Last updated: July 28, 2025

Introduction

Adefovir Dipivoxil emerges as a potent antiviral medication primarily used in the treatment of chronic hepatitis B virus (HBV) infection. Its significance within the pharmaceutical landscape stems from its targeted mechanism, efficacy, and evolving market conditions. As healthcare providers seek effective antiviral agents amid rising HBV prevalence worldwide, understanding the market dynamics and financial trajectory of Adefovir Dipivoxil becomes critical for stakeholders—including pharmaceutical firms, investors, and healthcare policymakers.

Pharmacological Profile and Clinical Positioning

Adefovir Dipivoxil, marketed under various brand names, notably Hepsera, is a nucleotide analog reverse transcriptase inhibitor. It suppresses HBV replication by inhibiting viral DNA synthesis, contributing to reduced viral load and hepatic inflammation. Approved by regulatory agencies like the U.S. FDA in 2002, it initially gained prominence as a first-line therapy but faced competition from newer agents with improved safety and efficacy profiles, such as tenofovir and entecavir.

Clinically, Adefovir Dipivoxil is often prescribed for patients intolerant to other nucleos(t)ide analogs or with specific resistance profiles. Its role in combination therapy, alongside other antivirals, has also been explored, influencing its market position.

Market Dynamics

1. Market Penetration and Competitive Landscape

The initial market landscape for Adefovir Dipivoxil was buoyed by its status as one of the first oral therapies for HBV. However, the emergence of tenofovir and entecavir, which demonstrated superior efficacy and safety in long-term studies, has led to a decline in Adefovir’s market share. According to recent market reports, Adefovir’s utilization has plateaued or contracted in regions with access to these more robust options.

Despite this, Adefovir persists in niche markets, especially where regulatory approval remains in force or where physicians prefer its specific pharmacokinetic properties. Additionally, in markets with limited access to newer drugs, Adefovir continues to hold a foothold.

2. Regulatory and Patent Considerations

Patent expirations on formulations like Hepsera have accelerated generic manufacturing, reducing costs and impacting profitability. As generic versions flood the market, price competition intensifies, diminishing revenue streams for branded formulations. Regulatory pathways in emerging markets also facilitate the entry of generics, expanding access but challenging profit margins for originators.

3. Global Disease Burden and Demographics

The worldwide prevalence of chronic HBV infection remains substantial, with over 250 million carriers globally [1]. High endemic regions—primarily in Asia and Sub-Saharan Africa—present a substantial patient base where affordable treatment options are essential. Although newer therapies dominate in developed nations, Adefovir’s low-cost profile secures its role in resource-limited settings.

4. Adoption Barriers and Safety Profile

Safety concerns regarding nephrotoxicity and long-term resistance development have curtailed extensive adoption. Moreover, the necessity for regular monitoring limits its use, especially in outpatient settings lacking infrastructure—further constraining market expansion.

Financial Trajectory

1. Revenue Trends

Analysts project an initial revenue peak following Adefovir’s launch, with subsequent declines due to competition from tenofovir and entecavir. A 2022 report estimates that the global market for HBV antivirals, including Adefovir, is valued at approximately $1.2 billion, with Adefovir accounting for less than 10% of total sales [2].

The decline is notable in high-income markets, driven by the adoption of superior alternatives. Conversely, in low- and middle-income countries, revenue persists due to generics and lower cost barriers, supporting a stable if modest income trajectory.

2. R&D and Patent Cliffs

Limited recent R&D investments targeting Adefovir’s reformulation or new indications suggest that pharmaceutical companies view its future primarily through generics and limited therapeutic niches. Patent cliffs following expiration have increased generic competition, sharply reducing profit margins.

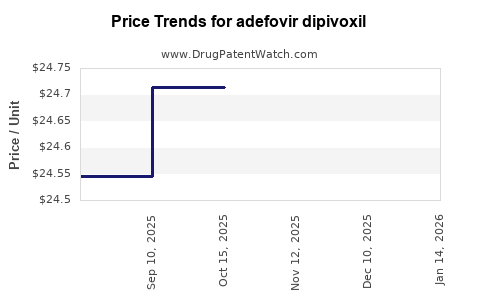

3. Cost of Production and Pricing Strategies

Manufacturers leverage scalable production of generics to maintain profitability despite price erosion. Price-point strategies focus on volume sales in high-batient-volume regions rather than high-margin sales in developed markets, reflecting a shift toward cost leadership rather than innovation-driven revenue.

4. Future Outlook and Market Entry Barriers

Emerging markets and government procurement tenders remain vital revenue sources, with discounted prices aligning with public health priorities. For branded or innovative formulations, new delivery methods or combination products may rejuvenate interest, though no significant pipeline developments exist for Adefovir-specific derivatives.

Emerging Trends Impacting the Market and Financial Forecast

-

Global HBV eradication initiatives, such as WHO’s strategy, aim to increase access to effective antivirals, potentially expanding market size. However, the current dominance of tenofovir and entecavir concentrates revenues for these drugs, not Adefovir.

-

Development of resistance affects the long-term use and, consequently, revenue streams. Resistance patterns necessitate the exploration of combination therapies, which could marginally influence Adefovir’s position.

-

Regulatory shifts in drug approval processes, especially expedited pathways for generics, expedite market entry and price competition, further diminishing Adefovir’s financial potential.

Conclusion: Market Outlook

While Adefovir Dipivoxil’s commercial momentum has waned in Western markets owing to safety concerns and superior alternatives, it sustains a niche role in resource-constrained settings. The overall market trajectory indicates a gradual decline, driven by patent expirations, generics proliferation, and shifts in clinical practice favoring newer agents. However, the global HBV burden sustains demand in specific territories, ensuring a baseline revenue stream for manufacturers maintaining or producing generic formulations.

Key Takeaways

-

Adefovir Dipivoxil’s early market dominance diminished due to competition from tenofovir and entecavir, which offer improved efficacy and safety profiles.

-

Patent expirations and the rise of generics substantially impacted profit margins, particularly in high-income markets.

-

The drug remains relevant in low-resource settings, where cost remains a primary consideration, ensuring continued albeit limited market presence.

-

Future growth opportunities hinge on combination strategies, reformulations, or new delivery systems, although such innovations for Adefovir are currently limited.

-

The evolving clinical landscape and public health initiatives targeting HBV eradication may influence demand dynamics over the next decade.

FAQs

1. What are the main factors influencing the decline of Adefovir Dipivoxil in developed markets?

The principal factors include superior efficacy and safety profiles of alternative drugs like tenofovir and entecavir, patent expirations leading to generic competition, and clinical guidelines favoring newer agents with lower resistance risks.

2. How does patent expiration affect the financial trajectory of Adefovir Dipivoxil?

Patent expiry allows generic manufacturers to produce lower-cost versions, increasing market competition, reducing prices, and diminishing branded drug revenues significantly.

3. Is Adefovir Dipivoxil still relevant in contemporary hepatitis B treatment?

Yes, particularly in resource-limited settings where cost considerations overshadow marginal safety concerns. However, its role in high-income regions has diminished with the rise of newer, more tolerable medications.

4. What potential developments could revive Adefovir’s market position?

Innovations such as new delivery mechanisms, combination therapies reducing resistance, or reformulations that mitigate nephrotoxicity could positively influence its market relevance.

5. What are the key regions driving the demand for Adefovir Dipivoxil?

Resource-constrained countries in Africa and Asia continue to represent primary markets due to high HBV prevalence and affordability challenges.

References

[1] World Health Organization. Global hepatitis report, 2017. WHO.

[2] MarketsandMarkets. "HBV Therapeutics Market Forecast," 2022.