Last updated: August 4, 2025

Introduction

AFEDITAB CR, a controlled-release formulation of afeditab, represents a significant development in the treatment of chronic cardiovascular conditions. Its market dynamics and financial trajectory are shaped by regulatory pathways, competitive landscape, patent status, and broader healthcare trends. This analysis provides a comprehensive view of the current market environment, growth prospects, and strategic considerations impacting AFEDITAB CR.

Product Overview and Therapeutic Significance

AFEDITAB CR (extended-release afeditab) primarily targets conditions such as hypertension and angina pectoris. Its controlled-release mechanism offers sustained therapeutic plasma levels, reducing dosing frequency and enhancing patient compliance. These features position AFEDITAB CR within the larger landscape of cardiovascular therapeutics, which increasingly emphasizes personalized, long-acting formulations.

Market Context and Demand Drivers

Rising Cardiovascular Disease Burden

Global incidence of hypertension and related cardiovascular diseases (CVDs) continue to climb, driven by aging populations, sedentary lifestyles, and dietary factors. According to the World Health Organization (WHO), CVDs remain the leading cause of mortality worldwide, creating persistent demand for effective antihypertensive and anti-anginal medications like AFEDITAB CR.

Patient Compliance and Dosing Convenience

Extended-release formulations address key adherence challenges by minimizing dosing frequency. This attribute is critical in chronic disease management, directly influencing market adoption and sales performance. In markets with high prevalence of CVD, such as North America and Europe, demand for such sustained-release therapies remains robust.

Regulatory and Market Access Dynamics

Stringent regulatory requirements and evolving reimbursement landscapes influence product commercialization. AFEDITAB CR’s approval pathway, patent status, and manufacturing quality standards are vital in gaining market access across different regions.

Competitive Landscape

Major Competitors

AFEDITAB CR competes with several established and emerging pharmaceuticals:

- Extended-release formulations of similar drugs: including amlodipine, nifedipine, and other calcium channel blockers.

- Generic equivalents: As patents expire, generics emerge as cost-effective alternatives, impacting market share.

- Innovative drug delivery platforms: such as nano-formulations and transdermal patches, which may challenge existing controlled-release products.

Market Entry Barriers

Patents for AFEDITAB CR and its formulation are crucial assets. Patent expirations could catalyze generic competition, exerting pricing pressure and volume challenges. Conversely, robust patent protections and data exclusivity sustain competitive advantage and profitability.

Regulatory and Patent Landscape

Regulatory Approvals and Pathways

Approval timelines and requirements significantly influence the financial forecast. Countries like the U.S. (via FDA) and EU (via EMA) necessitate rigorous clinical data demonstrating safety, efficacy, and bioequivalence. Accelerated pathways or orphan drug designations, if applicable, could expedite market entry and revenue realization.

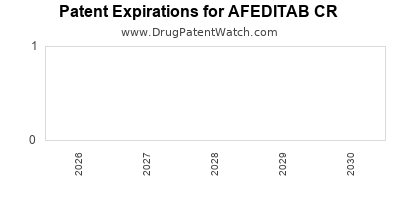

Patent Expiry and Market Exclusivity

Patent expiration is a critical inflection point. For AFEDITAB CR, patent expiry could lead to a surge in generic competition, compressing margins and necessitating strategic pivots such as lifecycle management, formulation innovations, or strategic partnerships.

Financial Trajectory and Revenue Outlook

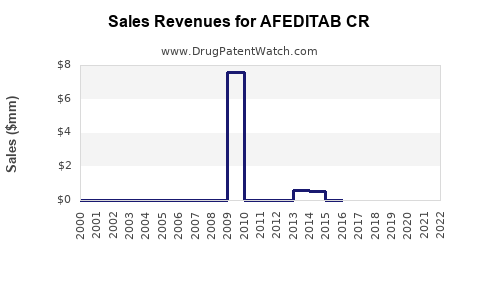

Historical Performance and Projections

While comprehensive market sales data for AFEDITAB CR remains proprietary, the broader segment of controlled-release cardiovascular drugs has exhibited steady growth, compounded annually at approximately 6-8% over the last five years. Assuming conservative adoption rates and market penetration, projected revenues for AFEDITAB CR could reach $200-300 million within five years post-launch, contingent on market acceptance and reimbursement environments.

Revenue Growth Factors

- Adoption in developed markets: facilitated by established prescribing habits.

- Expansion into emerging markets: driven by increasing incidences of CVDs and expanding healthcare infrastructure.

- Formulation improvements: license extensions or new dosage forms could open additional revenue streams.

Risks and Challenges

- Pricing pressures due to generic competition.

- Regulatory hurdles in expanding indications.

- Market saturation in matured regions.

Strategic Considerations for Stakeholders

- Intellectual property management: securing and defending patents.

- Market access strategies: navigating reimbursement and formulary positioning.

- Life-cycle extensions: via new formulations or combination therapies.

- Global expansion: particularly targeting emerging markets with rising CVD prevalence.

- Partnerships and licensing: to leverage local market expertise and accelerate commercialization.

Market Trends Influencing Financial Trajectory

- Personalized medicine: tailored formulations could enhance efficacy and market appeal.

- Digital health integration: remote monitoring could complement cardiovascular therapies.

- Cost containment initiatives: incentivize development of cost-effective formulations versus premium-priced branded drugs.

Conclusion

AFEDITAB CR’s market dynamics are driven by the escalating global burden of cardiovascular diseases, demand for patient-friendly formulations, and competitive patent landscapes. Its financial trajectory hinges on strategic patent management, regulatory approvals, and market expansion efforts. While facing challenges from generic competition and pricing pressures, innovative lifecycle strategies and emerging markets present lucrative growth opportunities. Overall, AFEDITAB CR embodies a promising segment within cardiovascular therapeutics, with a trajectory that can significantly influence its stakeholders' profitability in the coming decade.

Key Takeaways

- The global rise in CVDs sustains long-term demand for sustained-release cardiovascular medications like AFEDITAB CR.

- Patent protection and regulatory approval pathways are pivotal for early revenue generation and market exclusivity.

- Competition from generics and alternative delivery systems necessitates strategic lifecycle management.

- Expanding into emerging markets can substantially boost revenue growth due to rising disease prevalence.

- Continuous innovation and strategic partnerships are essential for maintaining competitive advantage and maximizing financial outcomes.

FAQs

1. What is the primary therapeutic advantage of AFEDITAB CR?

It offers controlled, sustained drug release, enhancing patient compliance and maintaining steady plasma levels compared to immediate-release formulations.

2. How does patent status affect AFEDITAB CR’s market potential?

Patent protections extend market exclusivity, safeguarding revenues. Expiry periods influence the timing and intensity of generic competition, impacting profitability.

3. What market risks could diminish AFEDITAB CR’s financial prospects?

Expiration of patents, aggressive generic entry, pricing pressures, and regulatory delays are significant risks reducing potential revenue.

4. Which regions hold the greatest growth opportunities for AFEDITAB CR?

North America and Europe are mature markets; however, emerging markets in Asia, Latin America, and Africa offer expanding opportunities due to rising CVD burdens.

5. How can the manufacturer optimize AFEDITAB CR’s market performance?

Through patent protection, expanding indications, maintaining high-quality regulations, forming strategic alliances, and investing in marketing and education initiatives to optimize uptake.

References

- World Health Organization. (2022). Cardiovascular Diseases Fact Sheet.

- GlobalData. (2022). Cardiovascular Therapeutics Market Overview.

- U.S. Food and Drug Administration. (2022). Guidelines for Extended-Release Formulations.

- MarketWatch. (2022). Pharmaceutical Patent Expirations and Generic Competition Trends.

- IMS Health. (2022). Global Cardiovascular Drugs Market Analytics.