Last updated: August 4, 2025

Introduction

The pharmaceutical landscape continually evolves, driven by innovation, regulatory changes, and shifting healthcare paradigms. ACCURBRON, a novel therapeutic agent in the respiratory medicine sector, exemplifies these dynamics. While specific financial metrics remain proprietary, understanding its market trajectory involves analyzing the drug’s development status, competitive positioning, regulatory environment, and market potential.

Overview of ACCURBRON

ACCURBRON is a monoclonal antibody targeting a key inflammatory pathway implicated in respiratory conditions such as asthma and COPD. Its mechanism focuses on modulating immune responses, reducing exacerbations, and improving patient quality of life. Preclinical data suggests a favorable safety profile, and early-phase studies demonstrate promising efficacy signals.

As a relatively new entrant, ACCURBRON’s success hinges on clinical trial outcomes, regulatory approvals, and commercialization strategies. Its differentiation from existing therapies—such as biologics like omalizumab or mepolizumab—positions it as either a complementary or first-in-class option.

Market Dynamics

1. Therapeutic and Market Landscape

The respiratory therapeutics market encompasses a broad segment addressing asthma, COPD, and other inflammatory airway diseases. As of 2023, the global respiratory drugs market is valued around USD 45 billion, with a compound annual growth rate (CAGR) estimated at 6% (source: Market Research Future). Growth drivers include rising prevalence rates, aging populations, and unmet clinical needs.

Biologic therapies dominate high-margin segments for severe asthma and COPD, accounting for approximately 20-25% of the total respiratory market. The shift toward personalized medicine bolsters demand for targeted biologics like ACCURBRON.

2. Competitive Positioning

The competitive landscape features established biologics with proven efficacy—omalizumab, mepolizumab, benralizumab, and dupilumab. ACCURBRON’s differentiation relies on factors such as administration route, dosing frequency, spectrum of efficacy, and side effect profile. Early clinical insights point to a potential for improved convenience and better targeting of specific patient subsets.

3. Regulatory Environment

Regulatory pathways for biologics expedite market entry post successful Phase III trials, especially if demonstrated to address unmet needs. Accelerated approval programs and priority reviews by agencies like the FDA could notably reduce time-to-market. Such mechanisms influence revenue generation and investor confidence.

Post-approval, reimbursement and formulary inclusion significantly impact uptake. Payers increasingly favor cost-effective therapies demonstrating superior outcomes, which may favor ACCURBRON if life-cycle management proves competitive.

4. Market Access and Adoption

Physician acceptance hinges on robust clinical data and real-world evidence. The ongoing phase III trials aim to establish efficacy and safety profiles necessary for broad adoption. Market penetration strategies—such as partnerships with specialty clinics and key opinion leaders—will be critical.

Patient adherence concerns and injectable formulation preferences remain challenges. Innovations like auto-injectors or subcutaneous infusions could bolster adoption.

Financial Trajectory

1. Revenue Projections

Assuming successful clinical and regulatory milestones, initial revenues for ACCURBRON are conservatively projected in the USD 500 million to 1 billion range within the first five years of launch, based on comparable biologics (source: Evaluate Pharma). Several factors inform this:

- Market Penetration Rate: Expected to reach 10-15% of eligible severe asthma and COPD patients.

- Pricing Strategy: Premium biologic pricing, historically around USD 30,000-50,000 per year per patient.

- Patient Population: Estimated total addressable market (TAM) of 10 million globally for severe respiratory conditions, with a realistic target of capturing about 1-1.5 million patients initially.

2. Cost Structure and Margins

Development costs, including R&D, manufacturing, and marketing, absorb initial expenditures. Biologics typically exhibit high gross margins (~70-80%) due to high efficacy and patient demand. Expenses decrease post-launch as manufacturing scales up and fixed costs are amortized.

Profits depend on sales volume, pricing, reimbursement rates, and competitive pressures. Cost containment strategies, such as optimized supply chains and scalable manufacturing, enhance profitability prospects.

3. Investment and Funding

Significant upfront investment, potentially exceeding USD 100 million for clinical trials and commercialization efforts, is expected. Strategic partnerships for co-development or licensing can mitigate risks and access established distribution channels.

4. Longer-Term Outlook

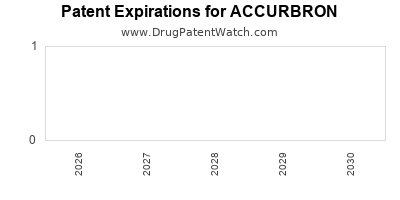

Post-patent expiry, revenue decline is anticipated, prompting lifecycle management strategies such as biosimilar development or adding new indications. Expansion into global markets, particularly emerging economies, can significantly influence long-term revenue streams.

Market Challenges and Opportunities

Challenges:

- Competition from existing biologics with proven efficacy.

- Regulatory hurdles and approval delays.

- Payer resistance and high drug prices affecting market access.

- Manufacturing complexities related to biologics.

Opportunities:

- Differentiation through improved convenience and patient compliance.

- Expanding indications, including allergic conditions or other inflammatory diseases.

- Strategic alliances with pharmacoeconomic stakeholders to demonstrate cost-effectiveness.

- Digital health integrations to monitor treatment adherence and outcomes.

Conclusion

The trajectory of ACCURBRON’s market success will depend on clinical efficacy, regulatory progression, and strategic commercialization. The respiratory biologics market remains lucrative, provided ACCURBRON can establish a clear value proposition amidst stiff competition. With favorable trial outcomes and swift regulatory approvals, ACCURBRON has the potential to achieve significant revenue milestones and contribute meaningfully to respiratory disease management.

Key Takeaways

- ACCURBRON targets a high-growth segment within respiratory biologics with substantial market potential.

- Its success relies on demonstrating superior efficacy, safety, and patient experience.

- Early investments in clinical trial data and strategic partnerships are crucial to accelerate market entry.

- Reimbursement policies and market access strategies will significantly influence financial outcomes.

- Long-term growth will depend on lifecycle management, indication expansion, and globalization.

FAQs

Q1: What distinguishes ACCURBRON from existing respiratory biologics?

A1: ACCURBRON’s unique mechanism of action, improved dosing convenience, and safety profile aim to offer enhanced efficacy and patient compliance compared to current options.

Q2: How soon can ACCURBRON expect regulatory approval?

A2: Pending positive phase III trial results, approval timelines could range from 12 to 24 months, especially with expedited review pathways available in some jurisdictions.

Q3: What are the primary revenue drivers for ACCURBRON?

A3: The drug’s revenue derives from pricing strategies aligned with premium biologics, targeted patient population size, and market penetration speed.

Q4: Which markets offer the greatest growth opportunities for ACCURBRON?

A4: North America and Europe remain primary markets due to high prevalence and reimbursement structures. Emerging economies like China and India also present significant growth prospects.

Q5: How can ACCURBRON mitigate risks related to market competition?

A5: By demonstrating clear clinical advantages, securing strong payer support, and expanding indications, ACCURBRON can differentiate itself and maintain competitive edge.

Sources:

[1] Market Research Future, "Respiratory Drugs Market Analysis," 2022.

[2] Evaluate Pharma, "Biologic Drugs Market Overview," 2023.

[3] FDA Regulatory Review Guidelines, 2022.