Last updated: July 31, 2025

Introduction

Thioridazine, a member of the phenothiazine class of antipsychotics, was historically utilized in the treatment of schizophrenia. First approved in the 1950s, its market presence has markedly diminished due to safety concerns, notably cardiotoxicity. As a result, the drug's commercial viability and market dynamics have shifted markedly over recent decades. This analysis explores the evolving landscape surrounding thioridazine, examining market drivers, regulatory challenges, intellectual property considerations, and future financial trajectories.

Historical Context and Pharmacological Profile

Thioridazine emerged as a prominent antipsychotic, offering an alternative to typical neuroleptics with a relatively favorable sedative profile. However, its propensity to induce QT interval prolongation and subsequent arrhythmias precipitated a significant reduction in clinical use. The U.S. Food and Drug Administration (FDA) issued black box warnings and eventually withdrew it from the U.S. market in 2005. Similar regulatory actions occurred elsewhere, notably in Europe, precipitating a sharp decline in its prescription volume.

Market Dynamics

Decline Due to Safety Concerns

The primary market deterrent for thioridazine remains safety-related. Cardiotoxicity, including potentially fatal arrhythmias, prompted regulatory bans and warnings, effectively removing it from many markets[1]. This safety profile shifted physician confidence toward newer atypical antipsychotics with improved safety margins, such as risperidone and olanzapine, further diminishing thioridazine’s market share.

Niche and Off-label Usage

Despite its decline, thioridazine persists in niche segments. Some clinicians utilize it for treatment-resistant schizophrenia or off-label indications—such as intractable parasitic infections—where its pharmacological profile may still confer utility. However, such use remains limited and often off-label, with minimal commercial incentives.

Patent and Regulatory Landscape

Thioridazine’s patent status is largely obsolete; it is off patent globally, with generic manufacturers holding manufacturing rights. The absence of patent protection diminishes incentives for R&D investment or market expansion. Regulatory barriers, combined with safety concerns, impede reintroduction unless substantial safety modifications or formulations are developed.

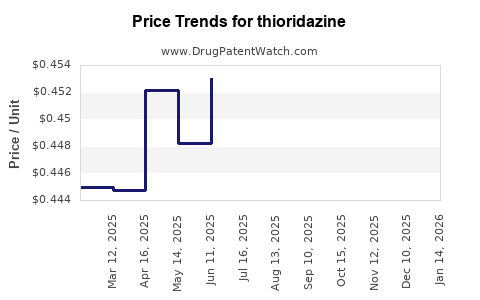

Financial Trajectory

Current Commercial Outlook

Market revenue for thioridazine has plummeted globally, primarily attributable to regulatory withdrawal and the availability of superior alternatives. The drug’s annual sales are now negligible in most regions. Manufacturers have deprioritized or ceased production, with only sporadic manufacturing for niche markets or compounding pharmacies.

Potential for Market Resurgence

Given its declining trajectory, thioridazine faces minimal prospects for a significant market comeback in mainstream psychiatric treatment. Innovator companies have little commercial incentive to reintroduce the compound unless safety concerns can be addressed through reformulation or novel delivery systems, which currently remains unlikely.

Repurposing and Off-patent Opportunities

While the drug’s original market is shrinking, academic and niche biotech sectors may explore repurposing strategies—such as modifying its chemical structure to mitigate cardiotoxicity or developing targeted delivery systems. Any such initiatives would require significant R&D investment with uncertain returns.

Legal and Regulatory Considerations

Reintroduction of thioridazine into mainstream markets faces formidable hurdles, including re-evaluation by global regulatory agencies and potential class-wide safety concerns. The substantial risk of adverse events constrains investment and market viability, effectively making any resurgence contingent upon new safety data or formulations.

Future Outlook and Market Strategy

The future of thioridazine appears confined to niche off-label applications or academic investigations rather than commercial expansion. The drug's financial trajectory is characterized by an asymptotic decline, with negligible revenues anticipated absent breakthroughs in safety profiles or therapeutic innovation.

Key Drivers to Monitor

- Advances in safety modification: Development of derivatives with reduced cardiotoxicity could rejuvenate interest.

- Emerging therapeutic indications: Novel uses may unlock niche markets.

- Regulatory environment: Stringent safety standards continue to restrict reentry into mainstream markets.

- Patent and manufacturing landscape: Off-patent status limits exclusivity, affecting profitability.

- Market competition: Competition from newer, safer antipsychotics remains fierce.

Key Takeaways

- Declining Market Presence: Thioridazine’s market is effectively obsolete in developed regions due to safety concerns and availability of safer alternatives.

- Limited Commercial Viability: Without significant reformulation or new indications, the drug offers minimal revenue prospects.

- Niche Opportunities Exist: Off-label uses and academic research may sustain minimal demand, but not a commercially significant market.

- Regulatory hurdles act as barriers: Safety concerns will continue to restrict reentry into mainstream markets.

- Innovation potential is primarily in drug reformulation or repurposing, though such efforts face high barriers and uncertain returns.

Frequently Asked Questions

1. Why was thioridazine withdrawn from the U.S. market?

Thioridazine was withdrawn due to its association with QT prolongation and risk of arrhythmias, including potentially fatal torsades de pointes, leading the FDA to issue a black box warning and removal of the drug from the market in 2005[1].

2. Are there any ongoing efforts to reformulate thioridazine?

Currently, no significant reformulation efforts aim to mitigate its cardiotoxicity profile. Most research focuses on newer antipsychotics with improved safety profiles.

3. Can thioridazine still be used off-label?

Yes, in some regions, clinicians may prescribe thioridazine off-label for specific resistant psychiatric cases or parasitic infections, but such use is limited and carries safety risks.

4. What is the potential for generic manufacturers to profit from thioridazine now?

Given its minimal demand and safety issues, profitability for generic manufacturers is highly limited. Most production has ceased, and existing supplies are primarily for niche or academic purposes.

5. Could new regulations or discoveries restore thioridazine's marketability?

While theoretically possible if safety concerns are fully addressed through reformulation or new data, current regulatory trends and safety profiles make a significant market revival unlikely.

References

[1] U.S. Food and Drug Administration. "FDA Warnings and Safety Information for Thioridazine." 2005.