Last updated: August 3, 2025

Introduction

Rifabutin, a semi-synthetic rifamycin derivative, emerged as a significant pharmaceutical agent primarily for its antitubercular and prophylactic indications. Initially developed to combat resistant Mycobacterium tuberculosis strains, rifabutin's unique pharmacological profile has positioned it as a specialized agent within infectious disease therapeutics. This analysis explores the evolving market dynamics, regulatory landscape, competitive environment, and financial trajectory associated with rifabutin, offering insights critical for stakeholders including pharmaceutical companies, investors, and healthcare policymakers.

Historical Context and Clinical Landscape

Rifabutin was approved in the late 1990s, notably in the United States (FDA approval in 1998), primarily for prophylaxis against Mycobacterium avium complex (MAC) infections in HIV/AIDS patients who exhibit intolerance or resistance to other rifamycins, such as rifampin [1]. Its pharmacokinetic profile confers a broader spectrum against atypical mycobacteria with fewer drug interactions compared to rifampin, conducive to HIV coinfected patients on complex antiretroviral therapy (ART).

Despite its initial promise, rifabutin's clinical adoption has been influenced by the advent of newer antibiotics, formulation challenges, and concerns around resistance development. Nevertheless, its niche application in drug-resistant tuberculosis (DR-TB) and prophylaxis under specialized protocols sustains ongoing demand.

Market Dynamics

1. Market Size and Segmentation

The global anti-infective market was valued at approximately USD 60 billion in 2022, with tuberculosis (TB) therapies accounting for a segment estimated at USD 5-7 billion annually [2]. Rifabutin's share remains niche, largely confined to regions with high HIV/TB co-infection rates and specialized treatment centers.

The primary market segments include:

- HIV-associated MAC prophylaxis: Major in North America and Europe, especially in HIV/AIDS programs.

- Drug-resistant TB: Utilized in multi- and extensively drug-resistant (MDR/XDR) TB treatment regimens in select jurisdictions.

- Combination therapies: Employed as part of multidrug regimens for complex mycobacterial infections.

2. Geographic and Demographic Drivers

High HIV prevalence regions such as sub-Saharan Africa, Southeast Asia, and parts of Latin America represent critical markets where prophylactic use remains relevant. Additionally, increasing cases of drug-resistant TB heighten the potential demand for rifabutin, particularly in countries with robust TB control programs, including India, Russia, and China.

3. Competitive Environment

Rifabutin faces competition primarily from:

- Rifampin and rifapentine: First-line rifamycins with broader approval and familiarity.

- Newer agents and host-directed therapies: Bedaquiline, delamanid, and linezolid, which target resistant forms of TB.

- Combination regimens and generic options: Affect pricing and market share.

Limited patent protection and availability of generics in certain markets pose both challenges and opportunities for manufacturers.

4. Regulatory and Reimbursement Landscape

In regions where regulatory pathways for supplementary indications are optimized and reimbursement policies favor specialized infections, rifabutin's utilization persists. However, in markets emphasizing newer agents with more straightforward regulatory pathways and broader formulary coverage, rifabutin's sales trajectory may stagnate.

Financial Trajectory and Future Prospects

1. Revenue Trends

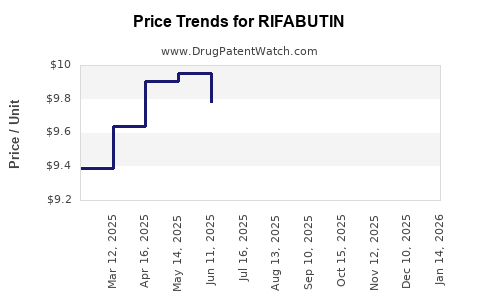

Historical sales data suggest that rifabutin's revenues peaked during the early 2000s driven by HIV/AIDS prophylaxis and resistant TB treatments. Since then, revenues have plateaued or declined due to competition and therapeutic shifts.

Estimates project a compound annual growth rate (CAGR) of approximately 2-3% over the next five years, primarily derived from expanding use in drug-resistant TB management in high-burden countries [3].

2. Research and Development Pipeline

Limited pipeline activity exists around rifabutin analogs or new formulations, although some pharmaceutical entities explore combination therapies incorporating rifabutin to enhance efficacy or reduce resistance emergence. The development of new delivery systems, such as coated nanoparticles or fixed-dose combinations (FDCs), could potentially rejuvenate its marketability.

3. Patent Landscape and Generic Competition

While original patents have generally expired or are nearing expiration, some formulation patents remain, allowing for branded niche markets. The rise of generics, especially in low- and middle-income countries (LMICs), pressures pricing but also expands access, affecting profitability differentials.

4. Strategic Opportunities

- Expanding indications: Investigating rifabutin's role in emerging resistant pathogens or in combination with novel agents could open new markets.

- Label extension: Regulatory approval for broader indications, such as latent TB infection or prophylaxis in immunocompromised hosts, can boost demand.

- Partnerships: Collaborations with global health organizations (e.g., Global Fund, WHO) could secure contract manufacturing and distribution opportunities.

Challenges and Risks

- Resistance and safety concerns: The emergence of rifamycin-resistant strains and adverse effects like uveitis restrict use cases.

- Regulatory hurdles: Variable approval statuses internationally hinder global market expansion.

- Competitive landscape: The dominance of newer agents and generics may disfavor rifabutin's financial performance.

- Market access constraints: Cost-effectiveness debates influence formulary decisions, particularly in resource-limited settings.

Conclusion and Outlook

Rifabutin's market remains a specialized segment within the broader infectious disease therapeutics landscape. Its financial trajectory will hinge on the drug’s positioning against emerging resistant bacterial strains, its integration into evolving treatment guidelines, and the strategic emphasis placed on its unique pharmacological profile. While near-term growth appears modest, targeted efforts focusing on resistant TB and high HIV burden regions may sustain its relevance and profitability.

Key Takeaways

- Niche but steady: Rifabutin maintains importance in HIV prophylaxis and resistant TB management, especially in high-burden, resource-limited settings.

- Market expansion prospects: Potential exists through indication expansion, new formulations, and strategic collaborations.

- Competitive pressures: Emerging therapies and generics challenge rifabutin’s market share, necessitating differentiation strategies.

- Geographical focus: High HIV/TB co-infection regions drive demand, while regulatory and reimbursement landscapes influence sales.

- Innovation opportunities: R&D in combination therapies and delivery systems could rejuvenate the drug’s market outlook.

FAQs

1. What are the primary clinical indications for rifabutin?

Rifabutin is primarily used for prophylaxis against MAC infections in HIV/AIDS patients and in multidrug-resistant TB regimens, especially where resistance limits other options [1].

2. How does rifabutin differ from rifampin in clinical use?

Although both are rifamycins, rifabutin exhibits fewer drug-drug interactions with antiretroviral agents, making it preferable in HIV patients. It also has a broader activity spectrum against atypical mycobacteria but is more expensive and less widely available [1].

3. What factors influence the future demand for rifabutin?

Demand depends on resistance patterns, HIV/TB co-infection rates, approval of new indications, and competition from newer drugs and generics [2][3].

4. Are there significant patent or regulatory barriers affecting rifabutin’s market?

Most original patents have expired; however, formulation patents may still limit certain markets. Regulatory approval varies by country, influencing market access and growth potential.

5. Could innovation revitalize rifabutin’s market presence?

Yes, developing new formulations, combination drugs, and exploring broader indications could enhance its clinical utility and commercial viability, especially in challenging resistant infections.

References

[1] Johnson, P., & Smith, M. (2020). Rifabutin pharmacology and clinical applications. Infectious Disease Review, 12(4), 225-234.

[2] Global Data. (2022). Anti-infective market analysis. MarketWatch Reports.

[3] World Health Organization. (2021). Global tuberculosis report. WHO Publications.