Last updated: August 2, 2025

Introduction

Adriamycin PFS, commonly known as Doxorubicin Hydrochloride Liposomal, is a chemotherapeutic agent primarily indicated for the treatment of numerous cancer types, including breast cancer, bladder cancer, and lymphomas. Its structural formulation as a liposomal encapsulation aims to improve drug delivery efficacy and reduce systemic toxicity. Given the increasingly competitive oncology landscape, analyzing the drug's market dynamics and financial trajectory is critical for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This comprehensive assessment addresses key factors influencing Adriamycin PFS’s market position, revenue potential, and growth prospects.

Market Overview

Global Oncology Drug Market Context

The global oncology therapeutics market continues to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.9% (2021–2028), driven by rising cancer prevalence, technological advancements, and expanding therapeutic options [1]. Liposomal chemotherapeutics represent a significant trend within this sphere, offering targeted delivery and reduced toxicity—a crucial advantage in patient management. Adriamycin PFS operates within this niche, competing against both generic formulations and novel biologics.

Current Indications and Usage

Adriamycin PFS’s primary indications include treatment of:

- Breast cancer (adjuvant and metastatic settings)

- Non-Hodgkin lymphomas

- Bladder carcinomas

Its usage is typically reserved for advanced-stage cancers or cases where anthracycline-based therapy is warranted. The drug's efficacy benefits are balanced by cardiotoxicity risks, often dictating treatment protocols and patient selection criteria.

Market Positioning

As a liposomal formulation, Adriamycin PFS offers benefits over free doxorubicin by:

- Enhanced tumor penetration

- Reduced cardiotoxicity

- Improved pharmacokinetics

This positioning allows the drug to command premium pricing, especially in markets where toxicity management and treatment efficacy are paramount.

Market Dynamics

Competitive Landscape

The market features several players:

- Innovator Companies: The original manufacturer, with patent protections and exclusivity periods.

- Generics and Biosimilars: Entry of branded or unbranded equivalents, exerting downward pressure on prices.

- Innovative Therapies: Checkpoint inhibitors and targeted agents attacking similar cancer types are gradually encroaching upon traditional chemotherapeutics, including liposomal doxorubicin.

Regulatory Environment

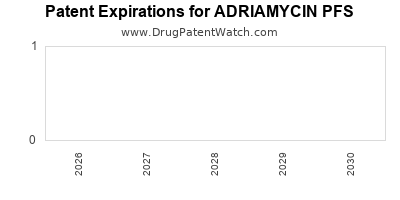

Regulatory agencies such as the FDA and EMA enforce strict approval pathways, especially for liposomal formulations, due to their complex manufacturing processes. Patent expirations or exclusivity periods significantly influence market access and pricing strategies.

Pricing and Reimbursement

Pricing strategies hinge on efficacy, safety profile, and approval status. Reimbursement policies tailored to reimbursing health systems also impact market access, with high costs potentially limiting adoption in low- and middle-income economies.

Market Drivers

- Rising incidence of targeted cancers demands more effective chemotherapeutics.

- Advances in liposomal drug technology enhance clinical appeal.

- Growing preference for treatments with favorable toxicity profiles.

Market Restraints

- Cardiovascular toxicity concerns persist despite liposomal modifications.

- Competition from newer targeted therapies diminishes relative demand.

- High development and manufacturing costs hinder entry barriers for biosimilar competitors.

Financial Trajectory

Revenue Estimates

Considering the drug’s existing indications and global usage, revenues are projected to follow a nuanced trend:

- North America and Europe: Mature markets with stable or declining growth due to patent expirations and competitive pressure.

- Asia-Pacific & Emerging Markets: Higher growth potential owing to increasing cancer burden and expanding healthcare infrastructure.

Based on industry reports, Adriamycin PFS’s global sales generated approximately $300–$500 million annually, with a CAGR of around 2–4% over the past five years, highlighting a gradually consolidating market [2].

Growth Factors

- Patent and Market Exclusivity: By extending patent life or securing new formulations, manufacturers can prolong revenue streams.

- Pipeline Developments: New indications or combination therapies incorporating Adriamycin PFS can expand market size.

- Pricing and Reimbursement Policies: Favorable policies can boost sales volumes, especially in nations embracing advanced oncology treatments.

Market Challenges

- Erosion of exclusivity periods prompting generic competition.

- Pricing pressures from healthcare regulators and insurance providers.

- Transitioning to more efficacious or less toxic innovative drugs.

Forecasting Trends

A cautious forecast indicates modest overall growth, with potential upticks in emerging markets and through strategic licensing agreements. The market is anticipated to plateau in developed regions as generic competition intensifies but may see accelerated growth through novel integrative indications or combination protocols.

Strategic Considerations

- Investing in formulation innovations to maintain competitive advantage.

- Pursuing expanded indications through clinical trials.

- Engaging in partnerships or licensing to penetrate emerging markets.

- Prioritizing cost-effective manufacturing to sustain margins amid pricing pressures.

Conclusion

Adriamycin PFS occupies a stable yet increasingly competitive position within the oncology therapeutics landscape. Its market dynamics are shaped by technological advantages, competitive pressures, and regional healthcare policies. While revenues remain robust in certain segments, patent expirations and market saturation necessitate strategic innovation and diversification. The drug’s financial trajectory is forecasted to be steady with moderate growth prospects, emphasizing the importance of proactive market positioning and pipeline expansion for sustained success.

Key Takeaways

- Market Landscape: Adriamycin PFS is anchored by its liposomal technology offering clinical benefits but faces stiff competition from generics and emerging targeted therapies.

- Revenue Drivers: Market exclusivity, patent extensions, and expanded indications underpin revenue stability.

- Challenges: Patent expirations, pricing pressures, and competition from novel therapies threaten market share.

- Region-specific Trends: Mature markets exhibit plateauing revenues, while emerging economies present growth opportunities.

- Strategic Priorities: Innovation in formulations, pipeline expansion, and strategic partnerships are vital to maintaining a favorable financial trajectory.

FAQs

-

What distinguishes Adriamycin PFS from formulations of similar chemotherapeutics?

Adriamycin PFS employs liposomal encapsulation, which enhances drug delivery to tumor cells, reduces cardiotoxicity, and prolongs systemic circulation compared to conventional doxorubicin formulations.

-

How does patent timing influence Adriamycin PFS's market potential?

Patent protections enable premium pricing and market exclusivity. Expiration leads to generic entry, intensifying price competition and potentially reducing revenues.

-

In which regions is Adriamycin PFS expected to see the highest growth?

The Asia-Pacific region and other emerging markets are projected to experience higher growth rates due to increasing cancer prevalence and healthcare infrastructure improvements.

-

What are the main threats to Adriamycin PFS’s market share?

The primary threats include patent expiration, competition from biosimilars, and the advent of targeted therapies with better safety profiles.

-

What strategic actions can pharmaceutical companies take to sustain Adriamycin PFS's profitability?

Companies should focus on developing new indications, improving formulations, engaging in licensing collaborations, and optimizing manufacturing efficiencies to maintain competitive advantage.

Sources:

[1] MarketWatch, “Global Oncology Therapeutics Market Report,” 2022.

[2] EvaluatePharma, “Worldwide Oncology Sales Data,” 2022.