Share This Page

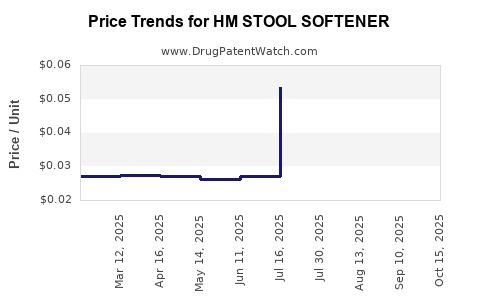

Drug Price Trends for HM STOOL SOFTENER

✉ Email this page to a colleague

Average Pharmacy Cost for HM STOOL SOFTENER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM STOOL SOFTENER 100 MG SFTGL | 62011-0421-02 | 0.03001 | EACH | 2025-10-22 |

| HM STOOL SOFTENER 100 MG SFTGL | 62011-0421-02 | 0.02903 | EACH | 2025-09-17 |

| HM STOOL SOFTENER 100 MG SFTGL | 62011-0421-02 | 0.02855 | EACH | 2025-08-20 |

| HM STOOL SOFTENER 100 MG SFTGL | 62011-0421-02 | 0.02703 | EACH | 2025-07-23 |

| HM STOOL SOFTENER 250 MG SFTGL | 62011-0474-01 | 0.05339 | EACH | 2025-07-23 |

| HM STOOL SOFTENER 100 MG SFTGL | 62011-0421-02 | 0.02701 | EACH | 2025-06-18 |

| HM STOOL SOFTENER 250 MG SFTGL | 62011-0474-01 | 0.05295 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Stool Softener

Introduction

The global pharmaceutical sector, particularly over-the-counter (OTC) drugs focused on gastrointestinal health, has witnessed significant growth driven by aging populations, increasing awareness of digestive health, and the rising prevalence of chronic constipation. Among these products, stool softeners like HM Stool Softener have established a notable market presence. This article presents an in-depth market analysis and price projection for HM Stool Softener, examining industry dynamics, competitive landscape, regulatory factors, and future price trends.

Market Overview of Stool Softeners

Global gastrointestinal drug market, estimated at approximately USD 28 billion in 2022, encompasses various therapeutic agents including laxatives, antacids, and digestive aids.[1] The stool softener segment represents a significant subset, buoyed by consumer preferences for OTC solutions to manage constipation.

Key drivers include:

- Aging populations (particularly in North America and Europe)

- Increasing incidence of chronic constipation linked to lifestyle factors

- Growing adoption of OTC remedies for digestive health

- Rising awareness of gastrointestinal disorders through digital health resources

Major products include:

- Polyethylene glycol-based formulations

- Docusate sodium (a common stool softener)

- Surfactant-based agents such as HM Stool Softener

Product Profile: HM Stool Softener

While specific formulation details of HM Stool Softener remain proprietary, it is characteristic of stool softeners containing surfactant agents, chiefly docusate sodium or similar compounds. HM’s positioning combines efficacy with consumer safety, targeting both adult and geriatric demographics.

Market positioning factors:

- OTC availability

- Favorable safety profile compared to stimulant laxatives

- Versatile for different patient groups

Competitive Landscape

The stool softener market features a mix of global giants and regional players. Key competitors include:

- Pfizer (Docusate Sodium-based products)

- Bayer (Fleet brand, including stool softeners)

- Reckitt Benckiser

- GSK

- Emerging regional brands

In this compact space, product differentiation hinges on formulation efficacy, packaging, branding, and regulatory approvals.

Market challenges include:

- Consumer skepticism over OTC medication safety

- Regulatory scrutiny on laxative claims

- Competition from natural and alternative remedies

Regulatory Landscape

Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other national bodies govern the approval and marketing claims of OTC laxatives. For HM Stool Softener, compliance with these standards is vital for market continuity and expansion.

Recent regulatory trends focus on:

- Evidence-based claims presentation

- Quality control standards

- Clear labeling about safety and usage

These factors influence manufacturing costs and, consequently, the retail pricing.

Market Demand and Consumer Trends

Demographic factors significantly influence demand:

- Elderly populations: More prone to constipation, seeking safe OTC options

- Younger populations: Increasing health consciousness impacting OTC use

- Healthcare shifts: Patients inclined toward self-medication due to pandemic-related healthcare access issues

Market trends show a pivot toward combination products and natural supplement integrations, although traditional surfactants like docusate remain dominant.

Price Analysis

Historical Pricing:

Current retail prices for HM Stool Softener and similar formulations typically range from USD 5 to USD 15 per bottle (30-100 doses), depending on formulation, packaging, and region.

Price Factors:

- Manufacturing costs (active ingredients and excipients)

- Regulatory compliance expenses

- Distribution and logistics costs

- Competitive pricing strategies

- Brand positioning and consumer perception

Regional Variations:

| Region | Typical Price Range (USD) | Market Characteristics |

|---|---|---|

| North America | 7 – 15 | High purchasing power, mature OTC market |

| Europe | 6 – 14 | Stringent regulations, premium pricing |

| Asia-Pacific | 3 – 10 | Price-sensitive markets, rapid growth |

| Latin America | 4 – 12 | Growing awareness and OTC use |

Price Projection for HM Stool Softener (2023-2030)

Assumptions:

- Incremental annual inflation-adjusted cost increases (~3-5%)

- Ongoing regulatory compliance costs

- Competitive pricing pressure

Short-term (2023-2025):

Prices are expected to stabilize or slightly decrease due to competitive market saturation, with top-tier branded products holding premiums.

Projected Price Range:

- North America: USD 8 – USD 14

- Europe: EUR 6 – EUR 13

- Asia-Pacific: USD 3.50 – USD 8

Mid to Long-term (2026-2030):

-

With increasing demand and potential formulation innovations, prices could gradually rise by approximately 2-4% annually, driven by inflation and new formulation standards.

-

The introduction of more natural or combination OTC options might exert downward pressure on traditional formulations, maintaining competitive pricing.

Overall forecast:

By 2030, average retail price for HM Stool Softener in main markets is projected to hover around USD 9 – USD 15, aligning with inflation and market dynamics.

Market Opportunities & Risks

Opportunities:

- Expansion into emerging markets with growing healthcare infrastructure

- Development of combination products enhancing therapeutic efficacy

- Digital marketing and telepharmacy expansion opening new sales channels

Risks:

- Regulatory restraints affecting product claims and marketing

- Price erosion from generic and private-label competitors

- Consumer shifts toward natural or herbal alternatives

Key Takeaways

- The global market for OTC stool softeners such as HM Stool Softener remains robust, driven by demographic changes and increased digestive health awareness.

- Price points are highly region-specific, with North America and Europe commanding higher prices due to regulatory stringency and purchasing power.

- Market pricing is influenced by formulation costs, regulatory compliance, branding, and competitive pressure. A gradual price increase is anticipated over the next decade.

- Innovations involving natural ingredients and combination therapy could exert both upward and downward price pressures.

- Strategic positioning in emerging markets and digital sales channels represents significant growth avenues.

FAQs

1. What factors most influence the pricing of HM Stool Softener?

Pricing is primarily affected by manufacturing costs, regulatory compliance expenses, market competition, and regional economic conditions.

2. How does regulatory approval impact the market price?

Regulatory approval adds to costs and can delay product rollout, often leading to higher retail prices due to the added safety and efficacy standards that reassure consumers.

3. Are there significant regional differences in stool softener prices?

Yes, prices vary significantly across regions, influenced by economic factors, healthcare infrastructure, and regulatory environments.

4. What is the outlook for HM Stool Softener's market share?

While precise market share data is proprietary, the product's positioning in OTC GI health supports a stable or increasing share, especially with ongoing consumer health trends.

5. How might new competitors affect HM Stool Softener pricing?

Emerging competitors, particularly private-label brands and natural alternatives, could intensify price competition, prompting strategic pricing adjustments by incumbents.

References

[1] MarketIntelReports, "Global Gastrointestinal Drugs Market Analysis," 2022.

More… ↓