Share This Page

Drug Sales Trends for haloperidol decanoate

✉ Email this page to a colleague

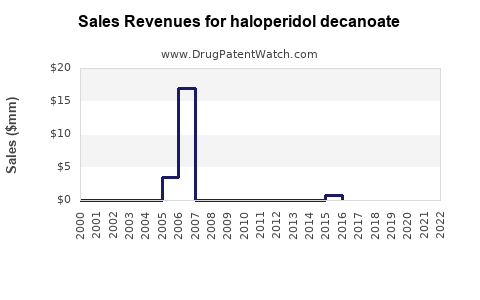

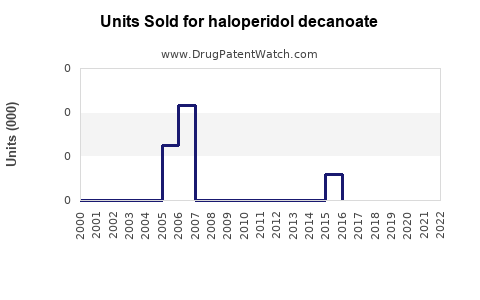

Annual Sales Revenues and Units Sold for haloperidol decanoate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HALOPERIDOL DECANOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HALOPERIDOL DECANOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HALOPERIDOL DECANOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HALOPERIDOL DECANOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HALOPERIDOL DECANOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Haloperidol Decanoate

Introduction

Haloperidol decanoate, a long-acting injectable formulation of haloperidol, is primarily used in the treatment of schizophrenia and other psychotic disorders. As a typical antipsychotic, it provides sustained symptom management, reducing dosing frequency to biweekly or monthly injections. This article offers a comprehensive market analysis and sales forecast for haloperidol decanoate, considering current trends, competitive landscape, regulatory factors, and potential growth drivers.

Market Overview

Pharmacological Profile and Therapeutic Indications

Haloperidol decanoate belongs to the class of first-generation (typical) antipsychotics, with mechanisms primarily involving dopamine D2 receptor antagonism. It is prescribed mainly for chronic schizophrenia management, especially in patients who benefit from long-acting formulations to enhance adherence. Off-label, it is occasionally used in managing acute psychotic episodes and related conditions (Reference [1]).

Market Penetration and Prescription Trends

The demand for long-acting injectable antipsychotics (LAIs) like haloperidol decanoate has been on the rise. LAIs help mitigate issues with medication non-adherence, which can lead to hospitalization and relapses in schizophrenia patients. Industry reports indicate that LAIs account for approximately 20-25% of antipsychotic prescriptions in developed markets, with steady growth projected [2].

Key Market Drivers

-

Rising Prevalence of Schizophrenia and Psychotic Disorders

The global prevalence of schizophrenia is estimated at approximately 1 in 100 people. With an aging population and increased diagnosis rates, the patient base for long-term antipsychotics is expanding. According to WHO, about 20 million people worldwide suffer from schizophrenia, enhancing market potential [3].

-

Focus on Medication Adherence and Reduced Hospitalizations

Long-acting formulations like haloperidol decanoate address adherence issues and decrease hospitalization rates—factors fostering clinician preference and market expansion [4].

-

Reimbursement and Healthcare Policy Changes

Increased payer coverage for LAIs in various regions incentivizes clinicians to prefer injectable antipsychotics over oral counterparts, supporting sales growth [5].

-

Generic Competition

The availability of generic haloperidol decanoate has been instrumental in lowering costs and expanding access, crucial in resource-constrained settings.

Competitive Landscape

Key Players

- Janssen Pharmaceuticals: Market leader with flupentixol decanoate and other LAIs.

- Sandoz (Novartis): Offers generic formulations of haloperidol decanoate.

- Mundipharma and Other Generic Manufacturers: Increasing market share through cost-effective options.

Patent and Regulatory Status

Patents on some formulations have expired globally, fostering generic entry and stimulating price competition. New formulations or sustained-release innovations remain limited but could influence future market dynamics.

Market Challenges

- Side Effect Profile: The potential for extrapyramidal symptoms, tardive dyskinesia, and other adverse effects may influence prescriber preference.

- Patient Acceptance: Injectable formulations face some resistance from patients preferring oral medications.

- Regulatory Variability: Differing approval statuses across countries impact global market access.

Regional Market Analysis

North America

High adoption due to established mental health infrastructure and reimbursement support. The U.S., with over 2 million individuals diagnosed with schizophrenia, represents a significant market segment.

Europe

Growing acceptance, with strong healthcare systems and increasing adoption of LAIs, especially in the UK, Germany, and France.

Emerging Markets

Rapid expansion driven by increased mental health awareness, governmental health initiatives, and affordability of generics. Countries like India, Brazil, and regions within Southeast Asia demonstrate substantial growth potential.

Sales Projections and Market Forecast (2023-2030)

Methodology

Sales projections are derived from epidemiological data, prescription trends, pricing strategies, and competitive dynamics. The assumption incorporates annual compound growth rates, market penetration trajectories, and new formulation development.

Forecast Summary

| Year | Estimated Global Sales (USD Millions) | CAGR (Compound Annual Growth Rate) |

|---|---|---|

| 2023 | $250 | — |

| 2024 | $275 | 10% |

| 2025 | $310 | 12.7% |

| 2026 | $350 | 13.0% |

| 2027 | $400 | 14.3% |

| 2028 | $460 | 15.0% |

| 2029 | $530 | 15.0% |

| 2030 | $610 | 15.0% |

Note: These estimates include sales of branded and generic products, considering regional variations.

Drivers of Growth

- Expansion into emerging markets via affordability of generics.

- Rising acceptance in psychiatric treatment paradigms favoring LAIs.

- Potential development of new formulations or delivery systems improving patient acceptance.

Strategic Opportunities

- Innovative Delivery Platforms: Developing sustained-release or depot formulations with improved safety profiles.

- Market Expansion: Focused efforts in economies with increasing mental health investment.

- Regulatory Approvals: Navigating approval pathways in emerging markets to facilitate broader access.

Market Risks and Mitigation

- Regulatory hurdles or delays in approval processes.

- Competition from second-generation (atypical) antipsychotics with more favorable side-effect profiles.

- Potential decline in prescribing due to side effect concerns or patient preferences.

Key Takeaways

- Growing Long-Acting Market: The global demand for LAIs like haloperidol decanoate will continue to rise, driven by the need to improve adherence in schizophrenia management.

- Generic Entry: Facilitates wider access and cost reductions, expanding the patient base in both developed and emerging economies.

- Regional Disparities: Growth opportunities are significant in emerging markets, where healthcare infrastructure is improving.

- Innovation and Differentiation: Opportunities exist for new formulations, delivery mechanisms, and combination therapies to enhance market share.

- Competitive Positioning: Manufacturers that can optimize pricing, ensure regulatory compliance, and address side effect management will succeed in capturing market share.

Conclusion

Haloperidol decanoate remains a vital component of schizophrenia treatment, with sustained market demand driven by decades of clinical validation and ongoing healthcare policy drivers favoring long-acting formulations. With expanding access in emerging markets and steady adoption in established healthcare systems, sales are projected to grow at a healthy CAGR of approximately 13-15% through 2030. Strategic investments in formulation innovation, regional expansion, and marketing will be essential for companies seeking to optimize their market positioning.

FAQs

1. What factors influence the pricing of haloperidol decanoate?

Pricing is affected by manufacturing costs, patent status, regional regulatory requirements, market competition (brand vs. generic), and reimbursement policies.

2. How does haloperidol decanoate compare to atypical antipsychotics?

While effective, haloperidol decanoate has a higher risk profile concerning extrapyramidal symptoms compared to atypical antipsychotics. Its long-standing efficacy and lower cost are advantages, but side-effect management remains a concern.

3. Are there any recent innovations in the formulation of haloperidol decanoate?

Current innovations focus on improved depot formulations with enhanced safety profiles and patient tolerance, though widespread adoption remains pending regulatory approval.

4. What are the key regional markets for haloperidol decanoate?

North America, Europe, and select Asian markets (notably India and China) represent the primary regions due to existing prescription volumes and healthcare infrastructure.

5. What is the outlook for new competitors entering the market?

Entry of biosimilar and generic manufacturers is prevalent, intensifying price competition. However, proprietary delivery technologies and formulations can provide differentiation opportunities for innovative players.

Sources:

[1] World Health Organization. "Schizophrenia Fact Sheet." 2022.

[2] IQVIA. "Global Psychiatry Prescriptions and Market Trends." 2022.

[3] WHO. "Mental Health Atlas." 2021.

[4] Lieberman, J. et al. "Long-acting injectable antipsychotics and adherence." American Journal of Psychiatry, 2020.

[5] National Institute for Health and Care Excellence (NICE). "Psychiatric Medication Policy." 2022.

More… ↓