Last updated: July 27, 2025

Introduction

Ciprofloxacin, a broad-spectrum fluoroquinolone antibiotic, remains a cornerstone in antimicrobial therapy, particularly for urinary tract infections, respiratory infections, and certain gastrointestinal conditions. Despite emergence of resistance, Ciprofloxacin maintains substantial market share, driven by a broad spectrum of indications, cost-effectiveness, and extensive global approvals. Analyzing its current market landscape alongside projected pricing dynamics offers valuable insights for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Size

The global Ciprofloxacin market was valued at approximately USD 950 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 3% through 2030, reaching an estimated USD 1.25 billion. Key factors influencing this growth include broad clinical application, ongoing demand in developing markets, and the prevalence of bacterial infections resistant to other antibiotics.

Geographical Market Distribution

- North America: Dominates the market, with mature healthcare infrastructure, high antibiotic consumption, and widespread awareness of bacterial infections. The U.S. alone accounts for roughly 40% of the global Ciprofloxacin market.

- Europe: The second-largest market, driven by high healthcare expenditure and stringent regulatory frameworks emphasizing antibiotic stewardship.

- Asia-Pacific: Exhibits the fastest growth propelled by rising infection rates, expanding healthcare access, and cost-sensitive markets favoring generic formulations.

- Rest of the World: Latin America, Middle East, and Africa are witnessing incremental growth driven by increasing infectious disease burden and improving healthcare infrastructure.

Leading Manufacturers and Market Dynamics

Several key players dominate, including Bayer, Sandoz (a Novartis division), Teva Pharmaceuticals, and Mylan. The market is characterized by a combination of branded and significant generic presence, which influences pricing dynamics substantially.

Regulatory and Competitive Landscape

Advancements in antibiotic resistance management have prompted regulatory agencies to implement stringent guidelines. Nonetheless, Ciprofloxacin's established efficacy sustains regulatory approvals globally. The entry barriers for generics remain moderate, fostering a competitive environment that heavily influences market prices.

Current Pricing Landscape

Brand vs. Generic

- Brand-name Ciprofloxacin: Generally priced higher, often ranging from USD 10–15 per 250 mg tablet in developed markets.

- Generics: Price points can be as low as USD 0.20–0.50 per tablet, offering substantial cost advantages.

Factors Impacting Pricing

- Regulatory approvals and patent status: Patents on original formulations have expired or are nearing expiration, facilitating generic proliferation.

- Manufacturing costs: Lower in emerging markets, leading to significantly reduced prices.

- Market demand and competition: Higher competition equates to downward pricing pressure.

- Supply chain dynamics: Disruptions during global health crises, such as the COVID-19 pandemic, can influence prices temporarily.

Price Trajectory and Projections

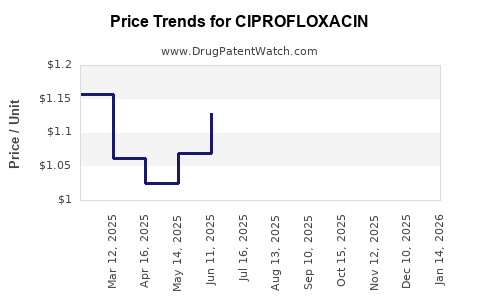

Historical Trends

Over the past decade, Ciprofloxacin prices have declined driven by patent expirations, increased generic competition, and cost-focused procurement policies in public healthcare sectors.

Projected Trends (2023–2030)

- Increased generic penetration: Expected to sustain downward pressure on prices, especially in emerging markets.

- Potential for price stabilization in developed markets: Due to regulatory oversight and resistance management, prices may plateau rather than decrease further.

- Impact of antimicrobial stewardship: Heightened emphasis on appropriate antibiotic use could dampen volume sales, indirectly affecting pricing strategies.

Influencing Factors for Future Pricing

- Antibiotic resistance trends: Rising resistance may lead to increased demand for combination therapies or newer agents, diminishing Ciprofloxacin's market share and pricing.

- Regulatory policies: Stricter guidelines may impose additional costs on manufacturers, potentially stabilizing or increasing prices for certain formulations.

- Global health policies: Efforts to curb overuse may reduce consumption volumes, increasing per-unit costs and influencing pricing dynamics.

- Emerging market growth: Cost-sensitive markets will continue to favor low-cost generics, maintaining overall pressure on prices worldwide.

Implications for Stakeholders

- Pharmaceutical companies: Opportunities exist to innovate formulations—such as extended-release versions—or to develop combination therapies to maintain competitive advantage.

- Healthcare providers: Choosing between branded and generic formulations will depend on cost, efficacy, and resistance considerations.

- Investors: Price stability in developed markets over the forecast period suggests reliable revenue streams, while growth in emerging markets specializes with volume-driven gains.

Regulatory and Market Challenges

- The increasing threat of antimicrobial resistance complicates long-term market sustainability.

- Regulatory compliance costs and evolving standards impose pressure on pricing strategies.

- Patent expirations continuously influence market dynamics, fostering generic competition and exerting downward price pressures.

Conclusion

The Ciprofloxacin market reflects a mature industry characterized by intense generic competition, price sensitivity, and regulatory oversight. While declining prices are expected in most markets driven by generics and increasing competition, strategic innovation and targeted applications could cushion significant declines. The projected steady supply and broad clinical utility ensure Ciprofloxacin remains a key player in antimicrobial therapies, with price stability more likely in developed markets and sustained volume growth in emerging territories.

Key Takeaways

- Market Size & Growth: Currently valued at nearly USD 1 billion globally, with steady growth projections driven by rising infection rates and generic availability.

- Pricing Trends: Prices continue to decline in generic markets, with significant variability between regions—higher in brand formulations, notably in developed economies.

- Competitive Dynamics: Generics dominate, exerting downward pressure; innovation and combination therapies may mitigate price erosion.

- Regulatory Impact: Stringent regulations and antimicrobial stewardship efforts influence both quantity consumption and pricing strategies.

- Future Outlook: The overall market remains robust due to Ciprofloxacin’s established clinical utility; however, resistance issues and policy changes may reshape its economic landscape.

FAQs

1. How does antibiotic resistance impact Ciprofloxacin pricing?

Rising resistance diminishes Ciprofloxacin’s efficacy for certain infections, reducing demand and potentially lowering prices. Conversely, resistance-driven need for alternative therapies can stimulate demand for new or combination drugs, indirectly influencing Ciprofloxacin’s market positioning.

2. Are patent expirations influencing Ciprofloxacin pricing?

Yes. Patent expirations have led to a surge in generic manufacturers, increasing competition and driving prices downward, particularly in low- and middle-income countries.

3. What regions offer the most cost-effective Ciprofloxacin formulations?

Emerging markets such as India, China, and parts of Southeast Asia provide the most affordable generics due to lower manufacturing and regulatory costs, with prices sometimes less than USD 0.50 per tablet.

4. Will Ciprofloxacin remain relevant amid newer antibiotics?

While newer agents with broader spectra or resistance profiles are emerging, Ciprofloxacin’s proven efficacy, low cost, and extensive clinical experience ensure its continued relevance, especially where access to newer drugs is limited.

5. What factors could lead to price stabilization or increases?

Regulatory constraints, antimicrobial stewardship policies limiting overuse, or new formulations with improved safety profiles could stabilize or increase Ciprofloxacin prices, offsetting downward trends driven by generics.

Sources

[1] Grand View Research, “Ciprofloxacin Market Size, Share & Trends Analysis Report,” 2022.

[2] MarketsandMarkets, “Antibiotics Market by Product Type, Application, and Region,” 2023.

[3] World Health Organization, “Antimicrobial Resistance Global Report,” 2021.

[4] IQVIA, “Global Antibiotics Market Data,” 2022.

[5] U.S. Food & Drug Administration, “Antimicrobial Drug Approvals,” 2023.