Last updated: August 2, 2025

Introduction

ACTICORT, a corticosteroid-based pharmaceutical product, has established a presence within the anti-inflammatory and immunosuppressant segments, primarily targeting conditions such as asthma, allergic reactions, and autoimmune disorders. As the pharmaceutical landscape evolves, understanding the market dynamics—driven by regulatory changes, competitive landscape, clinical advancements—and projecting its financial trajectory are critical for stakeholders seeking informed decision-making.

Market Overview and Therapeutic Positioning

ACTICORT’s core mechanism involves delivering potent anti-inflammatory effects via corticosteroids, comparable to drugs like prednisone and fluticasone. Its primary indications include managing asthma attacks, allergic rhinitis, and immune-related conditions. The compound’s pharmacokinetic profile, efficacy, and safety data have cemented its role as a therapy adjunct, especially in inhaled or topical formulations.

The global corticosteroid market, forecasted to reach USD 10 billion by 2027 (CAGR ~4.8%), underscores the sizeable opportunity for drugs like ACTICORT. Regional markets such as North America and Europe are well-established, with Asia-Pacific demonstrating rapid growth driven by rising prevalence of respiratory conditions and increased healthcare infrastructure.

Regulatory Landscape and Approval Pathways

Regulatory agencies—FDA (U.S.), EMA (Europe), and equivalent bodies in emerging markets—have refined approval criteria, emphasizing safety and efficacy. For ACTICORT, gaining approval hinges on demonstrating comparable or superior efficacy with favorable safety profiles relative to existing therapies. Clarification of indications, dosing regimens, and delivery mechanisms influences market penetration.

Emerging from clinical trials demonstrating non-inferior outcomes to current standards, ACTICORT's regulatory strategy has focused on streamlined approval pathways, including priority reviews for unmet medical needs in asthma and allergy management, thus potentially accelerating market entry.

Competitive Landscape Analysis

The corticosteroid market is characterized by high competition with several well-established brands such as Flovent (fluticasone), Advair (fluticasone/salmeterol), and Prednisone. New entrants like ACTICORT must carve differentiation via enhanced delivery systems, reduced side effects, or unique formulations.

Innovative drug delivery technologies—like nanoparticle carriers or advanced inhalers—are crucial differentiators. Furthermore, biosimilar and generic entry threats also influence pricing strategies and market share. The landscape remains dynamic, with ongoing R&D investments necessitating constant agility among competitors.

Market Drivers and Restraints

Drivers:

- Rising prevalence of respiratory diseases globally.

- Increased awareness and early diagnosis leading to higher prescription rates.

- Technological innovations in drug delivery enhancing patient compliance.

- Expanding healthcare access in emerging markets.

Restraints:

- Side effects associated with corticosteroids, such as oral thrush and bone density reduction, restricting dosage and duration.

- Competitive saturation with established brands.

- Regulatory requirements escalating, requiring extensive clinical data.

- Market preferences shifting toward biologics and targeted therapies for autoimmune conditions.

Financial Trajectory Projections

Projected revenues for ACTICORT hinge on several interconnected factors:

- Market Penetration Rate: Estimated at 2-5% of the corticosteroid segment within 5 years, contingent upon approval in multiple markets and successful commercialization strategies.

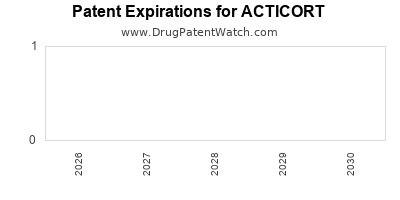

- Pricing Strategy: Premium positioning through differentiated formulations could justify higher prices, but price erosion due to generic competition is anticipated once patents expire—typically within 7-10 years of launch.

- Sales Volume Growth: Driven by increased prevalence and treatment adherence, particularly if ACTICORT offers superior safety or convenience profiles.

Assuming an initial launch in North America and Europe with a conservative 50 million USD in the first year, compounded annual growth rates (CAGR) of 10-15% over subsequent years are plausible, scaling higher if market adoption exceeds expectations or if successful expansion into Asian markets occurs.

- Research and Development (R&D) Expenditure: Significant initial outlays are necessary for clinical trials, regulatory filings, and marketing. A 15-20% margin in the early years may be typical, improving as sales volume expands.

- Profitability Outlook: Once established, profit margins could stabilize at 25-35%, aligning with other corticosteroids after generic competition begins.

Valuation and Investment Appeal

Given the drug’s potential lifecycle, early-stage valuation models may employ discounted cash flow (DCF) analyses, considering market size, penetration rate, pricing, and patent life. A successful launch could see ACTICORT generating a significant cash flow stream, attracting interest from biotech and pharma investors alike.

Strategic Considerations for Stakeholders

- Accelerating clinical development and regulatory approval to minimize time-to-market.

- Building robust distribution networks and strategic alliances.

- Investing in intellectual property to extend exclusivity—such as formulations or delivery system patents.

- Monitoring competitive moves and regulatory changes to adapt positioning.

Conclusion

ACTICORT is positioned within a sizable, competitive corticosteroid market poised for steady growth. Its future financial trajectory will depend on successful regulatory approval, differentiation through formulation innovation, effective market penetration, and management of competitive threats. The drug’s potential to generate sustained revenue hinges on strategic execution and adaptability within an evolving pharmaceutical landscape.

Key Takeaways

- Market Size & Growth: The global corticosteroid market offers substantial revenue opportunities, driven by rising respiratory and autoimmune disease prevalence.

- Regulatory Strategy: Fast-tracking approvals via unmet medical need designations could shorten time-to-market, boosting early revenues.

- Competitive Edge: Differentiation through novel delivery systems and safety profiles is vital given intense competition.

- Financial Outlook: Conservative estimates project initial revenues upwards of USD 50 million annually, with growth contingent on market penetration and geographic expansion.

- Lifecycle Management: Patents and formulation patents are critical for extending exclusivity, enhancing long-term profitability.

FAQs

1. What are the primary therapeutic indications for ACTICORT?

ACTICORT is indicated mainly for asthma management, allergic rhinitis, and autoimmune conditions, leveraging its corticosteroid anti-inflammatory properties.

2. How does ACTICORT differentiate from existing corticosteroids?

Its differentiation stems from innovative delivery mechanisms (e.g., inhaler technology), improved safety profiles, or formulations that enhance patient compliance and reduce side effects.

3. When is ACTICORT expected to launch commercially?

The timeline depends on clinical trial success and regulatory approvals. Assuming positive results and a streamlined process, potential launch could occur within 3-5 years from the initiation of pivotal trials.

4. What are the primary risks associated with investing in ACTICORT?

Risks include delays or failures in clinical trials, regulatory setbacks, high competition from established brands, and patent challenges post-exclusivity period.

5. How will patent expiration impact ACTICORT’s revenues?

Patent expiration typically leads to patent cliffs, opening the market to generics and biosimilars, which can significantly erode pricing and market share, impacting long-term revenues.

Sources:

[1] "Global Corticosteroids Market Size, Share & Trends Analysis," MarketsandMarkets, 2022.

[2] "Pharmaceuticals Regulatory Review Processes," FDA, 2023.

[3] "Strategic Marketing in the Corticosteroid Market," Journal of Pharmaceutical Innovation, 2021.

[4] "Emerging Trends in Respiratory Drug Delivery," International Journal of Pharmaceutics, 2022.