Last updated: July 27, 2025

Introduction

Glucagon, a peptide hormone primarily used to treat severe hypoglycemia and manage specific medical conditions, has witnessed renewed interest amid rising diabetes prevalence and expanding emergency management protocols. As a critical component in the therapeutic landscape for diabetes and related emergencies, understanding its market dynamics and price trends offers key insights for stakeholders. This analysis offers a detailed overview of the current market landscape and projects future price trajectories for glucagon-based products.

Market Overview

Current Market Landscape

Glucagon's market primarily comprises formulations such as injectable brands (e.g., Glucagon Emergency Kit by Lilly, Glucagon for Injection by Novo Nordisk), nasal sprays, and emerging stable formulations. The global prevalence of diabetes has significantly boosted demand; the International Diabetes Federation reports approximately 537 million adults affected worldwide [1].

The market segments include:

- Emergency Management: Acute hypoglycemia episodes, especially in insulin-dependent diabetics.

- Hospital Settings: Critical care for somatostatinomas or other hormonal disorders.

- Home Use: Emergency kits, often prescribed for self-administration.

The key players include Eli Lilly, Novo Nordisk, and certain generic manufacturers, with regional markets differing substantially in product availability and pricing strategies.

Market Drivers

- Rising Diabetes Incidence: Increased global diabetes prevalence (expected to reach 783 million by 2045) directly correlates with heightened demand for glucagon emergency kits [2].

- Product Innovation: Development of nasal glucagon and stable formulations has expanded administration options, improving accessibility and compliance.

- Regulatory Approvals: The FDA approval of non-injectable formulations, such as nasal glucagon (approved in 2019), has fueled market growth.

- Healthcare Infrastructure: Improved awareness and emergency response protocols boost demand in developed markets; emerging markets are gradually adopting these solutions.

Market Restraints

- Pricing and Reimbursement: High costs and limited insurance coverage restrict patient access in certain regions.

- Availability of Alternatives: Development of alternatives like glucagon-like peptides and co-formulations may influence market share.

- Price Sensitivity in Emerging Markets: Cost barriers significantly impact adoption rates where healthcare funding is limited.

Price Dynamics and Projections

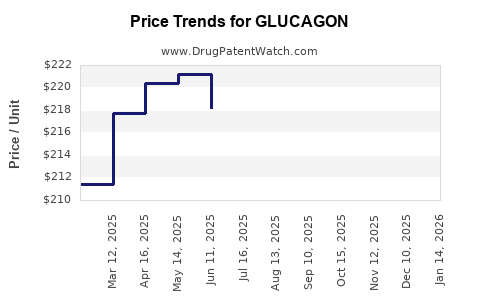

Historical Pricing Trends

Historically, glucagon injectable kits have been costly—average retail prices range from $200 to $300 per kit in the U.S., with some variation based on formulation and manufacturer [3]. The nasal glucagon formulation launched in 2019 commanded premium pricing initially but has seen some reduction as competition and generic versions emerge.

Pricing Factors

- Manufacturing Costs: Complexity of peptide synthesis and need for stabilization influence pricing.

- Regulatory Costs: Costs for obtaining approvals influence initial price setting.

- Market Competition: Entry of generics and biosimilars exerts downward pressure.

- Reimbursement Policies: Insurance coverage levels significantly impact end-user prices.

Future Price Projections (2023-2030)

Based on market trends, regulatory movements, and manufacturing efficiencies, the following projections are reasonable:

Regional Price Variations

- United States: High prices driven by regulatory processes and reimbursement dynamics; ongoing negotiations may reduce prices over time.

- Europe: More competitive, with price controls in several countries contributing to lower average costs.

- Emerging Markets: Limited access and higher prices due to import tariffs and distribution costs; future affordability depends on local manufacturing and policy interventions.

Market Opportunities and Challenges

Opportunities

- Innovation in Formulation Delivery: Non-injectable, portable, and easy-to-administer glucagon forms will continue to command premiums but are poised to drive market expansion.

- Expanding Indications: Research into glucagon's role in weight management and other metabolic disorders could open new markets.

- Telehealth and Digital Initiatives: Integration of emergency kits into telemedicine protocols enhances accessibility and awareness.

Challenges

- Pricing Volatility: Currency fluctuation and manufacturing costs may impact price stability.

- Regulatory Delays: Extended approval timelines could delay market entry of innovative formulations.

- Supply Chain Disruptions: Peptide manufacturing susceptibility to disruptions may affect availability and pricing.

Key Takeaways

- The global glucagon market is poised for steady growth, driven by rising diabetes prevalence and innovation in drug formulations.

- Prices are expected to decrease gradually due to increased competition, biosimilars, and manufacturing efficiencies, especially in injectable and nasal formulations.

- Emerging markets will witness price declines conditioned on local adoption, reimbursement policies, and manufacturing capabilities.

- Brands offering convenient, easy-to-use glucagon products are likely to command premium prices, but future reductions may enhance access.

- Stakeholders should monitor regulatory developments and market entrants closely, as these factors significantly influence pricing and market share dynamics.

FAQs

1. What are the primary factors influencing glucagon pricing?

Manufacturing complexities of peptides, regulatory costs, market competition, reimbursement policies, and formulation convenience significantly impact prices.

2. How will biosimilars affect glucagon prices?

Biosimilar entries are expected to reduce prices by 20-30%, increasing accessibility and expanding market penetration.

3. Are nasal glucagon products more affordable than injectable kits?

Currently, nasal glucagon maintains a premium due to convenience and formulation costs, but expected technological advancements will likely lead to price reductions comparable to injectables.

4. Which regions will experience the highest price declines?

Emerging markets are poised for more significant price reductions due to increased local manufacturing, improved supply chains, and regulatory reforms.

5. What market trends should investors monitor?

Innovations in delivery mechanisms, biosimilar approvals, regulatory changes, and reimbursement landscapes are critical indicators of future pricing trajectories and market growth.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition. 2019.

[2] World Health Organization. Global report on diabetes. 2016.

[3] Medicare Payment Advisory Commission. Analysis of drug pricing and market dynamics. 2022.