Last updated: July 27, 2025

Introduction

Topiramate, marketed primarily under the brand name Topamax among others, is an anticonvulsant and migraine prophylactic widely approved for treating epilepsy, migraine prevention, and off-label applications such as weight management and psychiatric disorders. Its robust clinical profile has solidified its role in neurological therapeutics, with the global market showing steady growth driven by expanding indications and increasing prevalence of target conditions. This analysis delineates the market landscape and projects future pricing trends for Topiramate based on current data, market dynamics, and regulatory considerations.

Market Overview

Global Market Size and Growth Trends

The global epilepsy drug market, where Topiramate finds its primary segment, was valued at approximately USD 4.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 3.5% through 2030 [1]. Within this, Topiramate constitutes approximately 20-25% of the prescription volume for anti-epileptic drugs (AEDs), underscoring its predominant market share among second-generation agents.

The migraine prophylaxis segment further bolsters the drug’s revenue potential. With migraine affecting over 1 billion globally (per WHO), the prophylactic medications market is expanding, fueled by heightened awareness and improved diagnosis, with Topiramate recognized as a first-line prophylactic agent due to efficacy and tolerability profiles.

Epidemiology and Patient Demographics

The rising prevalence of epilepsy, migraine, and associated neurological disorders, especially across aging populations in North America and Europe, enhances the demand for Topiramate. Notably, the increase in off-label uses—such as for weight loss and psychiatric conditions—further expands potential patient pools, although these indications influence pricing strategies differently due to regulatory and reimbursement nuances.

Manufacturers and Supply Chain Dynamics

Major pharmaceutical producers, including Janssen Pharmaceuticals (a Johnson & Johnson subsidiary), Teva Pharmaceuticals, and Dr. Reddy's Laboratories, dominate the market, with generic manufacturers increasingly capturing market share following patent expirations. The conversion to generics has profound implications on drug pricing dynamics, lowering costs and affecting revenue streams for originators.

Regulatory Environment and Patent Landscape

Topiramate’s original patents expired in Europe in 2011 and in the U.S. in 2009, ushering in a wave of generic competition. Recently, patent litigations and secondary patents have occasionally delayed generic entry in certain jurisdictions, allowing for periodical brand-name pricing stability.

Regulatory approvals for new indications or formulations (such as extended-release variants) could influence overall market prices. The FDA’s recent favorable stance on generic substitution policies supports price erosion once generics enter the market.

Pricing Dynamics and Market Forces

Brand-Name Pricing

Historically, Topiramate’s brand-name formulations sold at approximately USD 7-10 per tablet (25 mg / 100 mg strength) in the U.S. market pre-generic entry. These prices are driven by high-margin strategies, patent protections, and lack of immediate generics.

Generic Entry and Price Erosion

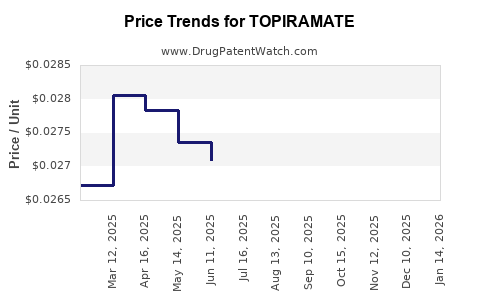

Following patent expiry, wholesale prices typically decline sharply—by 50-70% within the first year—driven by generic competition, with retail prices following suit after insurance negotiations and rebates. As of 2023, generic Topiramate is widely available at approximately USD 1-2 per 100 mg tablet wholesale.

Impact of Patent Litigation and Market Exclusivity

In some regions, secondary patents and legal disputes prolong exclusivity, temporarily stabilizing prices at higher levels. However, these are often challenged and eventually lead to significant price drops upon patent expiration.

Future Price Projections

Based on current trends and assuming a typical pattern of generic market entry, the following projections are made:

-

Short-term (1-2 years):

Post-patent expiration, wholesale prices for Topiramate are expected to stabilize around USD 1-2 per 100 mg tablet, with retail prices accessible to consumers under USD 3 per tablet due to insurance rebates and discount programs.

-

Medium-term (3-5 years):

Additional market penetration by generics and biosimilars could further reduce prices, potentially reaching USD 0.50-1.00 per tablet in mature markets, with some low-cost manufacturers offering even lower prices due to competitive pressures.

-

Long-term (beyond 5 years):

Price stabilization at generics prices is anticipated, with fluctuations depending on regional market dynamics, formulation innovations like extended-release versions, and potential new indications affecting demand. Prices are likely to plateau around USD 0.30-0.80 per tablet.

-

Impact of biosimilars and formulations:

The development of new formulations (e.g., controlled-release or combination therapies) may offer premium pricing for niche markets but are unlikely to significantly influence large-volume generics’ prices.

Market Opportunities and Challenges

Opportunities

- Expansion into off-label indications: Off-label uses such as psychiatric disorders and weight management could open new markets if supported by regulatory approvals.

- Emerging markets: Rapid healthcare infrastructure development in Asia, Latin America, and Africa presents growth opportunities, albeit with typically lower pricing levels.

- Formulation innovations: Extended-release formulations for improved adherence and convenience, potentially commanding premium prices.

Challenges

- Generic competition: Sustained price competition will continue to suppress revenues and over time reduce profit margins.

- Regulatory and reimbursement policies: Variability across regions influences pricing stability, with some countries implementing strict price controls.

- Off-label use regulation: Limited reimbursement for off-label applications may lower demand and impact pricing strategies.

Conclusion

The market for Topiramate remains resilient due to its proven efficacy, expansive indications, and established clinical position. While patent expirations catalyzed significant price reductions, the drug maintains steady demand across core markets. Future price trajectories suggest a continued decline in costs driven by generic competition, stabilizing at low price points in mature markets. Innovations, regulatory decisions, and emerging regions hold the key to potential market growth and pricing adjustments.

Key Takeaways

- Market steady growth is observed driven by increasing prevalence of neurological disorders and expanding indications.

- Patent expirations precipitated sharp price declines; current prices for generics are approximately USD 0.50-1.00 per tablet.

- Regional dynamics and regulatory policies significantly influence pricing trajectories and market penetration.

- Opportunities lie in biosimilars, formulation innovations, and emerging markets, while competition and regulation pose ongoing challenges.

- Long-term outlook anticipates stabilized low prices with potential slight increases in specialized formulations and niche markets.

FAQs

1. What factors influence Topiramate’s price in major markets?

Market dynamics such as patent status, generic competition, regulatory environment, reimbursement policies, and regional economic factors predominantly influence pricing.

2. How does generic competition impact Topiramate’s market price?

Generic entry typically causes immediate price erosion—reducing wholesale and retail prices by up to 70% within a year—and establishes a lower price equilibrium over time.

3. Are there upcoming formulations that could affect the price of Topiramate?

Yes, extended-release formulations are in development, potentially commanding higher prices due to improved adherence and convenience but are unlikely to dramatically alter the primary price trends driven by generics.

4. What role do off-label uses play in the market for Topiramate?

Off-label applications like weight management and psychiatric indications expand the total addressable market but often face reimbursement and regulatory hurdles, limiting their impact on official pricing trends.

5. Which regions offer the most growth opportunities for Topiramate?

Emerging markets in Asia-Pacific, Latin America, and Africa present growth opportunities, though often at lower price points due to economic factors and healthcare infrastructure development.

References

- MarketWatch. "Epilepsy Drugs Market Size, Share & Trends Analysis Report." 2022.

- IMS Health. "Global Anti-Epileptic Drugs Market Analysis." 2021.

- FDA. "Approvals and Patent Information for Topiramate." 2022.

- IQVIA. "Prescription Trends and Price Trends for Antiepileptic Drugs." 2022.

- WHO. "Global Burden of Disease: Neurological Disorders." 2022.