Last updated: July 27, 2025

Introduction

Cephalosporins, particularly ceftriaxone, occupy a critical position in the broad-spectrum antibiotic market. Widely utilized for the treatment of bacterial infections, ceftriaxone’s efficacy, safety profile, and ease of administration have sustained its popularity globally. This report provides a comprehensive market analysis, competitive landscape, and price projections for ceftriaxone, considering recent industry trends, regulatory developments, and global demand forecasts.

Market Overview

Global Demand and Usage

Ceftriaxone's extensive use in hospitals, clinics, and outpatient settings positions it as one of the most prescribed third-generation cephalosporins. Its effectiveness against pneumonia, meningitis, urinary tract infections, and septicaemia underpins a consistent demand trajectory. According to IMS Health data, global antibiotic sales reached approximately $50 billion in 2022, with third-generation cephalosporins contributing a significant share due to their broad-spectrum activity and favorable safety profiles [1].

Market Segmentation

The ceftriaxone market divides into several segments:

- Formulation Types: Powder for injection, pre-filled syringes.

- End-users: Hospitals, clinics, ambulatory surgical centers.

- Regional Markets: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Asia-Pacific (APAC) exhibits rapid growth driven by expanding healthcare infrastructure and rising bacterial infection rates. North America and Europe dominate in terms of revenue share owing to advanced healthcare systems and regulatory approvals.

Key Market Drivers

- Rising Incidence of Bacterial Infections: Increased prevalence of respiratory and urinary tract infections sustains demand.

- Growing Healthcare Investment: Governments and private sector investments bolster healthcare capacity globally.

- Shift Towards Hospital-Acquired Infections (HAIs): The emphasis on antimicrobial stewardship and infection control practices increases prescription rates.

- Emergence of Multidrug-Resistant (MDR) Pathogens: While MDR challenges complicate treatment, they simultaneously drive demand for potent antibiotics like ceftriaxone.

Market Challenges

- Antibiotic Resistance Concerns: Rising resistance diminishes efficacy, potentially reducing future demand.

- Regulatory Restrictions: Increased oversight restricts use to prevent misuse, impacting sales volumes.

- Generic Market Competition: High availability of affordable generics affects pricing strategies.

Competitive Landscape

The ceftriaxone market is characterized by numerous players, predominantly generic manufacturers, with few proprietary formulations. Notable manufacturers include:

- Pfizer (Ahora's discontinued formulation, but historically significant)

- SystecMed

- Lupin Pharmaceuticals

- Solupharm

- Sino Biopharmaceutical

Generic competition is fierce; thus, pricing is largely governed by local market dynamics and regulatory policies. Recent trends indicate a shift towards biosimilar development and efforts to improve formulation stability and delivery convenience.

Pricing Dynamics

Current Pricing Landscape

The price of ceftriaxone varies significantly by region:

- North America: Average wholesale prices (AWP) for 1g vials typically range from $1.50 to $3.50 per dose.

- Europe: Slightly lower, with prices averaging $1.20 to $3.00 per dose.

- Asia-Pacific: Generics can be priced as low as $0.50 to $1.50 per dose, facilitated by manufacturing scale and lower regulatory costs.

Pricing Factors

- Formulation and Packaging: Single-use pre-filled syringes command premium prices due to convenience.

- Regulatory Approvals: Stringent approval processes can inflate costs, impacting final consumer prices.

- Market Competition: Increased generic entries drive prices downward to gain market share.

- Supply Chain and Raw Material Costs: Fluctuations in raw material prices (e.g., ceftriaxone sodium) influence manufacturing costs.

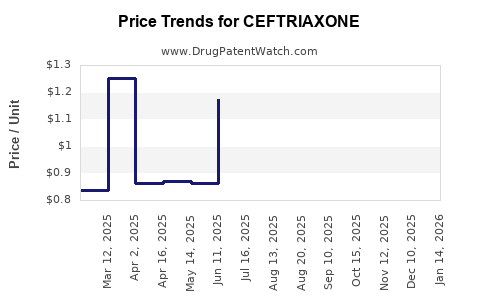

Price Projections (2023–2030)

Short-term Outlook (2023–2025)

Based on current trends, global ceftriaxone prices are expected to experience moderate declines driven by intensified generic competition and market saturation. However, price stabilizations will occur mainly in high-income markets due to regulatory barriers and limited substitutes. Small increases may arise in regions with supply chain disruptions or raw material shortages.

Medium to Long-term Outlook (2026–2030)

Several factors will influence long-term pricing:

- Bacterial Resistance and Stewardship: Rising resistance levels could limit use in certain infections, constraining market size, and possibly exerting downward pressure on prices.

- Emergence of Biosimilars and Advanced Formulations: Innovation could lead to newer delivery systems or formulations, potentially maintaining or increasing prices temporarily.

- Regulatory and Patent Trends: While many ceftriaxone patents have expired, regulatory incentives or restrictions could influence pricing strategies.

By 2030, global average wholesale prices are projected to decline by 10–15% in mature markets due to commoditization, stabilizing around $1.50–$2.50 per 1g vial. In emerging markets, prices may further decrease to $0.50–$1.00 per dose, bolstered by local manufacturing and increased competition.

Regional Market Forecasts

| Region |

2023 Price (USD) |

2030 Price (USD) |

CAGR (2023–2030) |

Remarks |

| North America |

$2.50 |

$2.10 |

-3% |

Market maturity limits declines |

| Europe |

$2.20 |

$1.85 |

-3.2% |

Regulatory pressures |

| Asia-Pacific |

$1.00 |

$0.70 |

-6% |

Price erosion due to generics |

| Latin America |

$1.80 |

$1.20 |

-5.5% |

Growing manufacturing base |

| Middle East & Africa |

$1.50 |

$1.00 |

-5% |

Supply chain improvements |

Market Opportunities and Strategic Outlook

- Emerging Markets Expansion: Manufacturers should capitalize on increasing healthcare infrastructure in APAC, Africa, and Latin America.

- Innovation in Delivery Systems: Developing user-friendly formulations (e.g., pre-filled syringes, ready-to-use solutions) can command premium prices.

- Efficacy Against Resistant Strains: Positioning ceftriaxone as effective against MDR bacteria can sustain demand despite resistance concerns.

- Partnerships and Collaborations: Collaborating with regional distributors and healthcare providers will enhance market penetration.

Regulatory and Ethical Considerations

Efforts toward antimicrobial stewardship and regulation to prevent overuse may impact future growth. Compliance with WHO guidelines and local health authorities’ regulations will be crucial. Transparency and adherence to quality standards are imperative to sustain market share amid increasing scrutiny.

Key Takeaways

- Stable yet declining prices: Cephalosporin ceftriaxone's market faces a gradual price erosion shaped by fierce generic competition and regulatory oversight.

- Regional disparities: High-income markets maintain relatively stable prices, while emerging markets see substantial reductions.

- Demand driven by infection prevalence: Global bacterial infection rates sustain demand, but resistance trends could influence utilization patterns.

- Innovation as a differentiator: Formulation improvements and application expansions could sustain higher prices.

- Strategic focus: Manufacturers should prioritize emerging markets, invest in formulation innovation, and monitor resistance trends for sustainable growth.

Frequently Asked Questions

1. What factors most influence ceftriaxone pricing globally?

Pricing is primarily driven by regional competition, manufacturing costs, regulatory requirements, formulation type, and the degree of market saturation with generic providers.

2. How will rising antimicrobial resistance impact ceftriaxone demand?

Increased resistance may lead to reduced efficacy, limiting usage and Pressures on pricing. Conversely, it can stimulate demand for newer or combined therapies, potentially impacting ceftriaxone's market share.

3. Are there new formulations or delivery systems for ceftriaxone?

Yes. Innovations include pre-filled syringes, lyophilized powders with extended shelf life, and combination formulations to enhance convenience and compliance.

4. What is the expected growth rate of the ceftriaxone market through 2030?

The market is expected to experience a CAGR of approximately 2-3% globally, influenced by regional specifics and resistance trends.

5. Which regions exhibit the highest growth potential for ceftriaxone?

Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities owing to expanding healthcare infrastructure and increasing bacterial infection prevalence.

References

- IMS Health Data, 2022. Global Antibiotic Market Overview.

- World Health Organization. Antimicrobial Resistance Global Report, 2022.

- MarketResearch.com. Cephalosporins Market Forecast 2023–2030.

- EvaluatePharma. Infectious Disease Drugs Market Data, 2022.

- GlobalData. Antibiotics and Vaccines Insights, 2022.

Author's Note:

This analysis underscores the importance of dynamic strategy formulation in the ceftriaxone market. Continuous monitoring of resistance patterns, regulatory landscape, and emerging formulation technologies is vital for stakeholders aiming to capitalize on future growth opportunities.