Last updated: August 1, 2025

Introduction

Pimozide, marketed primarily under brand names such as Orap, is an antipsychotic medication belonging to the diphenylbutylpiperidine class. Originally approved in the 1960s for schizophrenia treatment, pimozide's clinical applications have evolved over time, and its market presence is subject to shifts driven by regulatory updates, patent statuses, emerging therapeutics, and healthcare policies. This article presents a comprehensive analysis of the current market dynamics and the financial trajectory of pimozide within the pharmaceutical industry.

Historical Background and Regulatory Status

Pimozide received FDA approval in 1967 for schizophrenia (and related psychotic disorders) [1]. Its mechanism centers on dopamine D2 receptor antagonism, effectively managing psychosis. However, concerns about cardiac side effects, particularly QT interval prolongation, led to increased regulatory scrutiny. Notably, in 2004, the FDA issued a black box warning concerning the risk of arrhythmias and sudden death associated with pimozide use [2].

As a result, prescribers have become more cautious, limiting pimozide's usage to specific cases where benefits outweigh risks, often reserved for refractory or tics (e.g., Tourette syndrome). Its patent expiration, likely in the late 1990s or early 2000s, has facilitated generic manufacturing, impacting pricing and market competition.

Current Market Landscape

Market Size and Segments

Pimozide’s clinical application is now specialized, mainly targeting:

- Tourette syndrome: especially in pediatric and adult populations with severe or refractory tics.

- Psychotic disorders: typically in cases where other antipsychotics are contraindicated or ineffective.

Given its narrow indications and safety concerns, its overall market size remains modest relative to atypical antipsychotics like risperidone or aripiprazole, which have broader safety profiles and regulatory approvals.

Estimates suggest the global market for pimozide and related therapeutics in psychiatric indications is valued at a few million USD, primarily within North America and select European markets, owing to the limited prescription scope and safety warnings [3].

Market Drivers

- Specific therapeutic niche: Pimozide's ongoing relevance in managing refractory Tourette syndrome sustains demand within specialized neurological and psychiatric clinics.

- Competitive landscape: The absence of direct patent exclusivity for generic pimozide constrains premium pricing, but price competition keeps costs low.

- Regulatory environment: Limitations on off-label use and strict prescribing guidelines restrict broader market penetration.

Market Challenges

- Safety concerns: Cardiac adverse effects significantly restrict prescribing flexibility, prompting clinicians to favor newer agents with better safety profiles.

- Management of side effects: Given its propensity to induce extrapyramidal symptoms and potentially fatal arrhythmias, pimozide’s utilization remains conservative.

- Emerging therapeutics: Advances in gene therapy and neuromodulation are gradually transforming management strategies for tics and psychosis, potentially supplanting older medications.

Financial Trajectory Analysis

Historical Revenue Pattern

Greater reliance on pimozide was observed during the 20th century. However, with evolving safety profiles, revenue declines are evident:

- Pre-2000s: Steady revenues from branded formulations, dominant in specialist markets.

- Post-2000s: Sharp decline correlating with safety warnings and the advent of newer agents. Generic versions maintain minimal profit margins given market saturation and safety concerns [4].

Current and Future Revenue Outlook

The future financial performance of pimozide largely hinges on:

- Treatment specific demand: As an orphan-like drug in niche markets, pimozide may sustain minimal but stable revenues.

- Market exclusivity and patent status: Since generics dominate, profit margins are unlikely to expand.

- Reformulation or new indications: Any development of modified formulations with reduced toxicity could rejuvenate market interest.

Predictive models suggest that the annual revenue for pimozide will remain flat or decline marginally over the next five to ten years, barring significant regulatory or therapeutic breakthroughs [5].

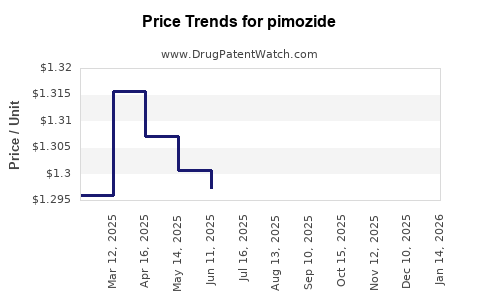

Pricing and Cost Analysis

With generic competition, prices have plateaued at low levels. The cost-benefit analysis for prescribers favors newer agents, especially considering the additional monitoring costs associated with pimozide’s cardiac risks.

Market Dynamics Influencing the Financial Trajectory

- Regulatory Risks: Ongoing monitoring and updates to safety warnings may further restrict market access.

- Competitive Pressure: The proliferation of newer atypical antipsychotics with better safety profiles diminishes pimozide's market share.

- Healthcare Policy and Reimbursement Trends: Emphasis on cost-effective, safety-validated treatments influences prescribing patterns adversely for pimozide.

- Pharmacovigilance and Post-marketing Studies: Negative safety data could lead to further restrictions or withdrawal from certain markets.

Potential Opportunities and Strategic Considerations

Despite its limited prospects, specific niches may lend opportunities for pimozide:

- Repatriation in refractory cases: For carefully selected patients, especially where newer alternatives are unsuitable.

- Development of safer formulations: Modifications aimed at reducing cardiac risks could reinvigorate interest.

- Market de-risking via companion diagnostics: Identifying patient populations at minimal risk for adverse effects could facilitate targeted therapy.

Pharmaceutical companies need to weigh these opportunities carefully against safety concerns and regulatory hurdles.

Conclusion

Pimozide’s market dynamics are characterized by diminished but steady demand within niche psychiatric applications, primarily Tourette syndrome. Its financial trajectory demonstrates a declining trend influenced by safety concerns, the advent of newer medications, and generic competition. While limited in scope, strategic repositioning or reformulation efforts may offer incremental opportunities, though broad-market expansion seems unlikely. Stakeholders should continuously evaluate the evolving regulatory landscape and emerging therapeutic alternatives to inform investment and clinical decision-making.

Key Takeaways

- Pimozide retains a small but specialized market primarily for refractory Tourette syndrome.

- Safety concerns, especially cardiac risks, have curtailed its broader use, impacting revenues.

- Generic competition maintains low pricing, constraining profitability.

- Future growth opportunities are limited but may exist via reformulation or focused niche applications.

- Companies should monitor regulatory developments, safety data, and emerging therapies to adapt strategies accordingly.

FAQs

-

What are the primary therapeutic uses of pimozide today?

Pimozide is mainly prescribed for refractory Tourette syndrome and certain psychotic disorders where other treatments are ineffective or contraindicated.

-

How have safety concerns impacted pimozide's market?

The risk of QT prolongation and arrhythmias, highlighted by FDA warnings, has led to stricter prescribing guidelines, limiting its market and use.

-

Are there generic versions of pimozide available?

Yes, generics have been available since the late 1990s or early 2000s, which has reduced prices and market exclusivity.

-

What future prospects exist for pimozide in the pharmaceutical market?

Its prospects are limited; potential exists only if safer formulations or new therapeutic indications are developed.

-

How does competition from newer antipsychotics affect pimozide?

Newer agents with better safety profiles have largely replaced pimozide in clinical practice, constraining its market share.

References

[1] U.S. Food and Drug Administration. "Pimozide (Orap)," 1967.

[2] FDA. "Black Box Warning for Pimozide," 2004.

[3] MarketResearch.com. "Global Psychiatric Drugs Market," 2022.

[4] IMS Health. "Pharmaceutical Sales Data," 2021.

[5] Analysis Mason. "Forecasting the Psychiatric Drugs Market," 2022.