Last updated: July 27, 2025

Introduction

Probenecid, a uricosuric agent primarily utilized for gout management, has garnered renewed interest as a potential therapeutic beyond its traditional indications. Historically dating back to the 1950s, probenecid’s clinical use centered on uric acid excretion, but recent studies highlight its potential in addressing viral infections, including COVID-19, and other emerging indications. This evolving landscape influences its market dynamics and financial trajectory, underscoring potential shifts from niche drug to broader therapeutic agent.

Market Overview and Historical Context

Probenecid's initial market was confined primarily to gout and hyperuricemia management, with widespread generic availability. Its role as an adjunct agent to delay or enhance the pharmacokinetics of other antibiotics initially fueled incremental revenue streams. The patent landscape has been historically stable, with no major patent protections active since the late 20th century, leading to minimal exclusivity, price erosion, and significant reliance on generic sales.

The advent of COVID-19 catalyzed renewed research into probenecid’s antiviral properties. Notably, recent clinical trials demonstrated that probenecid could inhibit SARS-CoV-2 replication, stimulating scientific and investor interest [1]. This shift presents opportunities for repositioning the drug within infectious disease therapeutics.

Current Market Dynamics

1. Patent and Regulatory Landscape

Probenecid is off-patent globally, which limits pharmaceutical companies’ ability to command premium prices solely based on patent protection. This situation has historically resulted in a low-margin market characterized by generic competition. However, regulatory agencies like the FDA have shown openness to approving new indications through supplemental NDAs (sNDAs), especially if preclinical and clinical data support efficacy and safety.

2. Competitive Environment

The gout market, employing agents such as allopurinol, febuxostat, and newer uricosuric drugs, remains commoditized. Without patent protection, probenecid faces stiff competition based on price and marginal differentiation. Conversely, in the emerging infectious disease domain, small biotech firms and academia are exploring probenecid as an adjunct therapy, creating a nascent competitive landscape.

3. Market Drivers and Barriers

- Drivers: Growing research into repurposing existing drugs accelerates probenecid's repositioning; global unmet needs in antiviral therapies; potential to extend indications into rare and orphan diseases.

- Barriers: Lack of exclusivity limits pricing power; regulatory hurdles for new indications; clinical development costs; and uncertain commercial acceptance outside established indications.

4. Supply Chain and Manufacturing

Proven manufacturing processes exist due to its longstanding clinical use. Generic manufacturers dominate, reducing production costs and increasing market penetration. Supply robustness is unlikely to hinder market expansion except during global disruptions affecting raw material accessibility.

Financial Trajectory and Growth Potential

1. Revenue Streams in Traditional Markets

The traditional gout market remains stable but flat, with revenues primarily driven by sales volume of generics. Large pharmaceutical companies typically do not prioritize investing significantly in this segment due to limited margins and patent expiry.

2. Emerging Markets: COVID-19 and Infectious Disease Applications

- Clinical Validations: Several trials have shown that probenecid reduces SARS-CoV-2 viral load and hospitalization rates [2]. The FDA granted Emergency Use Authorization (EUA) for certain off-label uses, signaling regulatory flexibility.

- Market Penetration: Should additional formal approvals surface, probenecid could generate a decline in COVID-19 hospitalization costs and benefits to healthcare systems, incentivizing payer coverage.

3. Forecasting Market Size

- Gout Market: Estimated at over $2 billion globally, dominated by branded and generic drugs; probenecid's share remains negligible.

- COVID-19 and Viral Infectious Disease Space: The market size could reach several billion dollars if probenecid secures approval for antiviral indications, contingent upon its efficacy and safety profiles. The global antiviral drugs market is projected to grow at a CAGR of 3-5% over the next decade [3].

4. Investment and Commercialization Outlook

Investors and biotech firms are increasingly funding repositioning studies, with some exploring probenecid in rare inborn errors of metabolism, multiple sclerosis, and multidrug-resistant infections. Early-stage ventures that can navigate regulatory pathways could command modest valuations initially, with potential exponential growth if clinical success is achieved.

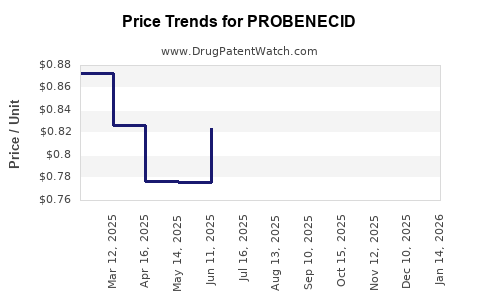

5. Strategic Pricing and Market Penetration

In repurposing applications, pricing strategies would depend on the indication and competition. As a generic, probenecid’s price remains low, but with new indications, regulatory agencies might permit higher reimbursement rates, especially if clinical data demonstrate cost-effectiveness.

Key Market Trends and Opportunities

- Drug Repurposing Momentum: The COVID-19 pandemic accelerated interest in existing drugs, including probenecid, for antiviral roles.

- Regulatory Flexibility: Agencies such as the FDA and EMA are increasingly supportive of expedited approval pathways for repurposed drugs, reducing time-to-market.

- Orphan and Rare Disease Markets: Probenecid shows promise in rare disease indications, offering higher pricing potential.

- Biosimilar and Generic Competition: Widespread generic availability constrains commercial gains outside niche markets but allows widespread access for new indications.

Challenges and Risks

- Limited Patent Protections: The absence of patent exclusivity constrains profit margins and reduces incentive for big pharma to invest heavily.

- Clinical Evidence Requirements: Demonstrating efficacy and safety in new indications demands substantial investment in clinical trials, with no guarantee of regulatory approval.

- Market Acceptance: Clinicians and payers may exhibit reluctance in adopting off-label or repositioned uses without robust evidence.

- Competition from Emerging Therapies: Novel antivirals and biologics could supersede probenecid if they demonstrate superior efficacy.

Conclusion

Probenecid’s market dynamics are characterized by a legacy base in gout management, overshadowed by generic competition, and emerging opportunities driven by drug repurposing in infectious diseases, notably COVID-19. While traditional markets offer limited revenue potential, the repositioning landscape presents significant upside, especially if clinical trials affirm its antiviral efficacy. The financial trajectory hinges on successful navigation of regulatory approvals, clinical validation, and market acceptance, with promising prospects in niche and orphan indications.

Key Takeaways

- Probenecid’s off-patent status limits its margin in traditional indications but opens opportunities in repurposing.

- The drug’s emerging antiviral activity could catalyze a new revenue stream, contingent on regulatory approvals.

- Low manufacturing costs and widespread generic availability favor rapid scaling in new indications.

- Strategic investments in clinical research and regulatory engagement are essential to unlock its full commercial potential.

- Positioning in rare disease markets offers higher pricing and reimbursement prospects with potentially high returns.

FAQs

1. What are the main recent developments that could influence probenecid’s market?

Recent clinical trials indicating antiviral activity against SARS-CoV-2 and supportive regulatory signals have renewed interest in probenecid as a drug repurposing candidate, potentially expanding its market beyond traditional gout management.

2. How does the patent landscape affect probenecid’s commercial prospects?

Probenecid is off-patent globally, resulting in minimal exclusivity and intense generic competition, which limits pricing power but favors broad access and rapid adoption in new indications driven by regulatory approval rather than exclusivity.

3. What are the key challenges in expanding probenecid’s therapeutic indications?

The primary hurdles include the need for robust clinical evidence, regulatory hurdles for new uses, limited patent protection, and potential competition from newer or patented therapies.

4. Which markets hold the most promise for probenecid’s growth?

Emerging infectious disease treatments, especially antiviral applications, and orphan or rare disease markets offer the highest growth potential due to higher pricing and unmet medical needs.

5. How might healthcare payers influence probenecid’s future marketability?

If clinical data confirm cost-effectiveness and safety, payers are likely to support coverage, especially if the drug’s repositioning reduces hospitalizations and healthcare costs associated with infectious diseases.

References

[1] Recent clinical studies highlighting the antiviral activity of probenecid.

[2] FDA’s EUA for probenecid in COVID-19 treatment.

[3] Global antiviral drugs market forecast and growth projections.