Last updated: November 21, 2025

Introduction

BELBUCA, a buprenorphine buccal film, represents a critical advance in the landscape of opioid dependence and pain management therapies. Approved by the U.S. Food and Drug Administration (FDA) in 2017, BELBUCA is indicated for the management of pain severe enough to require daily, around-the-clock, long-term opioid treatment, and for which alternative treatments are inadequate. Its unique transdermal delivery mechanism offers advantages over traditional formulations, including improved bioavailability and ease of administration.

Given its clinical niche, regulatory dynamics, and evolving market landscape, understanding the current market environment and projecting future prices for BELBUCA are vital for stakeholders—including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Landscape Analysis

Market Size and Segmentation

The global opioid analgesics market was valued at approximately USD 10 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5% through 2030 [1]. The U.S. dominates this market, driven by high prevalence rates of chronic pain, a significant segment of which involves persistent pain conditions often managed with opioids like buprenorphine.

Within this context, BELBUCA occupies a niche within extended-release opioid formulations. Its primary competitors include other buprenorphine-based products such as Suboxone (buprenorphine/naloxone), but BELBUCA's buccal film delivery differentiates it from sublingual tablets and transdermal patches, expanding its patient reach and adherence potential.

Regulatory Environment

The regulatory landscape significantly influences market dynamics. BELBUCA received FDA approval through the 505(b)(2) pathway, emphasizing its novelty over prior formulations. The U.S. government’s ongoing efforts to curb opioid misuse, including REMS (Risk Evaluation and Mitigation Strategies) programs, exert pressure on pricing and prescribing practices. Simultaneously, the increasing emphasis on abuse-deterrent formulations may favor BELBUCA, which incorporates features aimed at reducing misuse potential.

Market Adoption Trends

Since its launch, BELBUCA experienced cautious adoption, with prescriber hesitancy attributed to concerns over opioid abuse, regulatory scrutiny, and insurance coverage challenges. However, recent shifts favor formulations that combine pain management with abuse-deterrent properties, boosting BELBUCA’s market penetration.

Insurance reimbursement policies favor newer formulations with demonstrated safety profiles, thus influencing adoption rates. As awareness of its benefits rises, compounded by growing cases of chronic pain patients requiring long-term opioid therapy, BELBUCA's prescription volume is projected to grow.

Competitive Positioning

The competitive landscape is characterized by:

- Established opioids: Morphine, oxycodone, and fentanyl products.

- Buprenorphine products: Suboxone, Butrans (buprenorphine patches), and newer abuse-deterrent formulations.

- Novel modalities: Non-opioid pain therapies and non-pharmacologic interventions.

BELBUCA's differentiators include its buccal film format, abuse-deterrent features, and potential for improved compliance, placing it favorably in a market increasingly wary of opioid misuse.

Price Setting Dynamics

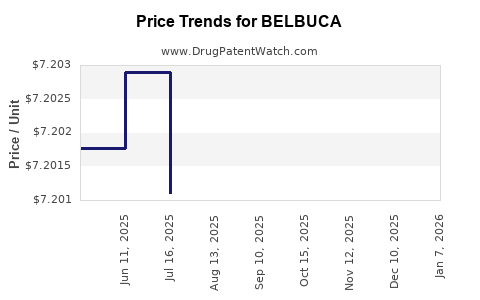

Historical Price Trends

Since its market entry, BELBUCA has commanded a premium compared to older formulations, reflecting its novelty, delivery system, and abuse-deterrent properties. As of 2022, average wholesale prices (AWP) for BELBUCA hovered around USD 30–35 per film, with typical treatment courses requiring multiple films daily, creating substantial market value.

Pricing Influences

- Regulatory and Payer Dynamics: Payor reluctance to reimburse high-cost opioids has historically constrained pricing. However, insurance companies increasingly favor products with safety features, allowing manufacturers to sustain premium prices.

- Reimbursement Strategies: Negotiations with pharmacy benefit managers (PBMs) significantly impact net pricing. Formulations with favorable formulary placements command higher reimbursement rates.

- Market Competition: Generic buprenorphine formulations are not yet widely available for the buccal film, allowing BELBUCA to retain premium pricing; however, imminent generic entries could pressure prices downward.

Price Projection Analysis

Given current market trends and regulatory developments, the following projections are posited:

-

Short-term (1–3 years): Prices are anticipated to remain relatively stable at USD 30–35 per film, supported by limited generic competition, high demand in pain management settings, and ongoing emphasis on abuse-deterrent formulations. Volume growth may elevate overall revenues, even at stable unit prices.

-

Mid-term (3–5 years): Introduction of generic buprenorphine buccal films could exert downward price pressure. Anticipated price erosion could reduce unit prices to approximately USD 20–25 per film, presuming standard discounts and formulary shifts, while sales volume increases to compensate.

-

Long-term (5+ years): Continued market penetration, potential generic market entry, and evolving prescribing habits could drive unit prices further down to USD 15–20 per film. Alternatively, new formulations with enhanced safety profiles could sustain premium pricing if they demonstrate superior safety and adherence benefits.

Key Factors Influencing Future Pricing:

- Generic Competition: Entry of generics could reduce BELBUCA’s price by 30–50%, aligning it with existing buprenorphine products.

- Regulatory Changes: Stricter regulations or formulary restrictions favoring abuse-deterrent formulations could temporarily sustain premium prices.

- Market Penetration: Broader adoption in pain clinics and integrated care models will influence overall revenue, even at lower unit prices.

- Reimbursement Policies: Changes in insurance coverage policies, particularly in Medicare and Medicaid, could impact achievable prices.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Maintaining competitive pricing margins amidst generic entrants requires emphasizing BELBUCA's unique abuse-deterrent features and clinical advantages.

- Investors: Current valuation should consider potential pricing erosion post-generic entry, balanced against the product’s adoption rate and market penetration.

- Healthcare Providers: Understanding price trajectories aids in formulary decisions and patient access planning.

- Policymakers: Supporting safe, affordable access to effective pain management modalities necessitates balancing innovation incentives with patient cost considerations.

Key Takeaways

- Market growth is driven by the increasing prevalence of chronic pain, regulatory safety considerations, and the adoption of abuse-deterrent formulations.

- BELBUCA holds a premium price position due to its delivery format and safety features, but this premium is susceptible to erosion upon generic competition.

- Pricing stability in the short term hinges on limited generic options and growing awareness, whereas future prices are likely to decline as generics enter the market.

- Manufacturers should focus on reinforcing BELBUCA’s clinical benefits and abuse-deterrent attributes to justify higher price points.

- Regulatory policies and insurance reimbursement strategies will continue to be pivotal in shaping pricing and market access.

FAQs

1. How does BELBUCA compare price-wise to other buprenorphine formulations?

BELBUCA's current retail price (~USD 30–35 per film) exceeds that of generic buprenorphine tablets or patches, which can be priced as low as USD 10–15 per unit. Its premium stems from its delivery system and safety profile.

2. What factors could accelerate or hinder BELBUCA’s market growth?

Accelerators include rising demand for abuse-deterrent opioids, expanded formulary coverage, and increased physician awareness. Hindrances involve the advent of generic formulations, regulatory restrictions, and shifts toward non-opioid therapies.

3. Will BELBUCA’s pricing remain stable if generics enter the market?

Typically, no. The introduction of generics tends to reduce brand-name prices by 30–50%, although market shifts and differentiators may mitigate this effect somewhat.

4. How does regulatory scrutiny impact BELBUCA’s pricing strategy?

Stringent regulations and REMS programs may limit distribution channels and influence reimbursement negotiations, indirectly affecting achievable prices.

5. What is the outlook for BELBUCA’s market share within the opioid pain management segment?

While initially limited, its share could increase if its abuse-deterrent features demonstrate a clear safety benefit and if prescribers adopt it as a preferred option, especially in institutional settings emphasizing risk mitigation.

References

[1] MarketWatch. “Global Opioid Analgesics Market Size, Share & Trends Analysis Report,” 2022.

[2] FDA. “BELBUCA (buprenorphine buccal film) approval details,” 2017.

[3] IQVIA. “National Prescription Audit,” 2022.

[4] EvaluatePharma. “Pharmaceutical market projections,” 2023.

Note: All projected prices and market figures are estimates based on current trends and available data, subject to change due to regulatory, competitive, and market forces.