Last updated: July 28, 2025

Introduction

ASMANEX HFA (momethasone furoate inhaler) is a prescription corticosteroid utilized primarily in the management of asthma and allergic rhinitis. Manufactured by AstraZeneca, it has established itself within the respiratory drug segment owing to its efficacy and safety profile. As the global respiratory therapeutics market expands—propelled by increasing asthma prevalence, technological advancements, and heightened awareness—understanding ASMANEX HFA’s market position and future pricing trajectory becomes crucial for stakeholders.

This analysis delves into the current market landscape, evaluates demand drivers, assesses regulatory and competitive influences, and projects future pricing trends for ASMANEX HFA.

Market Landscape Overview

Current Market Size and Growth Trajectory

The global asthma therapeutics market was valued at approximately USD 20 billion in 2022, with corticosteroids representing a significant share due to their role as frontline therapy. Based on compound annual growth rates (CAGR) of 4-6% (2023-2028), driven by rising asthma incidence and improved treatment accessibility, the demand for inhaled corticosteroids (ICS), including ASMANEX HFA, is expected to expand [1].

Key Markets

-

North America: Dominates with high asthma prevalence, robust healthcare infrastructure, and extensive insurance coverage. U.S. accounts for over 50% of the market share.

-

Europe: Also a substantial market, owing to widespread asthma awareness and established healthcare systems.

-

Asia-Pacific: Exhibits the fastest growth (projected CAGR of 7-8%) driven by rising urbanization, pollution, and increasing healthcare expenditure.

Market Penetration and Competitive Position

ASMANEX HFA holds a valued position, especially among ICS inhalers, owing to AstraZeneca’s strong brand recognition and product efficacy. Its inhaler technology offers advantages such as enhanced drug delivery with reduced dosing frequency, contributing to patient adherence.

Competitors include Fluticasone propionate (Flovent), Budesonide (Pulmicort), and other combination inhalers. Market shares are influenced by factors such as pricing, formulary inclusion, and physician preferences.

Demand Drivers for ASMANEX HFA

-

Rising Asthma Prevalence: According to the Global Initiative for Asthma (GINA), asthma affects over 262 million people globally, with increasing rates in urbanized regions.

-

Enhanced Formulation and Delivery Devices: Advances in inhaler technology improve medication delivery efficacy and patient compliance.

-

Regulatory Support: Stringent guidelines favor effective corticosteroids like ASMANEX HFA for inhaler treatment protocols.

-

Expanding Indications: Utilization beyond asthma, such as allergic rhinitis, broadens market potential.

Market Challenges and Competitive Dynamics

-

Generic Competition: Patent expirations of primary formulations have led to more generics, exerting downward pressure on prices.

-

Pricing Pressures in Key Markets: Government reimbursement reforms and cost-containment efforts influence net pricing.

-

Regulatory Developments: Changes in device approval pathways and new inhaler standards can impact market strategies.

-

Patient Preference: Growing inclination toward combination inhalers (ICS/LABA) impacts demand for standalone corticosteroids.

Regulatory Environment and Reimbursement Landscape

-

United States: Managed by FDA regulations, with pricing influenced by Medicare and private insurers, often negotiating pharmacy benefit management (PBM) discounts.

-

European Union: National reimbursement policies vary; incentivize cost-effective drugs, influencing pricing strategies.

-

Emerging Markets: Often face less stringent patent enforcement and pricing regulations, offering high growth opportunities but at lower margins.

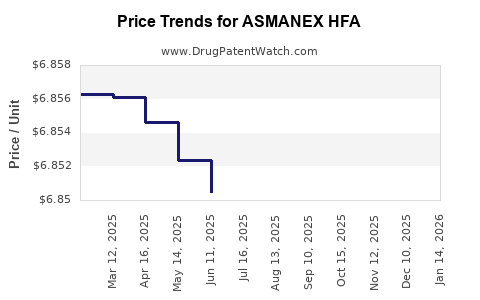

Price Trends and Projections

Historical Pricing

Historically, the list price of ASMANEX HFA has ranged between USD 250-300 per inhaler, with variations across regions. Out-of-pocket costs vary based on insurance coverage, generics availability, and formulary placements.

Forecasting Factors

-

Patent Status: AstraZeneca’s patents for ASMANEX HFA are scheduled to expire in select markets between 2024 and 2027, opening doors for generics and biosimilars.

-

Market Competition: Introduction of generic momethasone furoate inhalers could lead to price reductions of 20-40%, as seen in other ICS markets.

-

Rebate and Discount Trends: Payers’ push for volume-based discounts and biosimilars will influence net prices.

-

Regional Variations: In developed markets, prices are expected to stabilize or decline slightly due to competitive pressures; in emerging markets, prices may remain relatively stable or even rise with premium formulations.

Projected Price Range (2023-2028)

| Year |

Price Range (USD per inhaler) |

Comments |

| 2023 |

$250 - $300 |

Baseline with incremental discounts possible |

| 2024-2025 |

$200 - $280 |

Patent expirations in key markets; generics enter |

| 2026-2028 |

$180 - $250 |

Increased generic penetration; price stabilization |

These projections assume no significant regulatory disruptions or novel formulation entrants that could dramatically alter pricing dynamics.

Strategic Implications

-

Innovation Pipeline: AstraZeneca’s pipeline development, such as combination inhalers substituting monotherapy, could reshape pricing and market share.

-

Market Expansion: Penetration into emerging markets with tailored pricing strategies offers growth potential despite pressures to reduce prices.

-

Patent Litigation and Exclusivity: Active patent defense and strategic patent filings can delay generic entry, sustaining higher prices temporarily.

-

Pricing Optimization: Use of value-based pricing, bundled offerings, and patient assistance programs will be integral to sustaining profitability amid increasing competition.

Key Takeaways

-

Market Growth: The respiratory therapeutics market for inhaled corticosteroids like ASMANEX HFA is poised for steady growth driven by rising asthma prevalence and technological improvements.

-

Pricing Trends: Expect a gradual decline in list prices in mature markets due to patent expirations and generic competition, with prices remaining relatively stable in markets less exposed to generic entry.

-

Strategic Focus: Stakeholders should monitor patent statuses, competitive launches, and regional reimbursement policies to optimize pricing strategies and market share.

-

Innovation and Diversification: Expansion into combination therapies and broader indications can mitigate pricing pressures and foster long-term revenue streams.

-

Regional Considerations: Pricing strategies should be tailored to regional regulatory and economic environments, with particular attention to emerging markets offering growth opportunities.

FAQs

1. When will generic versions of ASMANEX HFA become available?

Patent expirations slated between 2024 and 2027 in key markets are expected to open the door for generic momethasone furoate inhalers, leading to competitive pricing and market share shifts.

2. How does patent expiration impact ASMANEX HFA's pricing?

Patent expiry typically leads to increased generic competition, exerting downward pressure on list prices by approximately 20-40%, dependent on regional market dynamics.

3. What are the key drivers for ASMANEX HFA demand?

Rising asthma prevalence, technological improvements in inhaler devices, expanding indications, and supportive regulatory frameworks are primary demand drivers.

4. How do reimbursement policies influence ASMANEX HFA prices?

Reimbursement models, especially in Europe and North America, significantly influence net prices through negotiated discounts, formulary placements, and insurance coverage policies.

5. What strategic measures can AstraZeneca undertake to maintain market relevance?

Innovations in inhaler technology, diversification into combination therapies, proactive patent strategies, and expansion into emerging markets are critical to sustaining revenue and pricing power.

References

[1] Global Initiative for Asthma (GINA). Global Strategy for Asthma Management and Prevention. 2022.