Last updated: July 28, 2025

Introduction

Oxiconazole nitrate is a synthetic imidazole antifungal agent primarily used topically for treating dermatophyte and candidiasis infections. It is marketed under various brand names, including Oxistat and Oxiconazole, and is often prescribed for conditions such as athlete’s foot, ringworm, and yeast infections. The drug’s unique pharmacological profile, emerging clinical applications, and evolving market landscape heavily influence its economic prospects. This analysis examines the current market dynamics, competitive landscape, regulatory environment, and future financial trajectory of oxiconazole nitrate.

Pharmacological Profile and Clinical Applications

Oxiconazole nitrate operates by inhibiting fungal cytochrome P450-dependent enzymes, thereby disrupting ergosterol synthesis essential for fungal cell membrane integrity. Its efficacy in dermatological infections with a favorable safety profile has sustained its utilization in topical formulations. However, with the advent of newer antifungal agents—such as efinaconazole, sertaconazole, and newer azole derivatives—its dominance faces challenges.

While primarily used in topical applications, off-label or combination uses under exploration could potentially expand its clinical scope. Nonetheless, the limited systemic absorption and scope for topical metered-dose formulations position oxiconazole as a niche yet stable antifungal agent.

Market Landscape and Competitive Environment

Global Market Share and Regional Trends

The global antifungal market was valued at approximately USD 13.3 billion in 2022, with topical antifungals accounting for a significant segment due to their safety profile and ease of application [1]. Oxiconazole nitrate's market share remains relatively modest compared to agents like clotrimazole, terbinafine, and econazole, primarily owing to its regional availability and the presence of generic competitors.

Regions with high prevalence of dermatophytic infections, such as Asia-Pacific and Latin America, present growth opportunities, supported by increasing healthcare access and dermatology awareness [2]. Conversely, North America's antifungal market is highly saturated, with key players focusing on innovation and line extensions.

Key Manufacturers and Patent Status

Major pharmaceutical companies like Novartis (via its generic arm), Bayer, and specialty dermatology firms produce oxiconazole formulations. Patent protections for oxiconazole have largely expired, enabling generic manufacturers to supply most markets, which exerts downward pressure on prices and margins.

Despite the expiration of key patents, formulations and delivery mechanisms can be patented, creating opportunities for branded derivatives or combination products. As patent cliffs encourage generic proliferation, companies focus on market penetration and cost efficiency.

Regulatory Landscape

Regulatory approvals vary regionally. In the U.S., oxiconazole nitrate is an FDA-approved topical antifungal (marketed as Oxistat), whereas other markets, such as the European Union, have different approval statuses and labeling. Slow regulatory approval times and varying clinical data requirements influence market entry and expansion strategies.

Furthermore, regulatory agencies increasingly scrutinize safety and efficacy profiles, especially concerning off-label uses. Recent approvals or clearances for novel formulations or indications could substantially influence market dynamics.

Market Drivers and Restraints

Drivers

- Rising Incidence of Fungal Infections: The global burden of dermatophyte infections is rising due to increased urbanization, climate change, and immunosuppressive therapies [3].

- Growing Preference for Topical Treatments: Patients favor topical over systemic antifungals due to fewer systemic side effects.

- Brand Multiplicity and Cost-Effectiveness: The availability of generic formulations enhances affordability, expanding patient access.

- Potential for Combination Therapies: Innovations combining oxiconazole with other agents could offer superior efficacy.

Restraints

- Intense Competition from Newer Agents: Agents like efinaconazole and tavaborole demonstrate superior pharmacokinetics, fostering clinician preference.

- Limited Clinical Indications: Being primarily topical and dermatophyte-focused limits widespread systemic adoption.

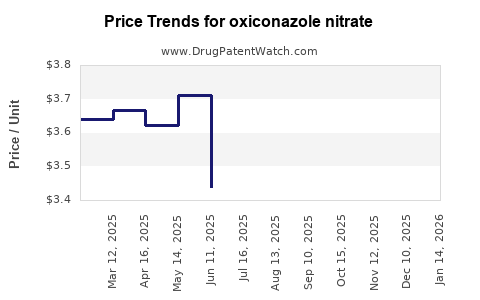

- Pricing Pressures: Generic competition and aggressive pricing strategies reduce profitability.

- Regulatory and Patent Challenges: Patent expirations facilitate generic entry, eroding margins.

Financial Trajectory and Market Forecast

Current Financial Status

Given its status as a generic antifungal, oxiconazole nitrate generates modest but stable revenues within the dermatology segment. Estimated global sales are approximately USD 150-200 million annually, primarily driven by emerging markets and established dermatology markets (North America, Europe).

Projected Market Trends (2023–2030)

- Moderate Growth: CAGR estimates range between 3-5%, driven by increased dermatological diagnostics and rising skin infection prevalence in developing regions.

- Market Penetration through Formulation Innovation: Development of sophisticated delivery systems like foam, gel, and medicated cloths could stimulate demand.

- Potential Market Expansion: Off-label and combination uses in conjunction with systemic agents could expand market size and application spectrum.

Influence of Novel Formulations & Indications

Innovations such as combination topical therapies with corticosteroids or novel delivery technologies could enhance efficacy and patient adherence, thereby positively impacting revenues. Conversely, the entry of more potent or convenient agents may threaten market share.

Impact of Regulatory and Patent Dynamics

Patent expirations generally lead to sales erosion, but strategic investments in formulation patents or novel indications can sustain profitability. For example, certain jurisdictions may offer extensions or new approvals for improved formulations.

Emerging Opportunities

- Expanding into Adjunct or Adjacent Markets: Incorporation into products for interdigital tinea or onychomycosis, albeit systemic formulations are limited.

- Geographic Expansion: Targeting underserved markets with rising dermatological health awareness.

- Partnerships & Licensing: Collaborations with biotech firms to develop combination or new formulation patents.

Summary of Financial Outlook

While oxiconazole nitrate’s revenues are unlikely to experience exponential growth, steady, incremental increases are anticipated, aligned with overall dermatology market expansion. Strategic focus on formulation refinement, geographic expansion, and potential off-label applications will influence its long-term financial trajectory.

Key Market Factors Summary:

- Steady demand for topical antifungals fuels ongoing sales.

- Patent expirations intensify price competition, constraining margins.

- Emerging regions present growth opportunities due to increased fungal infection rates.

- Innovation and formulation improvements can open new revenue streams.

- Adverse competition from newer azoles and systemic agents remain persistent threats.

Conclusion

Oxiconazole nitrate maintains a niche yet stable position within the antifungal market. Its future financial trajectory hinges on strategic formulation innovations, geographic expansion, and navigating patent landscapes. While competitive pressures and generic entry challenge profitability, sustained demand in dermatology, especially in emerging markets, supports steady growth prospects.

Key Takeaways

- Oxiconazole nitrate is a well-established topical antifungal with steady global demand, especially in dermatology.

- Market growth is constrained by patent expirations, generic competition, and competition from newer azoles.

- Emerging markets and formulation innovations represent significant growth drivers.

- Its financial outlook suggests modest but consistent revenue streams, with potential for expansion through strategic partnerships and formulation advancements.

- Monitoring regulatory changes, patent statuses, and competitive product launches is essential for assessing future market positions.

FAQs

1. What are the primary clinical indications for oxiconazole nitrate?

Oxiconazole nitrate is primarily indicated for the topical treatment of dermatophyte infections such as athlete’s foot, ringworm, and candidiasis of the skin.

2. How does oxiconazole nitrate compete with other antifungals?

It competes mainly on safety and efficacy in topical applications but faces stiff competition from newer agents like efinaconazole, which may offer superior pharmacokinetic profiles or broader spectrum.

3. What factors could influence the pricing of oxiconazole-based products?

Patent expirations lead to increased generic availability, which generally drives prices downward. Formulation innovations and regional market dynamics also influence pricing.

4. Are there ongoing clinical trials expanding oxiconazole’s indications?

Currently, most development focuses on formulation improvements; extended indications for systemic fungal infections are not predominant due to pharmacokinetic limitations.

5. What is the outlook for oxiconazole nitrate in the next decade?

A stable, slow-growth outlook predicated on regional market expansion, innovation, and strategic positioning, with risks from market competition and patent challenges.

References

[1] MarketWatch. “Antifungal Market Size & Share, Industry Analysis, Trends & Forecasts.” 2022.

[2] Grand View Research. “Global Dermatology Market Insights,” 2022.

[3] World Health Organization. “Fungal Infections: An Emerging Public Health Concern,” 2021.