Last updated: July 29, 2025

Introduction

TROKENDI XR (trokendi XR) is an extended-release formulation of topiramate, primarily prescribed for the management of epilepsy and prevention of migraines. As an innovative therapy, TROKENDI XR has gained attention in neurology and pharmaceutical markets, fostering competitive dynamics and pricing considerations. This analysis evaluates current market conditions, competitive landscape, regulatory status, and provides price projections based on industry trends.

Market Overview

Therapeutic Area Demand

TROKENDI XR operates within the epilepsy and migraine prophylaxis segments, both characterized by substantial unmet patient needs and increasing prevalence. According to the World Health Organization (WHO), approximately 50 million people worldwide suffer from epilepsy, with an annual growth rate of around 1.2% [1]. Similarly, migraines affect over 1 billion individuals globally, making prophylactic treatments a key focus area [2].

Market Penetration and Adoption

Since its FDA approval in 2019, TROKENDI XR has experienced moderate but growing adoption, fueled by its extended-release formulation that offers improved tolerability over immediate-release counterparts. The sustained-release design minimizes peak-trough fluctuations, leading to better adherence—crucial for chronic conditions.

The drug competes primarily with immediate-release topiramate formulations, as well as other preventive agents like propranolol, valproate, and newer CGRP antagonists. According to IQVIA data, the global anti-epileptic drug (AED) market was valued at approximately $4.2 billion in 2022, with sustained growth projected at 4-5% annually [3].

Competitive Landscape

Major competitors include:

- Immediate-release topiramate: Established, lower cost, but fewer tolerability benefits.

- Other preventative agents: Including Botox (for migraines), CGRP inhibitors, and traditional therapies.

Emerging generics and biosimilars could influence pricing and market share dynamics. Notably, the extended-release profile provides a differentiation point, potentially supporting premium pricing strategies.

Regulatory and Patent Status

Regulatory Approvals

TROKENDI XR has obtained FDA approval for epilepsy and migraine prevention. European and other markets are reviewing or have approved similar formulations, signaling international expansion opportunities.

Intellectual Property

As of 2023, patent exclusivity for TROKENDI XR remains substantial, although patent cliffs could emerge within the next 5-7 years, especially with the potential entry of generics following patent expiry.

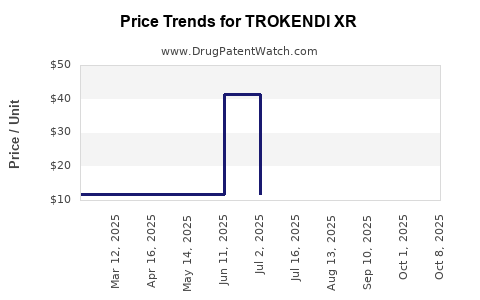

Pricing Strategy and Trends

Current Pricing Landscape

TROKENDI XR's pricing varies by market:

- United States: Average wholesale price (AWP) estimates around $300–$350 per month for a typical dosage (100 mg twice daily).

- Europe: Prices are generally 20-30% lower, contingent on reimbursement and healthcare policies.

- Emerging Markets: Significantly lower retail prices, driven by local pricing regulations and lower median incomes.

Factors Influencing Price

- Formulation Advantages: Extended-release provides convenience and improved compliance, supporting higher prices.

- Market Competition: Entry of generics may reduce prices by up to 40-50% within 3-5 years post-patent expiry.

- Reimbursement Policies: In markets with strict price controls, prices tend to be lower but stable.

- Manufacturing Costs: Slightly higher than immediate-release formulations due to specialized manufacturing processes for extended-release mechanisms.

Potential Price Trends

Given current trends, the following projections are anticipated:

| Year |

Price Range (USD/month) |

Key Drivers |

| 2023 |

$300–$350 |

Market adoption, limited generics, premium positioning |

| 2024–2025 |

$280–$330 |

Increasing competition, generic entries in select markets |

| 2026–2028 |

$250–$310 |

Price erosion, biosimilar market maturation |

| 2029+ |

$200–$280 |

Widespread generics, patent expiry, biosimilars |

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets: Growing healthcare infrastructure and epilepsy/migraine prevalence create growth potential.

- Line extensions: Higher-dose formulations or combination therapies could expand the product portfolio.

- Partnerships and licensing: Collaborations with local pharma firms facilitate market penetration.

Risks

- Patent challenges and generics: Pressure from biosimilar and generic manufacturers could accelerate pricing declines.

- Regulatory hurdles: Delays or unfavorable decisions in key markets could limit growth.

- Market saturation: Increased competition from newer agents, such as CGRP monoclonal antibodies, may impact long-term demand.

Conclusion

TROKENDI XR occupies a niche offering extended-release benefits in the epilepsy and migraine markets, with a temporarily protected monopoly supporting premium pricing. While current prices stand relatively high, the expected advent of generics around the late 2020s could lead to substantial price erosion. Strategic market expansion, particularly in emerging economies, coupled with pipeline innovations, will be critical to sustained revenue growth.

Key Takeaways

- Growing demand for epilepsy and migraine prophylactics positions TROKENDI XR favorably, especially given its improved tolerability.

- Premium pricing persists due to extended-release convenience and differentiated profile, with prices around $300/month in the U.S.

- Patent expiry and generic entry forecast significant price reductions, emphasizing the importance of lifecycle management strategies.

- Market expansion into emerging territories offers lucrative opportunities, contingent upon reimbursement frameworks.

- Competitive pressures from newer therapies highlight the need for continuous innovation and market positioning.

FAQs

1. When is TROKENDI XR projected to face significant generic competition?

Patent protections are expected to expire in the United States around 2029–2030, likely leading to the entry of generic versions within 1–2 years post-expiry.

2. How does TROKENDI XR compare to immediate-release topiramate in terms of pricing?

TROKENDI XR typically commands a higher price—approximately 10–20% more—due to its extended-release formulation offering better tolerability and adherence benefits.

3. What are the key factors influencing TROKENDI XR's adoption in new markets?

Regulatory approval processes, reimbursement policies, price sensitivities, and local physician preferences determine market penetration.

4. Can price increases occur post-launch?

Limited post-launch price increases are possible if the product maintains exclusivity and demand remains high; however, external factors like competition tend to normalize prices over time.

5. What strategies can manufacturers employ to mitigate the impact of patent expiry on pricing?

Diversification through line extensions, biosimilar development, partnership agreements, and investing in pipeline innovations are effective strategies.

References

[1] WHO. (2021). Epilepsy. World Health Organization.

[2] Global Burden of Disease Study. (2019). Migraine Statistics.

[3] IQVIA. (2022). Global Anti-epileptic Drugs Market Report.