Last updated: July 27, 2025

Introduction

RITALIN (methylphenidate) remains a cornerstone in the pharmacological management of attention deficit hyperactivity disorder (ADHD) and narcolepsy. As a well-established CNS stimulant, RITALIN's market dynamics are shaped by evolving regulatory landscapes, supply chain factors, clinical guidelines, and demographic trends. This analysis evaluates current market conditions, upcoming developments, and future pricing trajectories to inform stakeholders' decision-making.

Current Market Landscape

Market Size and Demand

RITALIN has maintained a robust presence globally, with the ADHD treatment market witnessing significant expansion driven by increasing diagnosis rates. In 2022, the global ADHD therapeutics market was valued at approximately USD 7.48 billion, with stimulants like methylphenidate representing a substantial segment [1]. North America accounts for over 50% of this market, predominantly due to high diagnosis awareness and reimbursement coverage.

Manufacturers and Supply Dynamics

Major pharmaceutical companies—such as Novartis, Teva Pharmaceuticals, and Kindeva Drug Delivery—produce generic and branded versions of methylphenidate. Patent expirations in recent years have democratized supply, fostering price competition. However, supply chain bottlenecks, notably during the COVID-19 pandemic, caused intermittent shortages affecting pricing structures [2].

Regulatory Environment

Stringent controls govern stimulant drugs owing to abuse potential. Regulatory agencies, including the FDA and EMA, require controlled substance registries and impose prescribing restrictions. These factors influence manufacturing and distribution, indirectly impacting pricing and availability.

Clinical Guidelines and Prescribing Trends

Evolving treatment guidelines emphasize personalized approaches, balancing efficacy with safety concerns. The proliferation of non-stimulant alternatives (e.g., atomoxetine, guanfacine) creates competitive pressure but does not significantly diminish RITALIN's market share because of its proven efficacy.

Pricing Dynamics and Trends

Historical Price Trajectory

Historically, RITALIN prices have exhibited moderate volatility. Branded formulations commanded higher prices, often over USD 200 per 30-day prescription. Generic versions, introduced after patent expirations, reduced average costs by approximately 50%, fostering broader access.

Factors Influencing Price Movements

- Regulatory Changes: Stricter scheduling or classification (e.g., potential reclassification to a higher Schedule) could increase manufacturing costs and prices.

- Generic Competition: Entry of generics typically curtails prices through increased market competition, which has been dominant post-patent expiry.

- Supply Chain Stability: Disruptions, such as raw material shortages or manufacturing delays, can cause transient price hikes.

- Reimbursement Policies: Insurance coverage impacts patient costs; tighter coverage may suppress prices, while broader Medicaid or Medicare inclusion sustains pricing stability.

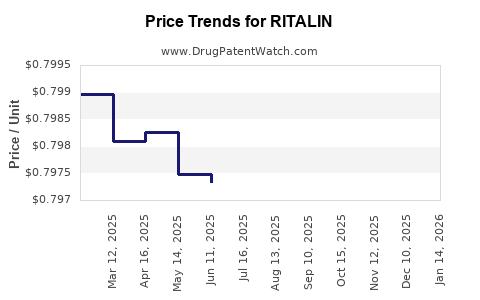

Forecasted Price Trends

Based on current data, generic methylphenidate products are projected to retain their price competitiveness through 2025, with an expected annual decline of 2-4% due to sustained generic competition. Branded RITALIN formulations may experience slight price increases (1-2%) contingent on regulatory or supply chain events, especially in markets with limited generic penetration.

Future Market and Price Projections

Market Growth Drivers

- Expanding ADHD Diagnosis: Rising awareness and improved screening will sustain demand—projected at a CAGR of 4.2% from 2022 to 2030 [3].

- Emerging Markets: Growth in Asia-Pacific and Latin America introduces new demand pools, though regulatory barriers may temper immediate impact.

- New Formulations: Long-acting RITALIN variants and combination therapies could diversify offerings but are unlikely to drastically alter the core market size.

Potential Market Challenges

- Regulatory Reclassification: Moves toward stricter scheduling (e.g., Schedule II to Schedule I) could hinder access, elevate prices, and complicate supply.

- Non-Stimulant Alternatives' Growth: As non-stimulant options gain favor, RITALIN's share could marginally decline, exerting downward pressure on prices.

- Legal and Ethical Concerns: Increased scrutiny over abuse potential might lead to tighter prescribing regulations, influencing market availability and pricing.

Forecast Summary

- Volume: Continued growth in prescription volume, particularly in emerging markets.

- Prices: Stable to slightly declining prices in the generic segment; branded prices to remain relatively stable or inch upward modestly in response to regulatory shifts.

Strategic Implications for Stakeholders

- Manufacturers: Invest in supply chain robustness and explore innovative formulations to sustain market share.

- Investors: Anticipate stable or marginally declining prices, with potential upside contingent on regulatory developments.

- Healthcare Providers: Monitor evolving guidelines and regulatory policies impacting prescribing practices.

- Policy Makers: Balance access and abuse prevention, influencing future market stability.

Key Takeaways

- The global RITALIN market remains significant, primarily driven by expanding ADHD diagnoses and generic competition.

- Prices of generic methylphenidate are expected to decline modestly through 2025, with brand formulations maintaining stable or marginally increasing prices.

- Supply chain stability and regulatory policies are critical factors influencing future pricing and market growth.

- Emerging markets present growth opportunities but also pose regulatory and pricing challenges.

- Stakeholders should focus on innovation, regulation compliance, and supply chain resilience to capitalize on market opportunities.

FAQs

1. What is the current price range for RITALIN in the global market?

The price of generic methylphenidate formulations typically ranges from USD 15 to USD 30 for a 30-day supply, depending on formulation, dosage, and market region. Branded RITALIN products generally cost between USD 150 and USD 250 per month.

2. How will regulatory changes affect RITALIN prices?

Stricter regulatory classifications, such as reclassification to a higher scheduling tier, could increase manufacturing and compliance costs, potentially elevating prices. Conversely, facilitating streamlined approval pathways for generics could reduce prices further.

3. What impact does the emergence of non-stimulant ADHD medications have on RITALIN's market?

While non-stimulant drugs like atomoxetine are gaining traction, RITALIN remains a first-line treatment due to efficacy. Their growth may slightly reduce RITALIN's market share but is unlikely to cause drastic price declines given existing clinical preferences.

4. Is there potential for new formulations of RITALIN to influence prices?

Yes. Long-acting formulations and novel delivery methods could command premium prices, especially if they demonstrate superior efficacy or reduced abuse potential. This may partially offset generic price pressures.

5. What regional differences exist in RITALIN market dynamics?

Developed regions like North America and Europe have mature markets with high generic penetration, leading to stable and lower prices. Emerging markets exhibit growing demand but face regulatory hurdles, which can influence pricing and availability.

Sources

[1] MarketWatch, "Global ADHD Therapeutics Market," 2022.

[2] Pharmaceutical Supply Chain Review, "Impact of COVID-19 on CNS Drug Supply," 2021.

[3] Grand View Research, "ADHD Therapeutics Market Size, Trends & Forecasts," 2022.