31, 2025

Introduction

ALEVE, a prominent OTC nonsteroidal anti-inflammatory drug (NSAID) generically known as naproxen sodium, commands a significant position within the pain relief segment. Its market dynamics are shaped by evolving consumer preferences, regulatory challenges, and competitive pressures. Understanding ALEVE’s financial trajectory offers vital insights into its growth potential and strategic positioning amid fluctuating healthcare landscapes.

Market Overview and Demand Drivers

ALEVE’s prominence stems from its efficacy in treating minor aches, inflammation, and fever. The global OTC pain management market is projected to reach over USD 35 billion by 2025, driven by rising prevalence of chronic and acute pain owing to aging populations, increased physical activity, and lifestyle-related conditions[1].

Key drivers include:

- Consumer Preference for OTC Solutions: Rising demand for self-medication options due to convenience and cost-effectiveness.

- Aging Demographics: Older populations are more prone to conditions like arthritis, amplifying NSAID usage.

- Regulatory Landscape Expansion: Greater acceptance of NSAIDs in OTC formulations globally, especially in emerging markets.

- Healthcare Cost Pressures: Cost containment initiatives incentivizing OTC drug adoption over prescription medications.

However, prevailing concerns around NSAID safety—particularly gastrointestinal, cardiovascular, and renal risks—affect market penetration and formulation innovation[2].

Competitive Landscape and Market Share

ALEVE faces stiff competition from other OTC NSAIDs such as ibuprofen (Advil, Motrin) and acetaminophen (Tylenol). While ibuprofen dominates certain segments due to its anti-inflammatory strength, ALEVE’s longer duration of action (up to 12 hours) provides a differentiation advantage.

Market share analysis indicates:

- ALEVE's Position: Estimated to hold roughly 20-25% of OTC NSAID sales in North America.

- Global Expansion: Growth in emerging markets is facilitated by unregulated or underpenetrated OTC sectors, with local brands competing on price.

- Brand Loyalty and Consumer Trust: ALEVE benefits from established branding, but generic versions erode margins and market share.

Innovative formulations, such as liquid gels and reduced gastrointestinal risk variants, are being introduced to enhance competitiveness.

Regulatory and Safety Considerations

Regulatory agencies, notably the U.S. Food and Drug Administration (FDA), monitor NSAIDs for safety issues, prompting formulation revisions or updated labeling. Concerns include:

- Cardiovascular Risks: Heightened attention towards potential heart attack and stroke risks with prolonged NSAID use.

- Gastrointestinal Safety: Development of GI-safe formulations to narrow safety margins.

- Labeling and Usage Restrictions: Increased requirements influence consumer perceptions and sales.

These factors determine market accessibility and influence R&D commitments, impacting the drug’s financial outlook.

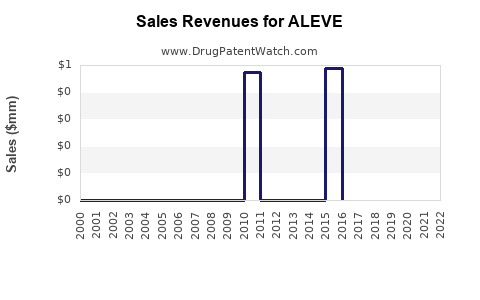

Revenue Generation and Financial Trajectory

ALEVE’s revenue trajectory is characterized by steady growth coupled with resilience during economic downturns, owing to the non-prescription status and broad consumer base.

-

Historical Revenue Trends: In North America, ALEVE generated approximately USD 900 million annually over the past 3 years, with a compound annual growth rate (CAGR) of around 3-4% globally[3].

-

Pricing Strategies: Premium branding and innovative formulations support higher price points. Volume-driven growth is enabling market penetration of generics and private-label brands, exerting downward pressure on margins but broadening access.

-

Market Expansion: Developing markets, including Asia-Pacific and Latin America, are showing increased OTC NSAID demand, projected to contribute an estimated 10-12% CAGR to global ALEVE revenues over the next 5 years[4].

-

Impact of Patent Life and Generics: Absence of patent exclusivity facilitates generic proliferation, which diminishes unit margins but boosts overall revenue volume.

-

Investment in R&D: To sustain growth, manufacturers are investing in safer, more effective formulations. This innovation pipeline influences long-term profitability.

Future Outlook and Growth Strategies

The future financial trajectory hinges on several strategic factors:

- Product Diversification: Launching new formulations targeting specific patient populations or reduced side effects.

- Regulatory Approvals: Achieving OTC status in major emerging markets to unlock unpenetrated demand.

- Digital and Direct-to-Consumer Marketing: Leveraging online platforms to increase brand reach and consumer engagement.

- Partnerships and Licensing: Collaborations with regional distributors for faster market access.

Forecasting models project ALEVE’s global revenues could reach USD 1.2 billion annually within 5 years, assuming sustained marketing efforts, innovation, and market expansion. Growth rates are tempered by safety concerns, regulatory hurdles, and competition, necessitating agility in strategic planning.

Regulatory and Industry Challenges

Regulatory uncertainty, especially pertaining to safety concerns, remains a critical risk. Post-market safety surveillance might lead to usage restrictions, impacting sales. Additionally, increasing consumer awareness about NSAID side effects may influence usage patterns, potentially dampening demand.

Industry challenges include:

- Navigating changing OTC regulations across jurisdictions.

- Managing safety perceptions while maintaining efficacy.

- Competing effectively against cost-effective generics.

Key Market Opportunities

- Emerging Markets: Rapid urbanization and increasing healthcare awareness offer substantial growth potential.

- Formulation Innovation: Developing GI-safe or cardio-safe NSAID variants could open premium segments.

- Digital Engagement: Enhancing consumer education and e-commerce channels to boost sales volume.

Conclusion

ALEVE’s market dynamics are shaped by demographic shifts, evolving safety profiles, regulatory criteria, and competitive forces. Its financial trajectory appears promising, driven by product innovation, strategic expansion, and brand strength. Nonetheless, ongoing safety concerns and regulatory navigation are pivotal to maintaining growth momentum.

Key Takeaways

- ALEVE continues to capitalize on OTC pain relief demand, supported by demographic and consumer behavior trends.

- The expanding global OTC market, especially in emerging regions, offers significant revenue growth opportunities.

- Competition from generics constrains margins but increases volume; innovation into safer formulations could command premium pricing.

- Regulatory challenges concerning NSAID safety must be proactively managed through product development and transparent communication.

- Strategic investment in digital marketing and market expansion will be critical to realizing its projected future revenue of approximately USD 1.2 billion within five years.

FAQs

1. How does ALEVE differentiate itself from other OTC NSAIDs?

ALEVE’s extended dosing interval (up to 12 hours) provides convenience, and its established brand recognition fosters consumer trust, setting it apart from competitors focusing on shorter-acting formulations.

2. What are the primary safety concerns associated with ALEVE?

NSAIDs like ALEVE carry risks of gastrointestinal bleeding, cardiovascular events, and renal impairment, prompting regulatory safety warnings and formulation development to mitigate these risks.

3. What market expansion opportunities exist for ALEVE?

Emerging markets in Asia, Africa, and Latin America present untapped demand, especially where OTC sectors are growing and regulatory pathways are evolving.

4. How will generic competition impact ALEVE’s revenue?

The proliferation of generic naproxen sodium formulations is likely to pressure margins but can expand overall market volume, supporting revenue growth through increased accessibility.

5. What role will innovation play in ALEVE’s future?

Developing safer, more targeted formulations and leveraging digital strategies will be essential to sustain growth amid regulatory and safety challenges.

Sources

[1] MarketsandMarkets, “Pain Management Market,” 2021.

[2] U.S. FDA, “NSAID Drug Safety,” 2020.

[3] IQVIA, “OTC Pharmaceutical Sales Data,” 2022.

[4] Statista, “OTC Drug Market Growth,” 2022.