Last updated: November 19, 2025

Introduction

Sulfamethoxazole (SMX) is a widely used antibiotic classified as a sulfonamide. It functions by inhibiting bacterial synthesis of dihydrofolic acid, disrupting bacterial DNA replication. Since its discovery and approval in the 1960s, sulfamethoxazole has become a cornerstone in antimicrobial therapy, often combined with trimethoprim to form co-trimoxazole, a prescription staple for various bacterial infections. Understanding its current market dynamics and financial trajectory requires an analysis of evolving clinical practices, regulatory landscapes, competitive forces, and emerging innovations within the antimicrobial space.

Market Overview and Historical Context

Sulfamethoxazole's initial success stemmed from its broad-spectrum activity and affordability. It primarily targeted urinary tract infections (UTIs), respiratory infections, and Pneumocystis jirovecii pneumonia (PCP). The combination with trimethoprim (co-trimoxazole) gained FDA approval in 1973, fortifying its market presence.

Over the decades, the widespread use of SMX co-trimoxazole positioned it as a first-line antibiotic globally. Nevertheless, proliferation of antimicrobial resistance (AMR) has significantly impacted its efficacy, prompting a re-evaluation of its role. Despite this, sulfamethoxazole remains relevant in select indications, especially in resource-limited settings.

Market Dynamics

1. Clinical Demand and Therapeutic Role

The global demand for sulfamethoxazole is driven by its continued utility in treating specific bacterial infections. It remains vital in managing UTIs, identified by persistent resistance issues with other antibiotics, and in prophylaxis for Pneumocystis pneumonia among immunocompromised populations, such as HIV/AIDS patients.

However, efforts to minimize sulfur antibiotic use due to resistance and adverse effects have led to a stagnation or decline in primary prescriptions. Still, in developing regions lacking access to newer antibiotics, sulfonamides maintain considerable importance.

Resistance Trends: The emergence of sulfamethoxazole-resistant strains reduces its clinical effectiveness, particularly in urinary pathogens like Escherichia coli. Resistance rates have increased globally, compounding pressures on healthcare providers to reconsider empirical therapies, which in turn influences market volume.

2. Regulatory Landscape and Patent Status

Sulfamethoxazole is a generic drug with no active patent protections, leading to commoditization. Consequently, pharmaceutical companies face limited incentives for research and development focused solely on sulfamethoxazole.

Regulatory bodies such as the FDA and EMA have maintained strict guidelines, especially concerning adverse effects like hypersensitivity reactions and hematologic toxicity. These regulations influence formulation standards but do not significantly impede existing generic markets.

3. Competitive Environment

The generic status of sulfamethoxazole results in intense price competition, constricting profit margins for manufacturers. It faces competition from newer broad-spectrum antibiotics, such as fluoroquinolones, and combination drugs that offer convenience or improved resistance profiles.

Emerging alternatives, including advanced antibiotics and novel antimicrobial agents, further threaten the market share of traditional sulfonamides.

4. Supply Chain and Manufacturing Factors

Manufacturing disruptions can occur due to raw material shortages or quality compliance issues. Given its low-margin nature, manufacturers may deprioritize supply stability, risking shortages that can influence market dynamics—particularly in low-resource settings where sulfamethoxazole is a cost-effective option.

Financial Trajectory and Future Outlook

1. Revenue Trends

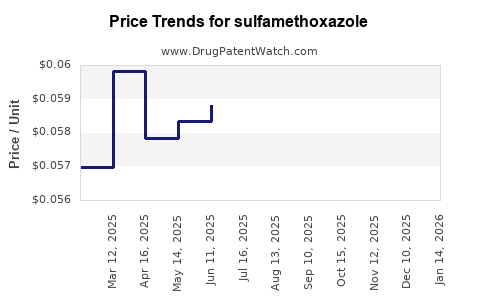

The global pharmaceutical market for sulfamethoxazole, historically valued in hundreds of millions of dollars annually, is witnessing a decline due to antimicrobial stewardship and rising resistance. The market is now predominantly driven by volume sales rather than profit margins.

In high-income countries, prescriptions are declining as guidelines favor newer, less resistance-prone agents. Conversely, in resource-constrained regions, demand remains relatively stable, supported by low-cost generics.

2. R&D and Innovation Prospects

The development of new formulations or combination therapies incorporating sulfamethoxazole faces bleak prospects given patent expiries and limited profitability. The focus in antimicrobial R&D has shifted toward novel classes, such as β-lactamase inhibitors, monoclonal antibodies, and bacteriophage therapy.

However, incremental innovations, such as improved formulations reducing adverse effects, could sustain niche markets temporarily but are unlikely to revive the overall financial trajectory substantially.

3. Market Expansion Opportunities

While traditional markets face decline, there are potential growth avenues:

- Combination Therapies: Developing novel fixed-dose combinations (FDCs) with newer agents to address resistance issues.

- Use in Veterinary Medicine: The veterinary sector continues to use sulfamethoxazole, opening alternative revenue streams.

- Emergent Markets: Expanding access and distribution in low-income regions where access to newer antibiotics remains limited.

4. Impact of Antimicrobial Stewardship and Resistance

Stewardship programs aiming to curtail inappropriate antibiotic use directly affect sales volumes. Resistance development further diminishes clinical utility, pressuring manufacturers away from investing in sulfamethoxazole-specific projects.

Key Trends and Drivers

a) Resistance and Stewardship Policies: Increasing global resistance rates and stewardship initiatives prioritize alternative agents, dampening future sales of sulfamethoxazole.

b) Generic Competition: Exhaustive patent expirations have led to a saturated, price-compressed market, constraining revenue.

c) Global Health Needs: In low-income countries, the low cost of sulfamethoxazole ensures continued relevance, sustaining demand in certain segments.

d) Regulatory and Safety Considerations: Enhanced awareness of adverse effects influences prescribing behaviors, potentially reducing usage.

Conclusion and Outlook

The market dynamics for sulfamethoxazole are characterized by declining demand in developed markets, driven by antimicrobial resistance, evolving clinical guidelines, and intense price competition. Financial trajectories suggest a plateau or slight decline in global revenues, with the most stable markets situated within low-income regions where cost remains paramount.

Future prospects hinge on targeted niche applications, incremental innovations, and strategic positioning within veterinary and resource-limited healthcare settings. In the radiating landscape of antimicrobial therapies, sulfamethoxazole’s role appears to be increasingly confined to specialized or legacy applications, with long-term financial growth prospects limited.

Key Takeaways

- Market decline is primarily driven by rising antimicrobial resistance and shifts toward newer antibiotics in high-income regions.

- Generic competition results in razor-thin margins, reducing incentives for R&D investment into sulfamethoxazole-specific innovations.

- In resource-limited settings, sulfamethoxazole maintains critical importance due to affordability and existing infrastructure.

- Antimicrobial stewardship policies, while essential for public health, limit the growth prospects of traditional drugs like sulfamethoxazole.

- Emerging niches include veterinary use and potential combination therapies tailored to circumvent resistance issues.

FAQs

1. Why has the demand for sulfamethoxazole declined in developed countries?

Advances in antimicrobial stewardship, rising resistance rates, and the availability of newer, more effective antibiotics have reduced reliance on sulfamethoxazole in developed nations.

2. Are there ongoing developments related to sulfamethoxazole formulations?

While incremental formulations with improved safety profiles are possible, significant R&D efforts are unlikely due to limited profitability and patent expiries.

3. How does antimicrobial resistance affect future sales of sulfamethoxazole?

Increasing resistance diminishes clinical efficacy, leading clinicians to favor alternative agents, thereby constraining future sales.

4. Is sulfamethoxazole still relevant in low-income countries?

Yes; due to its low cost and availability, sulfamethoxazole remains vital for treating common bacterial infections in resource-constrained settings.

5. What are potential opportunities for sulfamethoxazole within the pharmaceutical market?

Opportunities include veterinary applications, combination therapies addressing resistance, and supply chain stability in underserved markets.

References

- [1] Antibiotic Resistance Threats in the United States, 2019. CDC.

- [2] Ghasemiyeh, P., et al. (2020). An overview on sulfamethoxazole: World market and clinical perspectives. International Journal of Pharmaceutical Investigation.

- [3] European Medicines Agency (EMA). Guidance on antimicrobial stewardship policies.

- [4] World Health Organization. Report on global antimicrobial resistance.

- [5] Lien, K., et al. (2021). Impact of antimicrobial stewardship programs on antibiotic prescribing behaviors. Clinical Infectious Diseases.