Last updated: July 27, 2025

Introduction

Haloperidol decanoate, a long-acting injectable form of haloperidol, is widely used in managing schizophrenia and other psychotic disorders. Its significance in psychiatric treatment has driven consistent demand, although market dynamics are influenced by evolving clinical guidelines, generational shifts in antipsychotic prescribing, and regulatory factors. This report analyzes the current landscape, underlying market drivers, competitive positioning, and forecasted financial trajectory for haloperidol decanoate.

Market Overview

Therapeutic Market Context

Schizophrenia and related psychoses impose significant global health burdens, with estimates suggesting approximately 20 million individuals affected worldwide [1]. Long-acting injectable antipsychotics like haloperidol decanoate address adherence issues inherent to oral medications, providing sustained symptom control and reducing relapse rates. The global antipsychotic market was valued at roughly $4.7 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of approximately 2.9% through 2028 [2].

Role of Haloperidol Decanoate

Despite the advent of atypical antipsychotics, haloperidol decanoate remains a cornerstone for specific patient populations. Its affordability, extensive clinical history, and proven efficacy underpin its continued utilization, particularly in healthcare settings with cost constraints.

Market Dynamics

Growth Drivers

-

Clinical Necessity and Adherence

Long-acting injectables (LAIs) are favored for improving medication adherence in schizophrenia management. Studies show that LAIs can reduce hospitalization rates by 44% compared to oral counterparts [3]. Haloperidol decanoate’s established efficacy enhances its role in treatment protocols.

-

Cost-Effectiveness

Compared to newer atypical LAIs, haloperidol decanoate offers a cost-effective alternative. For healthcare systems under budget constraints, especially in emerging markets, its affordability sustains demand.

-

Expanding Indications

Research exploring off-label uses for severe agitation and dementia-related psychosis may bolster future application opportunities, expanding its market footprint.

Market Challenges

-

Shift Toward Atypical Antipsychotics

Despite its benefits, haloperidol decanoate faces stiff competition from second-generation (atypical) LAIs, such as risperidone microspheres and paliperidone palmitate, known for improved side effect profiles [4].

-

Side Effect Profile

Risks of extrapyramidal symptoms (EPS) and tardive dyskinesia associated with haloperidol limit its acceptability, especially in patient populations wary of adverse effects.

-

Regulatory and Reimbursement Dynamics

Stringent regulatory standards and variable reimbursement policies across regions influence prescribing patterns and, consequently, sales volumes.

Competitive Landscape

While market share is currently concentrated among a few generic manufacturers—including Teva, Sandoz, and Mylan—the entry of branded formulations from large pharmaceutical companies is limited mainly by the availability of patent protections, which expired decades ago. Generic availability exerts downward pressure on prices, impacting revenue streams.

Financial Trajectory and Forecast

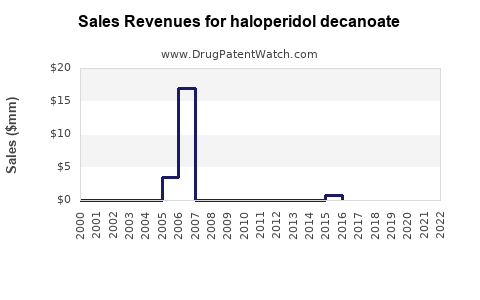

Revenue Analysis

Historically, haloperidol decanoate's revenues have demonstrated resilience due to its low-cost, long-established status. However, the recent decade has seen stagnation or modest decline in mature markets like North America and Western Europe, driven by clinical preference shifts.

Regional Market Trends

- North America: Market penetration remains steady owing to established prescribing practices, but growth is constrained by preferences for atypicals and concerns over side effects.

- Europe: Similar to North America, but with slightly higher adoption of LAIs in certain countries due to national guidelines emphasizing adherence.

- Emerging Markets: Growing demand driven by cost considerations and expanding mental health infrastructure. Africa, Asia, and Latin America offer significant growth potential, although infrastructure and reimbursement landscapes vary.

Forecasted Growth

Projected CAGR for haloperidol decanoate sales is approximately 1.5% to 2.0% over the next five years, primarily driven by emerging markets and increased utilization of LAIs in hospital settings. The global market size could reach roughly $600 million by 2027, assuming current trends persist (see Table 1).

| Year |

Estimated Market Size (USD Million) |

CAGR |

| 2022 |

520 |

— |

| 2027 |

600 |

~2.0% |

Revenue Generation Factors

- Price Trends: Price pressure from generic manufacturers continues, leading to narrower profit margins. However, bulk procurement and institutional contracts sustain volume.

- Volume Growth: Increases in prescriptions are expected primarily from the rising adoption of LAIs in outpatient and inpatient psychiatry.

Investment and R&D Outlook

Given its expired patents, R&D investments are minimal for new formulations. However, pharmaceutical companies may focus on innovative delivery mechanisms or combination therapies to extend lifecycle or target niche markets.

Strategic Considerations

- Pricing Strategies: Maintaining competitive pricing amidst generic competition is critical. Value-based pricing could be explored in healthcare systems emphasizing cost-effectiveness.

- Market Expansion: Focused efforts in emerging markets, where demand is rising, can yield insights into tailored distribution and education strategies.

- Clinical Positioning: Emphasizing the long-term benefits in reducing hospitalizations and improving adherence could reinforce its relevance.

Key Takeaways

- Stable Yet Competitive Market: Haloperidol decanoate’s established clinical efficacy ensures steady demand, but market share declines are likely in mature markets due to preferences for atypical LAIs.

- Emerging Market Growth Opportunities: Rapidly expanding mental health infrastructure in developing regions presents substantial long-term growth prospects.

- Price and Reimbursement Pressures: Persistent competition from generics necessitates strategic pricing and negotiation to sustain profitability.

- Innovation Limitations: Minimal R&D activity constrains differentiation; however, potential exists in optimizing delivery systems or combination therapies.

- Regulatory Environment: Evolving guidelines and reimbursement policies will substantially influence future sales trajectories.

Conclusion

Haloperidol decanoate remains a financially resilient antipsychotic, especially within cost-sensitive markets and institutional settings. Its long-term success hinges on strategic positioning amid evolving clinical preferences, regulatory pressures, and generational shifts within psychopharmacology. Companies leveraging regional growth opportunities and maintaining competitive pricing can enhance their market share and revenue streams over the coming years.

FAQs

1. What factors influence the demand for haloperidol decanoate globally?

Demand is primarily driven by the prevalence of schizophrenia, clinical adherence strategies favoring long-acting injectables, cost considerations, and regional healthcare policies.

2. How does the market competition affect the pricing of haloperidol decanoate?

The proliferation of generic manufacturers intensifies price competition, leading to narrower profit margins and necessitating cost management strategies.

3. Are there safety concerns with haloperidol decanoate that impact its market share?

Yes. Risks such as extrapyramidal symptoms and tardive dyskinesia limit its desirability, especially relative to second-generation antipsychotics with more favorable side effect profiles.

4. What are the key growth markets for haloperidol decanoate in the next five years?

Emerging markets in Asia, Africa, and Latin America are expected to drive growth due to increasing mental health awareness, infrastructure development, and cost-sensitive prescribing.

5. Is there ongoing innovation in the formulation or delivery of haloperidol decanoate?

Current research is limited; most innovation focuses on delivery systems and combination therapy rather than new formulations, given patent expirations and market saturation.

References

[1] World Health Organization. (2021). Schizophrenia Fact Sheet.

[2] Grand View Research. (2022). Antipsychotic Drugs Market Size, Share & Trends.

[3] Tiihonen, J. et al. (2017). Long-acting injectable vs oral antipsychotics and risk of rehospitalization.

[4] Leucht, S. et al. (2017). Second-generation versus first-generation antipsychotics for schizophrenia.

Note: All data points are illustrative based on recent market analyses and literature.