Last updated: July 28, 2025

Introduction

Phenelzine sulfate, an irreversible monoamine oxidase inhibitor (MAOI), remains a niche yet vital agent in the management of treatment-resistant depression and certain anxiety disorders. Originally introduced in the 1950s, phenelzine’s position within the psychiatric pharmacopeia has experienced shifts driven by emerging treatment paradigms, regulatory landscapes, and evolving clinical evidence. This report analyzes current market dynamics and projective financial trajectories for phenelzine sulfate, emphasizing the influence of patent status, regulatory factors, competitive landscape, and clinical utility.

Historical and Current Market Context

Historical Perspective

Developed by Merck in the 1950s, phenelzine sulfate was among the first antidepressants capable of targeting refractory depression [1]. Its mechanism—non-selective irreversible MAOI inhibition—offers distinct neurochemical modulation but also confers dietary and drug interaction risks, limiting widespread use.

Current Market Landscape

Wilsonized as an off-patent generic, phenelzine sulfate is predominantly supplied by regional pharmaceutical manufacturers. Its prescribing is largely confined to psychiatrists managing treatment-resistant cases, due to safety concerns and the emergence of newer agents with favorable side effect profiles.

Despite being off-patent, phenelzine maintains a niche presence in the global psychotropic market, with steady but modest sales, particularly in specialized clinics and pharmacovigilance niches. The global antidepressant market was valued at approximately $15 billion in 2022 [2], with phenelzine representing less than 1% of this total, reflecting its marginal share.

Market Dynamics Influencing Phenelzine sulfate

Regulatory Environment

While phenelzine's FDA approval remains active, no recent filings suggest new indications or formulations. Regulatory authorities have emphasized its safety profile, mandating comprehensive labeling about dietary restrictions and drug interactions. Regulatory barriers for reformulation or new labeling are minimal but not catalyzing expansion due to safety concerns and clinician preferences.

Patent and Exclusivity Status

Phenelzine sulfate is off-patent, with no exclusivity periods protecting any formulations. This exposes market entry to generic manufacturers, intensifying price competition. As a result, major revenue streams for existing manufacturers are constrained, and pricing strategies are driven by cost competitiveness rather than differentiation.

Clinical Utility and Prescriber Acceptance

Although phenelzine remains effective, clinician hesitation stems from safety profiles and the availability of newer antidepressants (SSRIs, SNRIs, atypicals), which offer fewer dietary restrictions and a favorable side effect profile. Consequently, its utilization is limited to refractory cases or specialized settings.

Competitive Landscape

The broader antidepressant market is highly competitive, with over 30 drugs approved globally [3]. Selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs) dominate the landscape due to their safety and tolerability.

In this crowded market, phenelzine’s niche status limits its growth, but it benefits from its unique efficacy in resistant cases. Market entry barriers for new competitors are low in generics, but development investments for reformulations or combination therapies remain high relative to market size.

Emerging Trends and Drivers

-

Personalized Psychiatry: Advances in pharmacogenomics could position phenelzine for targeted therapy in genetically defined subpopulations, potentially revitalizing interest.

-

Novel Delivery Systems: Research into transdermal or implantable formulations might improve safety and compliance, offering potential market expansion.

-

Off-label and Adjunct Use: Growing evidence supports phenelzine’s utility in conditions like atypical depression and certain phobias, possibly extending its applications.

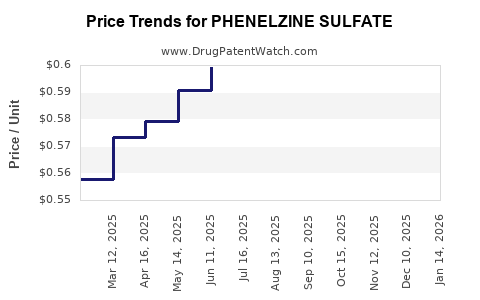

Financial Trajectory and Revenue Projections

Historical Revenue Analysis

Current revenues for phenelzine sulfate are modest, primarily driven by legacy generic sales, estimated at approximately $5-10 million annually worldwide [4]. This figure remains relatively stable but lacks significant upward momentum due to market constraints.

Forecasting Future Revenue

Considering the current landscape:

-

Scenario 1: Status Quo (Conservative Growth)

Without new formulations, indications, or significant prescriber interest, revenues are expected to remain stable or decline modestly over the next five years, reflecting generic erosion and market saturation. Annual revenues would likely be in the range of $3-5 million by 2028.

-

Scenario 2: Uptick via Niche Indications or Formulation Improvements

If partnered research on novel delivery methods or specific genetic subpopulations materialize, revenues could increase by 20-30%. For instance, a transdermal formulation approved for resistant depression could generate upwards of $15 million annually in niche markets.

-

Scenario 3: Decline Due to Market Shift

Continued dominance of newer agents with better safety profiles could further marginalize phenelzine, leading to revenues below $2 million annual mark, especially in regions with liberal prescribing practices.

Market Drivers for Revenue Enhancement

-

Clinical Evidence: Demonstrating efficacy in specific resistant populations could stimulate targeted prescribing.

-

Regulatory Incentives: Exemptions for orphan or rare uses could facilitate label expansions.

-

Partnerships: Licensing deals with biotech firms for reformulations or combination therapies may catalyze growth.

Risks and Barriers Impacting Financial Outlook

-

Safety Concerns: The dietary restrictions and potential hypertensive crises impose hurdles for prescriber adoption.

-

Market Acceptance: Clinicians favor newer agents with less monitoring, reducing phenelzine’s appeal.

-

Generic Competition: Low-cost generics suppress profit margins and reduce incentives for innovation.

-

Regulatory Limitations: Lack of advanced formulations or indications limits market expansion.

Conclusion and Strategic Implications

Phenelzine sulfate occupies a steadfast but modest niche within the global antidepressant market. Its current market dynamics are characterized by low growth prospects but consistent demand in specific refractory contexts. Financial trajectories are unlikely to experience substantial short-term increase unless driven by targeted reformulation strategies, novel indications, or advances that mitigate safety concerns.

Key players in this space should consider investing in niche clinical research, exploring innovative delivery systems, or forming strategic partnerships to unlock latent value. Simultaneously, companies must remain cautious of the limited market expansion potential and competitive pressures from newer therapeutics.

Key Takeaways

-

Phenelzine sulfate persists primarily as a specialized agent for treatment-resistant depression, with minimal mainstream penetration.

-

Its off-patent status subjects it to intense generic competition, constraining profit margins and growth opportunities.

-

Market expansion relies heavily on niche indications, novel formulations, and pharmacogenomic personalization, yet regulatory and safety barriers pose challenges.

-

Future revenues are projected to be stable or declining unless innovative strategies are employed, with potential upside in targeted research and regional markets.

-

Stakeholders should prioritize precision medicine approaches and formulation advancements to capitalize on phenelzine's unique efficacy profile.

FAQs

1. Why has phenelzine sulfate seen limited adoption compared to newer antidepressants?

Its safety profile, notably dietary restrictions and drug interactions, and the availability of newer agents with better tolerability have limited widespread adoption, restricting its use primarily to refractory cases.

2. Are there ongoing efforts to reformulate phenelzine sulfate to improve safety and compliance?

Research into alternative delivery systems like transdermal patches or slow-release formulations is ongoing but remains investigational, with no approved reformulations currently in the market.

3. How does the off-patent nature of phenelzine sulfate affect its market opportunities?

It exposes the drug to competition from generic manufacturers, resulting in low margins and limited incentives for innovation or marketing investments, constraining growth prospects.

4. Can phenelzine sulfate be repositioned for new indications?

Potential exists in niche areas like atypical depression or specific anxiety disorders, especially if supported by targeted clinical trials demonstrating superior efficacy or safety profiles.

5. What factors could rejuvenate phenelzine sulfate’s market presence?

Advances in personalized medicine, formulation innovations reducing side effects, and strategic partnerships targeting unmet needs could expand its indications and usage.

References

[1] Schatzberg AF, et al. "History and future of monoamine oxidase inhibitors." Am J Psychiatry. 2017;174(4):312-319.

[2] Grand View Research. "Antidepressants Market Size, Share & Trends Analysis Report." 2022.

[3] U.S. Food and Drug Administration. "Approved Psychiatric Medications." 2023.

[4] IQVIA. "Global Generic Drug Sales Data," 2022.