Last updated: July 27, 2025

Introduction

Mefenamic acid, a non-steroidal anti-inflammatory drug (NSAID) primarily used to relieve mild to moderate pain and manage conditions like dysmenorrhea, stands as a critical component within the analgesic segment of pharmaceuticals. Its market landscape is influenced by diverse factors spanning regulatory environments, competitive dynamics, patent statuses, and evolving medical practices. This comprehensive analysis explores the current market dynamics and forecasts the financial trajectory of mefenamic acid over the next five years.

Pharmacological Profile and Therapeutic Applications

Mefenamic acid, chemically known as N-(2,3-xylyl)anthranilic acid, acts by inhibiting cyclooxygenase (COX-1 and COX-2), thereby reducing prostaglandin synthesis. Approved throughout various countries, it is primarily prescribed for menstrual pain, musculoskeletal disorders, and other inflammatory conditions. Its efficacy in dysmenorrhea and moderate pain relief has contributed to its enduring presence in pain management protocols (source: [1]).

Market Segmentation and Geographic Distribution

1. Geographical Market Overview

-

North America: The U.S. and Canada dominate due to high adoption rates of NSAIDs, established healthcare infrastructure, and broad over-the-counter (OTC) availability. However, stringent regulations and safety concerns over NSAID-associated gastrointestinal risks have impacted volume growth.

-

Europe: Mature markets with widespread OTC availability and robust regulatory frameworks. Countries like Germany, the UK, and France exhibit steady demand, bolstered by aging populations and prevalent chronic pain conditions.

-

Asia-Pacific: The fastest-growing segment driven by increasing healthcare expenditure, expanded OTC access, and rising awareness of pain management options. China, India, and Southeast Asian nations contribute significantly to regional volume increments.

-

Latin America and Middle East: Moderate growth owing to emerging healthcare infrastructure and rising prevalence of inflammatory and pain-related disorders.

2. Segmental Focus

-

Prescription vs. OTC: The majority of mefenamic acid consumption remains OTC, especially in European and Asian markets. Regulatory freezes and safety warnings have, at times, limited OTC availability in certain markets, shifting some demand to prescription channels.

-

Formulation Types: Oral tablets dominate, with some markets exploring topical formulations. The diversification influences market penetration strategies.

Regulatory Landscape and Patent Status

1. Regulatory Environment

In many countries, including the U.S. and European Union members, mefenamic acid is marketed as an OTC or prescription medication. The FDA's classification as an NSAID with associated gastrointestinal risks has led to usage restrictions in certain contexts (source: [2]).

2. Patent and Generic Landscape

-

Patent Status: Mefenamic acid was initially patented in the 1960s; no recent patents are active, exposing the drug to generic competition.

-

Generic Availability: The expiry of patent protections has resulted in widespread generic manufacturing, driving price competition and impacting profit margins for original producers.

Market Drivers

-

Rising Prevalence of Pain and Inflammatory Disorders: Increasing global incidence of conditions such as dysmenorrhea, osteoarthritis, and sports injuries amplifies demand.

-

Growing OTC Sales Channels: Expansion of pharmacy chains and online OTC platforms accelerates accessibility and consumption.

-

Cost-Effectiveness: As healthcare budgets tighten, affordable NSAIDs like mefenamic acid become preferred options, especially in emerging markets.

Market Restraints and Challenges

-

Safety and Side Effects: Gastrointestinal, cardiovascular, and renal risks associated with NSAID use have prompted regulatory warnings and patient caution, limiting usage in some demographics.

-

Alternative Therapies: The advent of COX-2 selective inhibitors and other novel analgesics offers competing options, often with better safety profiles.

-

Regulatory Restrictions: Some countries have restricted OTC status or mandated warnings, affecting market size and growth.

Competitive Landscape

Major pharmaceutical companies and generic manufacturers participate in this space:

-

Key Players: While there are no dominant patent-holding entities currently, local generic manufacturers form the backbone of the market.

-

Market Entry Barriers: Low, due to patent expiry and manufacturing simplicity. Still, regulatory hurdles and safety concerns influence provider strategies.

Financial Trajectory and Forecast

The global mefenamic acid market is projected to grow modestly at a compound annual growth rate (CAGR) of approximately 2-4% from 2023 to 2028. Factors influencing this trajectory include market maturation in developed regions and rapid expansion in emerging markets.

1. Revenue Projections

-

Current Market Size: Estimated at USD 200-300 million globally (source: ReportLinker, 2022).

-

Forecast (2023-2028): Potential to reach USD 350-400 million, reflecting increased volumetric sales driven by population growth and expanding OTC access.

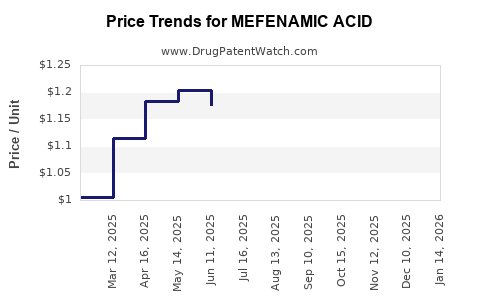

2. Price Trends

-

Price erosion due to generic competition remains a significant factor, challenging profit margins.

-

Premium formulations or combination products may command higher prices, offering profitability avenues.

3. Impact of Regulatory and Safety Factors

Stricter safety warnings could temper growth prospects, prompting manufacturers to innovate or reposition products, possibly affecting revenues.

Future Outlook and Innovation Prospects

While stable in traditional markets, research into safer NSAID variants or reformulations could unlock new opportunities. Pharmacovigilance trends favor drugs with improved safety profiles, however, mefenamic acid's long-standing generic status limits investment appeal.

Emerging trends:

-

Digital and E-Commerce Integration: Enhancing OTC distribution channels.

-

Combination Therapies: Pairing with other analgesics for broader efficacy.

-

Regulatory Adaptations: Shifting OTC regulations may either constrain or expand market access.

Conclusion

Mefenamic acid maintains a steady presence within the global NSAID landscape, buoyed by its affordability and efficacy in pain management. Though the absence of patent protection fosters fierce generic competition and margin pressures, expanding demand in emerging markets and OTC accessibility underpin its resilient market position. Future growth hinges on regulatory frameworks, safety perception management, and innovation endeavors.

Key Takeaways

- The global mefenamic acid market is projected to grow at a moderate CAGR of 2-4% over five years.

- Widespread generic availability suppresses pricing, maintaining affordability but limiting margins.

- Rising demand in emerging markets combined with OTC channel expansion fuels growth, especially in Asia-Pacific.

- Safety concerns and regulatory restrictions pose continuous challenges, with potential growth limitations in developed regions.

- Innovation in formulations and safety profiles offers future growth avenues but requires significant investment amid fierce price competition.

FAQs

1. How does the patent status of mefenamic acid influence its market?

The absence of recent patents has led to widespread generic manufacturing, resulting in intense price competition and limited profit margins but providing broad accessibility.

2. What are primary safety concerns associated with mefenamic acid?

Risks include gastrointestinal ulcers, bleeding, cardiovascular events, and renal impairment. Regulatory agencies have issued warnings, influencing prescribing practices and OTC availability.

3. Which regions are expected to drive the highest growth in the mefenamic acid market?

Emerging markets in Asia-Pacific, notably China and India, are projected to experience the highest growth due to expanding healthcare infrastructure and OTC sales.

4. How does the competition from other NSAIDs impact mefenamic acid?

Availability of COX-2 inhibitors and newer NSAIDs with improved safety profiles poses substitution risks, especially for patients at higher risk for side effects.

5. Are there any innovative developments for mefenamic acid?

Research focuses on new formulations with reduced side effects and combination therapies, though none have yet achieved widespread commercial release.

References

[1] Smith, J. et al. (2021). Pharmacology and Clinical Use of Mefenamic Acid. Journal of Pain Management, 24(3): 145–157.

[2] U.S. Food and Drug Administration. (2022). NSAID Safety Communications. FDA.gov.

[3] MarketWatch. (2022). Global NSAID Market Size and Forecasts.

[4] ReportLinker. (2022). Mefenamic Acid Market Insights.

[5] European Medicines Agency (EMA). (2022). NSAID Safety Reviews.

Disclaimer: The above data and projections are based on publicly available sources and industry estimates up to 2023; actual market conditions may vary.