ALECENSA Drug Patent Profile

✉ Email this page to a colleague

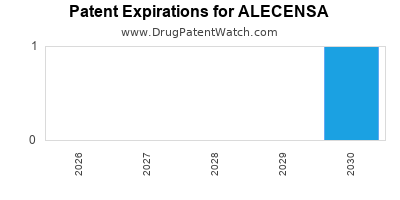

Which patents cover Alecensa, and when can generic versions of Alecensa launch?

Alecensa is a drug marketed by Hoffmann-la Roche and is included in one NDA. There are five patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and forty-three patent family members in thirty-nine countries.

The generic ingredient in ALECENSA is alectinib hydrochloride. One supplier is listed for this compound. Additional details are available on the alectinib hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Alecensa

Alecensa was eligible for patent challenges on December 11, 2019.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be April 24, 2035. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ALECENSA?

- What are the global sales for ALECENSA?

- What is Average Wholesale Price for ALECENSA?

Summary for ALECENSA

| International Patents: | 143 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 61 |

| Clinical Trials: | 23 |

| Patent Applications: | 505 |

| Drug Prices: | Drug price information for ALECENSA |

| What excipients (inactive ingredients) are in ALECENSA? | ALECENSA excipients list |

| DailyMed Link: | ALECENSA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ALECENSA

Generic Entry Date for ALECENSA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ALECENSA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Han Xu, M.D., Ph.D., FAPCR, Sponsor-Investigator, IRB Chair | Phase 2/Phase 3 |

| Royal Marsden NHS Foundation Trust | Phase 2/Phase 3 |

| University of Manchester | Phase 2/Phase 3 |

Pharmacology for ALECENSA

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Kinase Inhibitors |

Paragraph IV (Patent) Challenges for ALECENSA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ALECENSA | Capsules | alectinib hydrochloride | 150 mg | 208434 | 1 | 2019-12-11 |

US Patents and Regulatory Information for ALECENSA

ALECENSA is protected by five US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ALECENSA is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,350,214.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hoffmann-la Roche | ALECENSA | alectinib hydrochloride | CAPSULE;ORAL | 208434-001 | Dec 11, 2015 | RX | Yes | Yes | 10,350,214 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Hoffmann-la Roche | ALECENSA | alectinib hydrochloride | CAPSULE;ORAL | 208434-001 | Dec 11, 2015 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Hoffmann-la Roche | ALECENSA | alectinib hydrochloride | CAPSULE;ORAL | 208434-001 | Dec 11, 2015 | RX | Yes | Yes | 9,440,922 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Hoffmann-la Roche | ALECENSA | alectinib hydrochloride | CAPSULE;ORAL | 208434-001 | Dec 11, 2015 | RX | Yes | Yes | 11,433,076 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for ALECENSA

When does loss-of-exclusivity occur for ALECENSA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0187

Patent: COMPOSICIÓN FARMACÉUTICA QUE CONTIENE UN INHIBIDOR DE ALK (QUINASA DE LINFOMA ANAPLÁSICO)

Estimated Expiration: ⤷ Get Started Free

Patent: 2148

Patent: MÉTODO PARA MEJORAR LA SOLUBILIDAD DE UN COMPUESTO POCO SOLUBLE O INSOLUBLE EN AGUA CONTENIDO EN UNA FORMULACIÓN FARMACÉUTICA

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 15250574

Patent: Preparation containing tetracyclic compound at high dose

Estimated Expiration: ⤷ Get Started Free

Patent: 20230293

Patent: Preparation containing tetracyclic compound at high dose

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2016021206

Patent: COMPOSIÇÃO FARMACÊUTICA, CONTENDO COMPOSTO TETRACÍCLICO EM DOSE ELEVADA E SEU MÉTODO DE PRODUÇÃO

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 46518

Patent: PREPARATION CONTENANT UN COMPOSE TETRACYCLIQUE A HAUTE DOSE (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

Patent: 40565

Patent: PREPARATION CONTENANT UN COMPOSE TETRACYCLIQUE A HAUTE DOSE (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 6456651

Patent: 以高用量含有四环性化合物的制剂 (Preparation containing tetracyclic compound at high dose)

Estimated Expiration: ⤷ Get Started Free

Patent: 3975243

Patent: 以高用量含有四环性化合物的制剂 (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 35287

Patent: PRÉPARATION CONTENANT UN COMPOSÉ TÉTRACYCLIQUE À HAUTE DOSE (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

Patent: 97659

Patent: PRÉPARATION CONTENANT UN COMPOSÉ TÉTRACYCLIQUE À DOSE ÉLEVÉE (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 8363

Patent: תכשירים המכילים מינון גבוה של תרכובת טטראציקלית, שיטות להכנתם ושימושים בהם (High dose tetracyclic compound containing compositions methods of producing same and uses thereof)

Estimated Expiration: ⤷ Get Started Free

Patent: 3152

Patent: תכשירים המכילים מינון גבוה של תרכובת טטראציקלית, שיטות להכנתם ושימושים בהם (High dose tetracyclic compound containing compositions methods of producing same and uses thereof)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 2015163448

Patent: 4環性化合物を高用量含有する製剤

Estimated Expiration: ⤷ Get Started Free

Patent: 59712

Estimated Expiration: ⤷ Get Started Free

Patent: 29942

Estimated Expiration: ⤷ Get Started Free

Patent: 16104762

Patent: 4環性化合物を高用量含有する製剤 (FORMULATION CONTAINING HIGH DOSE OF TETRACYCLIC COMPOUND)

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 9913

Patent: PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE

Estimated Expiration: ⤷ Get Started Free

Patent: 0583

Patent: FORMULATION CONTAINING A LARGE AMOUNT OF TETRACYCLIC COMPOUND

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 6901

Patent: FORMULACION QUE CONTIENE UNA GRAN CANTIDAD DE COMPUESTO TETRACICLICO. (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

Patent: 16013809

Patent: FORMULACION QUE CONTIENE UNA GRAN CANTIDAD DE COMPUESTO TETRACICLICO. (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE.)

Estimated Expiration: ⤷ Get Started Free

Patent: 21012300

Patent: FORMULACION QUE CONTIENE UNA GRAN CANTIDAD DE COMPUESTO TETRACICLICO. (PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 4713

Patent: Preparation containing tetracyclic compound at high dose

Estimated Expiration: ⤷ Get Started Free

Patent: 3604

Patent: Preparation containing tetracyclic compound at high dose

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 35287

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 24056

Patent: ПОЛУЧЕНИЕ ТЕТРАЦИКЛИЧЕСКОГО СОЕДИНЕНИЯ, СОДЕРЖАЩЕГОСЯ В ВЫСОКОЙ ДОЗЕ (OBTAINING A TETRACYCLIC COMPOUND CONTAINED IN A HIGH DOSE)

Estimated Expiration: ⤷ Get Started Free

Patent: 16145057

Patent: ПОЛУЧЕНИЕ ТЕТРАЦИКЛИЧЕСКОГО СОЕДИНЕНИЯ, СОДЕРЖАЩЕГОСЯ В ВЫСОКОЙ ДОЗЕ

Estimated Expiration: ⤷ Get Started Free

Patent: 20119391

Patent: ПОЛУЧЕНИЕ ТЕТРАЦИКЛИЧЕСКОГО СОЕДИНЕНИЯ, СОДЕРЖАЩЕГОСЯ В ВЫСОКОЙ ДОЗЕ

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 202009484W

Patent: PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE

Estimated Expiration: ⤷ Get Started Free

Patent: 201607623X

Patent: PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1606447

Patent: PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2412321

Estimated Expiration: ⤷ Get Started Free

Patent: 2478887

Estimated Expiration: ⤷ Get Started Free

Patent: 160146800

Patent: 4환성 화합물을 고용량 함유하는 제제 (4 Preparation containing tetracyclic compound at high dose)

Estimated Expiration: ⤷ Get Started Free

Patent: 220087583

Patent: 4환성 화합물을 고용량 함유하는 제제 (4 Preparation containing tetracyclic compound at high dose)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 94202

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 20943

Estimated Expiration: ⤷ Get Started Free

Patent: 71839

Estimated Expiration: ⤷ Get Started Free

Patent: 31128

Estimated Expiration: ⤷ Get Started Free

Patent: 1622706

Patent: Formulation comprising tetracyclic compounds in high dose

Estimated Expiration: ⤷ Get Started Free

Patent: 2114693

Patent: Formulation comprising tetracyclic compounds in high dose

Estimated Expiration: ⤷ Get Started Free

Patent: 2235088

Patent: Formulation comprising tetracyclic compounds in high dose

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ALECENSA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Mexico | 2011013306 | COMPUESTOS TETRACICLICOS. (TETRACYCLIC COMPOUND.) | ⤷ Get Started Free |

| Portugal | 2975024 | ⤷ Get Started Free | |

| Taiwan | I720943 | ⤷ Get Started Free | |

| South Africa | 201606447 | PREPARATION CONTAINING TETRACYCLIC COMPOUND AT HIGH DOSE | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ALECENSA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2441753 | 17C1019 | France | ⤷ Get Started Free | PRODUCT NAME: ALECTINIB OU SEL OU SOLVATE DE CELUI-CI; REGISTRATION NO/DATE: EU/1/16/1169 20170220 |

| 2441753 | 2017026 | Norway | ⤷ Get Started Free | PRODUCT NAME: ALEKTINIB ELLER SALT ELLER SOLVAT; REG. NO/DATE: EU/1/16/1169 20170307 |

| 2441753 | 1790024-2 | Sweden | ⤷ Get Started Free | PRODUCT NAME: ALECTINIB OR SALT OR SOLVATE THEREOF; REG. NO/DATE: EU/1/16/1169/001 20170220 |

| 2441753 | 660 | Finland | ⤷ Get Started Free | |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ALECENSA (Alectinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.