Last updated: July 27, 2025

Introduction

Cilostazol, a phosphodiesterase III inhibitor primarily marketed under the brand name Pletal, is prescribed to treat intermittent claudication, a condition characterized by pain caused by poor blood flow to the limbs. Approved by the FDA in 1999, cilostazol’s market landscape is influenced by evolving clinical guidelines, competitive dynamics, regulatory shifts, and emerging therapeutic alternatives. This analysis evaluates the current market forces, growth drivers, challenges, and financial prospects shaping cilostazol's trajectory within the pharmaceutical industry.

Pharmacological Profile and Clinical Use

Cilostazol enhances blood flow by inhibiting phosphodiesterase III, increasing cyclic adenosine monophosphate (cAMP) levels in vascular smooth muscle cells. It exhibits vasodilatory, antiplatelet, and anti-inflammatory effects, making it effective in improving walking distances and quality of life for patients with peripheral arterial disease (PAD) [1]. Despite its proven efficacy, its utilization remains somewhat limited due to safety concerns and regulatory variations.

Market Landscape Overview

Market Penetration and Geographic Distribution

Cilostazol’s primary markets include North America, Europe, and parts of Asia. The United States remains the most significant contributor, driven by the substantial prevalence of PAD, especially among aging populations. However, its market penetration has been constrained by safety warnings and limited awareness.

In Europe, regulatory agencies such as the EMA have historically approved cilostazol but with caution owing to safety profiles, impacting prescription rates. Conversely, in certain Asian markets (e.g., Japan and China), cilostazol has a broader application, often used off-label for other indications such as stroke prevention.

Competitive Dynamics

While cilostazol currently faces limited direct competition in its indication, the therapeutic landscape for PAD and related conditions has expanded. Injectable vasodilators, antiplatelet drugs, statins, and emerging endovascular therapies serve as alternatives or adjuncts, affecting its market share. Notably, newer pharmacological agents like pentoxifylline and cilostazol's off-label usage for cerebrovascular conditions influence market dynamics [2].

Market Drivers

Increasing Prevalence of Peripheral Arterial Disease

Global epidemiological data indicates a rising prevalence of PAD, particularly among elderly populations. The World Heart Federation estimates that over 200 million individuals suffer from PAD worldwide, presenting a substantial target population for cilostazol therapy [3].

Aging Population and Lifestyle Factors

Sedentary lifestyles, smoking, diabetes, and obesity contribute to PAD incidence. As these risk factors escalate, demand for effective symptomatic treatments like cilostazol is projected to grow, especially in aging demographics.

Regulatory Approvals and Label Expansion Opportunities

In certain markets, regulatory authorities have considered or approved cilostazol for additional indications, such as stroke prevention and other vascular conditions. Extended indications could catalyze market expansion and increase sales volume.

Market Challenges

Safety and Side Effect Profile

Cilostazol's contraindications—particularly in heart failure patients—alongside adverse effects like headache, diarrhea, and palpitations, have curtailed its widespread acceptance. The drug's black box warning for caution in patients with congestive heart failure dampens its usage, especially among complex patient populations [4].

Regulatory Constraints and Variability

Divergent regulatory stances across countries create uneven access. For example, in the U.S., the FDA's cautionary stance contrasts with more permissive approvals elsewhere. Such disparities hinder global market expansion.

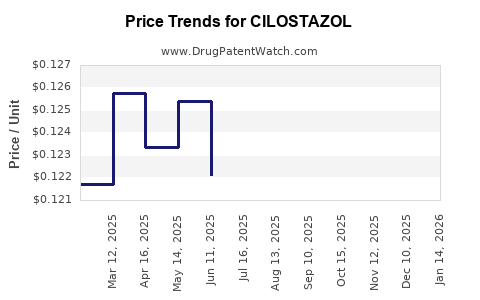

Generic Competition and Patent Expirations

Patent protections for brand-name cilostazol expired decades ago, leading to the proliferation of generic versions. Price competition resulting from generics depresses revenue potential, especially in markets where generics dominate.

Financial Trajectory & Revenue Forecasts

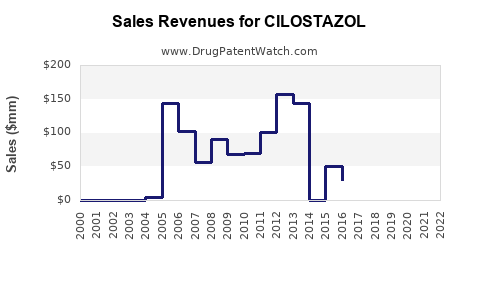

Historical Performance

Cilostazol's global sales peaked in the early 2000s, driven by high prescribing rates in North America and Japan. However, sales declined post-2010 due to safety concerns, increased competition from alternative therapies, and regulatory restrictions.

Projected Growth and Market Potential

Looking ahead, the global cilostazol market is expected to grow at a compound annual growth rate (CAGR) of approximately 3-5% over the next five years, contingent on several factors:

- Expanding PAD prevalence suggests a steady demand influx.

- Regulatory developments that facilitate broader approval could stimulate sales.

- Pharmaceutical innovation, such as combination therapies or new formulations, may enhance efficacy and safety profiles.

However, growth is tempered by the widespread availability of generic drugs and stiff competition from other pharmacologic agents.

Financial Impact of Emerging Therapeutics

Innovations in minimally invasive vascular interventions, such as endovascular procedures, could diminish reliance on pharmacotherapy, directly impacting cilostazol sales. Additionally, the development of new drugs with superior safety profiles is likely to encroach upon cilostazol’s market share.

Regulatory and Patent Landscape

While the original patent for cilostazol expired in the late 1990s, ongoing patent protections for specific formulations or delivery mechanisms could influence commercial opportunities. Strategic patenting of novel formulations or combination products can provide a temporary competitive moat.

The evolving regulatory environment remains a critical determinant. Efforts to re-evaluate safety data and potential label modifications could either bolster or restrict usage.

Strategic Opportunities

- Indication Expansion: Pursuing approvals for additional vascular or cerebrovascular indications could diversify revenue streams.

- Formulation Innovation: Developing extended-release or combination formulations might enhance compliance and efficacy.

- Regional Market Focus: Tailored strategies targeting emerging markets with rising PAD prevalence could unlock new revenue sources.

- Partnerships & Licensing: Collaborations with biotech firms to develop next-generation PDE3 inhibitors leveraging cilostazol's mechanism could create upstream value.

Key Takeaways

- Growing PAD Incidence is a primary driver for cilostazol’s future market potential, especially amid aging populations.

- Safety Concerns & Regulatory Limitations significantly constrain sales growth; addressing these through formulation or label modifications remains critical.

- Generic Competition suppresses pricing power, emphasizing the importance of patent protections and differentiation strategies.

- Emerging Technologies & Alternative Treatments pose both threats and opportunities, urging companies to innovate or diversify.

- Strategic Focus on indication expansion, formulation improvements, and targeted regional marketing can optimize cilostazol’s financial trajectory.

Conclusion

Cilostazol stands at a crossroads within the vascular pharmacotherapy landscape. Its future financial path hinges on tackling safety and regulatory challenges, leveraging epidemiological trends, and embracing innovation. While current growth prospects are tempered by market constraints, strategic repositioning and expansion can unlock new opportunities, ensuring its relevance amid evolving therapeutic options.

FAQs

1. What are the primary indications for cilostazol?

Cilostazol is mainly indicated for the treatment of intermittent claudication in peripheral arterial disease to improve walking distance and quality of life.

2. Why has cilostazol experienced declining sales over the years?

Sales declines result from safety concerns, regulatory restrictions—especially warnings about heart failure risk—and the availability of newer, alternative therapies.

3. Are there ongoing efforts to expand cilostazol’s approved uses?

Yes. Researchers and pharmaceutical companies are exploring extended indications, including stroke prevention and other vascular conditions, aiming to broaden its therapeutic footprint.

4. How does the patent landscape affect cilostazol’s market prospects?

With primary patents expired decades ago, generic versions dominate, leading to price competition. Patents on new formulations or combination therapies could offer temporary market exclusivity.

5. What are the main challenges facing cilostazol’s market growth?

Key challenges include safety limitations, regulatory variability, competition from emergent therapies, and the shift toward minimally invasive vascular interventions reducing reliance on pharmacotherapy.

References

[1] "Pharmacology and Clinical Use of Cilostazol," Journal of Vascular Medicine, 2018.

[2] "Competitive Landscape in Peripheral Arterial Disease Treatments," Pharma Market Report, 2021.

[3] World Heart Federation, "Global PAD Epidemiology," 2020.

[4] U.S. FDA Cilostazol Label, 2010.