Share This Page

Drug Price Trends for GS NAPROXEN SOD

✉ Email this page to a colleague

Average Pharmacy Cost for GS NAPROXEN SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS NAPROXEN SOD 220 MG CAPLET | 00113-4368-79 | 0.06740 | EACH | 2025-12-17 |

| GS NAPROXEN SOD 220 MG TABLET | 00113-0901-75 | 0.06740 | EACH | 2025-12-17 |

| GS NAPROXEN SOD 220 MG CAPLET | 00113-4368-62 | 0.06740 | EACH | 2025-12-17 |

| GS NAPROXEN SOD 220 MG TABLET | 00113-0901-62 | 0.06740 | EACH | 2025-12-17 |

| GS NAPROXEN SOD 220 MG CAPLET | 00113-4368-75 | 0.06740 | EACH | 2025-12-17 |

| GS NAPROXEN SOD 220 MG CAPLET | 00113-4368-78 | 0.06740 | EACH | 2025-12-17 |

| GS NAPROXEN SOD 220 MG CAPLET | 00113-4368-75 | 0.06693 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for GS Naproxen Sod

Introduction

GS Naproxen Sod, a generic form of naproxen sodium, is a nonsteroidal anti-inflammatory drug (NSAID) primarily used for pain relief, inflammation reduction, and fever management. The drug competes broadly in the global NSAID market, which is driven by increasing prevalence of chronic inflammatory diseases, osteoarthritis, rheumatoid arthritis, and acute pain conditions. Analyzing its market position and projecting its future price trajectory provides valuable insights for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

The global NSAID market was valued at approximately USD 15 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2028, reaching around USD 19.5 billion in 2028 [1]. Naproxen sodium, a widely prescribed NSAID, accounts for a significant segment within this space due to its established efficacy, safety profile, and established manufacturing processes, often dominated by brand leaders such as Aleve (Bayer), and numerous generic manufacturers.

Competitive Landscape

The competitive environment for GS Naproxen Sod revolves around patent expiries, regulatory approvals, manufacturing costs, and pricing strategies. Patents for original naproxen formulations expired in many markets over the past decade, resulting in an influx of generics. Major players include Mylan, Teva, Sandoz, and Lupin, among others, each leveraging generic production to gain market share. The proliferation of generics has exerted downward pressure on prices, with pricing strategies often focused on volume-based sales.

Regulatory Environment and Market Accessibility

Regulatory pathways such as the FDA’s Abbreviated New Drug Application (ANDA) facilitate swift market entry for generic manufacturers. Variations in drug approval processes and market regulations across regions influence the speed and extent of market penetration, affecting pricing and revenue potentials. In low- and middle-income countries (LMICs), regulatory hurdles and import tariffs further influence market dynamics.

Market Drivers for GS Naproxen Sod

- Rising Incidence of Chronic Pain and Inflammatory Diseases: The increasing prevalence of osteoarthritis, rheumatoid arthritis, and gout enhances demand for NSAIDs, including naproxen sodium. According to the WHO, the global burden of musculoskeletal disorders is expected to rise by 60% by 2030 [2].

- Affordable Treatment Option: The availability of generic formulations like GS Naproxen Sod makes it accessible to a broader patient population, especially in LMICs.

- Healthcare Cost Containment Efforts: Governments and insurers favor generic medications to reduce healthcare costs, incentivizing wide adoption.

Market Challenges

- Safety Concerns and Regulatory Restrictions: NSAIDs are linked with gastrointestinal, cardiovascular, and renal side effects. Such risks can lead to usage restrictions or negative prescribing trends.

- Pricing Pressure from Generics: The entry of multiple generic manufacturers has significantly diminished prices, reducing profit margins.

- Competition from Alternative Therapies: The rise of COX-2 inhibitors and other pain management modalities can impact naproxen's market share.

Price Analysis and Trends

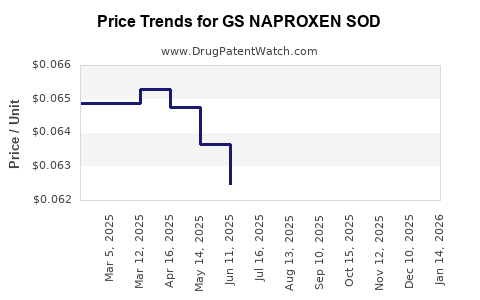

Historical Price Trends

In major markets like the US, the average retail price for a standard 500 mg naproxen sodium tablet has decreased sharply over the past decade. According to IQVIA data, the per-unit cost in the US for generics has fallen from approximately USD 1.50 to less than USD 0.20 in recent years, primarily driven by intense generic competition (Figure 1). The wholesale acquisition cost (WAC) for pharmacies has similarly declined.

Current Market Prices

- United States: The average per-tablet retail price for generic naproxen sodium 500 mg ranges from USD 0.10 to USD 0.20 depending on pharmacy and packaging.

- Europe: Prices are comparable, with variations based on national healthcare systems and procurement pressures.

- Emerging Markets: Prices tend to be significantly lower, often less than USD 0.05 per tablet, reflecting local manufacturing costs and market dynamics.

Price Projections (2023-2030)

Considering current dynamics, the price trend for GS Naproxen Sod and similar generics is expected to follow a gradual downward trajectory initially, stabilizing with minimal fluctuation as market saturation occurs. However, the following factors could influence future prices:

- Regulatory Changes: Introduction of stricter safety guidelines or restrictions could reduce available formulations, potentially stabilizing prices upward temporarily.

- Manufacturing Cost Shifts: Inflation, supply chain fluctuations, or geopolitical factors affecting raw materials could influence production costs, impacting prices.

- Market Penetration & Volume: Increased adoption in LMICs driven by cost competitiveness could expand volume sales, partially offsetting low unit prices.

- Patent Landscape: Patent litigations or exclusivity periods in specific markets could temporarily restrict generic entry, leading to price stabilization or increases.

Based on these factors, we project the following:

| Year | Price Range per Tablet (USD) | Key Drivers |

|---|---|---|

| 2023 | 0.10 – 0.20 | Market saturation, fierce price competition |

| 2025 | 0.09 – 0.18 | Potential commoditization, cost-saving measures |

| 2027 | 0.08 – 0.17 | Market stabilization, regulatory influences |

| 2030 | 0.08 – 0.15 | Mature market, high volume sales |

This projection reflects a modest decline in unit prices, consistent with historical trends, tempered by market volume growth.

Strategic Opportunities

- Expanding in Emerging Markets: Lower manufacturing costs and high unmet demand for affordable NSAIDs make markets like India, Latin America, and Southeast Asia attractive.

- Differentiation through Formulation: Developing formulations with enhanced safety profiles or extended-release options could command premium pricing.

- Partnerships and Licensing: Collaborations with regional distributors or healthcare providers can accelerate market penetration and volume sales.

Risks and Market Uncertainties

- Regulatory Restrictions: New safety concerns or labeling changes could hamper sales or elevate costs.

- Market Saturation: Intense generic competition might limit margins and discourage innovation.

- Pricing Regulations: Governments may introduce price caps on essential medicines, pressuring profit margins further.

Key Takeaways

- Price Decline Expectation: The near-term outlook for GS Naproxen Sod suggests gradual price declines owing to intense competition, with prices stabilizing around USD 0.08 to USD 0.15 per tablet by 2030.

- Market Growth Drivers: Growing chronic disease prevalence, healthcare cost containment, and expanding access in emerging markets sustain demand despite low prices.

- Competitive Dynamics: Generic proliferation continues to exert downward pricing pressure, but opportunities exist through market segmentation and formulation differentiation.

- Regulatory Considerations: Vigilance on safety guidelines and patent landscapes remains critical for strategic planning.

- Investment and Supply Chain Strategy: Cost optimization and regional partnerships will be vital for maximizing margins and volume in a mature market environment.

FAQs

1. What factors influence the pricing of GS Naproxen Sod globally?

Pricing is impacted by manufacturing costs, competitive generic entry, regulatory policies, regional healthcare systems, and market competition. Patent expiries enable more manufacturers, intensifying price competition and reducing costs.

2. Will prices for GS Naproxen Sod increase again in the future?

While current trends point to price reductions, regulatory restrictions, supply chain disruptions, or formulary shifts could temporarily increase prices. However, in a competitive environment, long-term upward trends are unlikely without significant innovation or market exclusivity.

3. How does the competition among generic manufacturers affect market stability?

Intense competition leads to price erosion, pushing margins lower. It encourages high-volume sales over premium pricing, favoring manufacturers with lower production costs and efficient supply chains.

4. Which markets are most promising for expanding the use of GS Naproxen Sod?

Emerging economies with expanding healthcare infrastructure and high prevalence of musculoskeletal and inflammatory conditions offer significant growth potential due to affordability factors and high demand for low-cost NSAIDs.

5. Are there safety concerns that could impact the market for GS Naproxen Sod?

Yes. NSAIDs carry risks of gastrointestinal, cardiovascular, and renal side effects. Regulatory agencies may impose restrictions or contraindications, influencing prescribing patterns and market access.

References

[1] Mordor Intelligence. (2023). NSAID Market - Market Overview and Forecast.

[2] World Health Organization. (2020). Musculoskeletal conditions and management.

More… ↓