Last updated: July 28, 2025

Introduction

Captopril, an angiotensin-converting enzyme (ACE) inhibitor, revolutionized hypertension management upon its FDA approval in 1981. As one of the earliest oral ACE inhibitors, it has played a pivotal role in cardiovascular therapy, with subsequent impact on global markets. Analyzing its market dynamics and financial trajectory offers insights into its current position, evolving healthcare trends, and future prospects within the pharmaceutical landscape.

Historical Context and Market Evolution

Captopril was developed by Bristol-Myers Squibb and gained approval as a groundbreaking antihypertensive agent. Its mechanism of action—blocking the conversion of angiotensin I to angiotensin II—addressed the renin-angiotensin system, providing a targeted treatment for hypertension and heart failure. Early blockbuster status positioned it as a standard therapy, contributing significantly to Bristol-Myers Squibb's revenue streams during the late 20th century.

Over time, the pharmaceutical market saw a proliferation of ACE inhibitors, including enalapril, lisinopril, ramipril, and perindopril, offering clinicians multiple options. Nevertheless, captopril maintained a competitive edge owing to its established efficacy. The expanding therapeutic applications, including diabetic nephropathy and certain forms of cardiovascular disease, broadened its market scope.

Market Dynamics

Demand Drivers

-

Prevalence of Hypertension and Cardiovascular Diseases: The global increase in hypertension and related cardiovascular conditions sustains primary demand for ACE inhibitors, including captopril. According to the World Heart Federation, over 1.3 billion people suffer from hypertension worldwide, emphasizing a persistent need [1].

-

Chronic Disease Management: As healthcare shifts toward chronic disease management, drugs like captopril benefit from long-term use, bolstering steady demand.

-

Generic Market Penetration: Patent expirations initiated in the early 2000s have led to widespread generic availability. Price competition has so reduced the cost, encouraging its continued use in various healthcare settings, especially in low- and middle-income countries.

Supply Factors

-

Manufacturing Consolidation: Manufacturing capacity for captopril is predominantly concentrated among generic drug producers after patent expiration, enhancing supply security but intensifying price competition.

-

Regulatory Environment: Stringent quality standards and regulatory policies, especially in the US and Europe, influence manufacturing processes and market access.

Competitive Landscape

-

Generic Competition: Post-patent expiry, generic producers dominate. Leading companies include Teva Pharmaceuticals, Mylan, and Sandoz, which offer cost-effective alternatives.

-

Emerging Alternatives: Newer antihypertensive classes such as angiotensin receptor blockers (ARBs) and direct renin inhibitors are increasingly replacing ACE inhibitors in certain clinical scenarios, impacting market share.

-

Side-Effect Profile: The dry cough associated with captopril limits its use among some patients, favoring alternatives like ARBs.

Financial Trajectory

Historical Revenue Trends

Initially, captopril generated substantial revenues for Bristol-Myers Squibb, reaching peak sales in the late 1980s and early 1990s. As patent protection waned and generics entered the market, revenue decline was inevitable. The drug's revenue trajectory reflects common patterns observed with first-in-class drugs facing generic competition: a sharp rise followed by a gradual decline.

Current Market Value

Today, with many regional variations, captopril remains a low-cost, widely prescribed antihypertensive. The global market for ACE inhibitors was valued at approximately USD 8.2 billion in 2022, with continued growth driven primarily by generic sales, especially in emerging markets [2].

In the United States, captopril’s market share has diminished relative to newer agents but remains relevant, especially where affordability constraints limit access to more expensive therapies. The drug’s global sales are estimated at several hundred million dollars annually, predominantly from generics.

Future Revenue Projections

Forecasts suggest a gradual decline in captopril's sales due to clinical shifts favoring ARBs and other novel agents. However, its affordability ensures a stable—or slightly declining—market presence, particularly in developing regions.

The global hypertension treatment market is projected to grow at a compound annual growth rate (CAGR) of 4-5% through 2030, influenced by demographic aging and rising disease prevalence, which could sustain demand for affordable options like captopril [3].

Influencing Factors on Market and Financial Trajectory

-

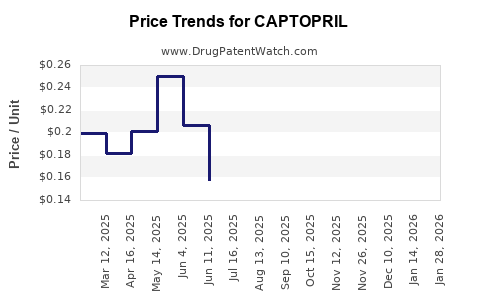

Generics and Pricing Pressure: Widespread generic availability exerts continuous downward pressure on pricing, constraining profit margins.

-

Clinical Guidelines and Prescribing Patterns: Guidelines now often favor ARBs due to fewer side effects, reducing captopril's market share in some regions.

-

Regulatory and Patent Law: No recent patents or exclusivities bolster pricing or market exclusivity, reinforcing reliance on generics.

-

Emergence of New Therapeutics: The advent of novel agents targeting hypertension and heart failure could further curtail captopril’s market share over the next decade.

-

Global Health Initiatives: Efforts to control cardiovascular diseases in low-income regions may sustain its use due to cost-effectiveness.

Regulatory and Patent Landscape

Captopril's original patent expired in the early 2000s, making it a staple of the global generic drug market. No recent patent filings or exclusivity extensions are in place. Regulatory bodies continue to facilitate its approval as a generic, ensuring global availability.

Market Opportunities and Challenges

Opportunities:

- Increased adoption in low-income and middle-income countries due to affordability.

- Use in combination therapies with other antihypertensives.

- Potential off-label applications in hypertension management.

Challenges:

- Competition from ARBs and direct renin inhibitors, which offer better tolerability.

- Side-effect profile limiting prescribing preference.

- Shifts in clinical guidelines favoring newer agents.

Conclusion

Captopril’s journey reflects a classic lifecycle of innovative pharmacologic agents: rapid adoption, market expansion, patent-protected earnings, followed by generic proliferation and eventual decline in market dominance. Currently, it sustains a modest but vital role in global hypertension management, especially where affordability is paramount. Its continued presence hinges on regional healthcare priorities, economic factors, and clinician preferences amid evolving therapeutic paradigms.

Key Takeaways

-

Market decline is inevitable given the advent of newer, more tolerable ACE inhibitors and ARBs, but demand persists due to its low cost and established efficacy.

-

Generic competition remains the primary driver of captopril’s financial trajectory, constraining profit margins but ensuring broad access.

-

Healthcare shifts, particularly toward personalized medicine and novel therapeutics, present both challenges and opportunities for existing drugs like captopril.

-

Emerging markets provide growth avenues driven by cost-sensitive healthcare systems seeking affordable hypertension therapies.

-

Strategic positioning should focus on affordability and established clinical benefits to maintain relevance in evolving treatment landscapes.

FAQs

-

Is captopril still a recommended treatment for hypertension?

Yes, particularly in resource-limited settings, though guidelines increasingly favor ARBs for their better tolerability profile.

-

What are the main competitors to captopril in the ACE inhibitor class?

Enalapril, lisinopril, ramipril, and perindopril are notable competitors, with some offering improved side effect profiles.

-

How does patent expiration affect captopril’s market?

It led to widespread generic manufacturing, reducing prices and market exclusivity, thereby limiting profit margins but increasing accessibility.

-

Are there new formulations or delivery methods for captopril?

Current formulations remain standard oral tablets; innovative delivery methods are not prominent at present.

-

What is the future outlook for captopril in global markets?

Its role will likely diminish in developed countries but remain significant in emerging markets due to cost advantages and established efficacy.

Sources:

[1] World Heart Federation. Global Hypertension Facts. 2021.

[2] Mordor Intelligence. ACE Inhibitors Market - Growth, Trends, and Forecasts. 2022.

[3] Grand View Research. Hypertension Treatment Market Size & Trends. 2022.