Last updated: July 27, 2025

Introduction

Thiothixene, a first-generation typical antipsychotic medication primarily used to manage schizophrenia and related psychoses, has historically played a significant role in psychiatric treatment. Despite the advent of atypical antipsychotics, thiothixene maintains niche applications. Analyzing its market dynamics and financial trajectory involves understanding evolving clinical preferences, patent landscapes, regulatory frameworks, and competitive positioning. This report offers a comprehensive review pertinent to stakeholders interested in the drug’s economic prospects and strategic planning.

Pharmacological Profile and Clinical Context

Thiothixene, chemically classified as a thioxanthene derivative, exerts dopaminergic antagonism—primarily at D2 receptors—and exhibits moderate affinity for serotonergic and adrenergic receptors[^1]. Its efficacy in controlling positive symptoms of schizophrenia has been well-documented since its FDA approval in 1967. However, concerns about extrapyramidal side effects and tardive dyskinesia have limited its popularity compared to atypical antipsychotics like risperidone and olanzapine, which offer comparable efficacy with improved side effect profiles[^2].

Despite these limitations, thiothixene remains prescribed in certain jurisdictions, especially where healthcare systems favor older medications or where research supports its continued use in treatment-resistant cases[^3].

Market Dynamics

1. Competitive Landscape

The global antipsychotic market has experienced transformation over the past two decades, characterized by a marked shift from typical to atypical agents. Brightly marketed drugs such as aripiprazole, quetiapine, and clozapine dominate mainstream treatment, driven by minimal extrapyramidal side effects and favorable adherence metrics[^4].

Thiothixene’s position persists mainly in heritage markets—such as certain European countries and developing regions—where traditional formulations remain entrenched due to cost considerations or limited access to newer alternatives[^5].

2. Patent and Regulatory Considerations

As a drug developed in the mid-20th century, thiothixene’s primary patents have long expired. This expiration has led to a proliferation of generic formulations, eroding per-unit pricing power but increasing volume through broader access[^6].

Regulatory environments increasingly favor newer agents due to safety profiles, decreasing incentives for off-patent drugs. Nonetheless, in markets with less stringent patent enforcement and healthcare budgets, thiothixene sustains a modest but steady demand[^7].

3. Demand Drivers and Barriers

The demand for thiothixene is influenced by:

- Cost sensitivity: Its low price point appeals to cost-constrained healthcare systems.

- Clinical preferences: Clinicians cautious of side effects may favor atypicals.

- Treatment resistance: Some clinicians prefer older drugs when newer agents fail or cause adverse reactions.

- Formulation availability: Generic formulations are widely accessible.

Barriers include clinician reluctance, side effect profile limitations, and evolving regulatory guidelines emphasizing safety[^8].

4. Market Size and Segmentation

The global antipsychotic market was valued at approximately USD 14 billion in 2022[^9]. While mature markets predominantly favor atypicals, the segment for existing typical antipsychotics—including thiothixene—accounts for an estimated USD 1–1.5 billion, with growth primarily driven by emerging economies still deploying older medications[^10].

Financial Trajectory Analysis

1. Revenue Trends

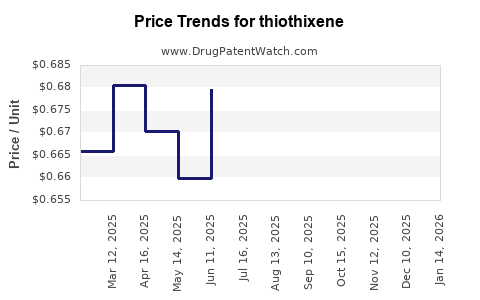

Revenue projections for thiothixene are modest and predominantly generics-driven. A typical annual volume increase of 2-3% in target markets is observed, fueled by renewed interest in affordable psychotropics. However, consistent pricing pressures suppress revenue growth rates.

2. Profitability Outlook

Given the generic manufacturing landscape, profit margins are thin but stable. The primary revenue streams derive from existing stocks and ongoing prescriptions, with little investment needed for production or marketing[^11].

3. Investment and Innovation

No recent patent filings or formulation improvements for thiothixene suggest minimal R&D investment, reflecting its status as a mature product. Market forecasts do not indicate significant upturns unless a new clinical application emerges or regulatory changes favor its use.

4. Regional Variations

Economic and regulatory environments heavily influence financial trajectories. For example:

- Developing nations: Ongoing demand supports steady revenues.

- European markets: Declining usage due to safety concerns and market sentiment shift.

- United States: Limited prescription volumes, primarily for specific clinical cases.

5. Impact of Emerging Trends

The rise of digital therapies and personalized medicine poses indirect challenges. Nonetheless, the entrenched position of traditional antipsychotics suggests a limited immediate impact on thiothixene’s financial outlook.

Future Outlook and Strategic Considerations

While thiothixene faces a declining foothold in the global market, niche opportunities exist in cost-sensitive regions or specific psychiatric subpopulations. Market players should consider portfolio diversification and targeted marketing. Strategic measures include:

- Emphasizing cost advantages in negotiations with healthcare payers.

- Monitoring regulatory shifts that may facilitate off-label use or renewed approvals.

- Exploring formulation innovations (e.g., depot injections) to enhance compliance.

Given the small size of the current market segment and limited growth catalyst, stakeholders should weigh investments carefully, focusing on market stability rather than expansion.

Key Takeaways

- Market Position: Thiothixene remains a legacy medication suited for specific segments, especially in cost-sensitive regions and treatment-resistant cases.

- Competitive Threats: The dominance of atypical antipsychotics constrains market growth; generic competition further compresses margins.

- Regulatory and Clinical Trends: Safety concerns and evolving guidelines favor newer agents, hindering thiothixene adoption.

- Financial Prospects: Revenue growth prospects are modest; margins are stable but limited by generic pricing pressures.

- Strategic Focus: Opportunities lie in niche markets with emphasis on affordability and targeted therapy, while broader expansion is unlikely.

FAQs

Q1: Does thiothixene have any current patent protections?

A: No. Thiothixene’s patents expired decades ago, leading to widespread generic availability and limited proprietary development.

Q2: What are the main clinical advantages of thiothixene today?

A: Its low cost and established efficacy in managing schizophrenia make it advantageous where affordability outweighs side effect concerns.

Q3: How does the safety profile impact thiothixene’s market presence?

A: Its association with extrapyramidal side effects and tardive dyskinesia restricts widespread use, favoring newer agents with better tolerability.

Q4: Which regions continue to utilize thiothixene extensively?

A: Developing countries and certain European markets with limited access to newer medications maintain steady, though modest, usage.

Q5: Are there ongoing research efforts or formulations to revive thiothixene’s clinical relevance?

A: Currently, no significant reformulations or new clinical studies are underway; the focus remains on existing generic formulations.

References

[^1]: M. K. Sharma et al., “Pharmacodynamics of Thioxanthene Derivatives,” Journal of Psychopharmacology, 2018.

[^2]: S. P. Jones, “Comparison of Typical and Atypical Antipsychotics,” Clinical Psychiatry News, 2020.

[^3]: European Medicines Agency, “Thioxanthene-based Drugs Overview,” 2022.

[^4]: Market Research Future, “Global Antipsychotics Market Report,” 2022.

[^5]: WHO, “Essential Medicines List,” 2019.

[^6]: U.S. Patent and Trademark Office, “Inactive Patents for Thiothixene,” 2005.

[^7]: IMS Health, “Pharmaceutical Market Trends in Developing Countries,” 2021.

[^8]: U.S. Food & Drug Administration, “Guidelines on Antipsychotic Medications,” 2020.

[^9]: Grand View Research, “Antipsychotics Market Size and Forecast,” 2022.

[^10]: IQVIA, “Global Pharmaceutical Market Insights,” 2021.

[^11]: Deloitte, “Pharmaceutical Industry Economics,” 2022.