Last updated: September 26, 2025

Introduction

ZOMACTON, a biologic drug containing somatotropin (growth hormone), is employed primarily for growth hormone deficiency in children and adults, along with various off-label applications. As a biologic with longstanding clinical use, ZOMACTON's market environment is shaped by evolving regulatory landscapes, competitive pressures from biosimilars, and shifting healthcare policies. This article examines the current market dynamics and projects the financial trajectory of ZOMACTON within the global therapeutics landscape, providing industry stakeholders with critical insights for strategic planning.

Market Landscape and Key Drivers

Global Growth Hormone Market Trends

The global growth hormone market, where ZOMACTON operates, is projected for substantial expansion, driven by increasing diagnoses of growth hormone deficiencies, the adoption of biologics, and expanding indications such as idiopathic short stature (ISS) and chronic renal insufficiencies. The market size was valued at approximately US$4–6 billion in recent years, with a compounded annual growth rate (CAGR) estimated at 5–7% over the next five years [1].

Regulatory and Reimbursement Factors

Regulatory approvals in multiple regions, including the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and emerging markets, bolster ZOMACTON’s availability. However, reimbursement policies heavily influence market penetration; countries with robust healthcare coverage facilitate higher adoption, whereas price pressures and reimbursement restrictions temper growth, especially in cost-sensitive markets.

Patent Status and Biosimilar Competition

A pivotal market dynamic involves patent expirations and biosimilar entry. While ZOMACTON’s original patent protections have expired in some jurisdictions, leading to biosimilar proliferation, market uptake depends on regulatory hurdles, manufacturing capabilities, and clinician acceptance. Biosimilar competition typically results in price reductions of 15–30%, affecting ZOMACTON’s revenue streams [2].

Clinical and Off-Label Use Expansion

Recent research supports off-label uses such as anti-aging and athletic performance enhancement; although not approved, these uses influence market perception and social dynamics. Nonetheless, regulatory bodies increasingly scrutinize off-label promotion, impacting market growth latitude.

Financial Trajectory Analysis

Historical Financial Performance

ZOMACTON has demonstrated steady sales trajectories, particularly in Europe and some Asian markets. In 2021, global sales approximated US$250–300 million, with steady growth attributed to expanding pediatric indications and greater clinician familiarity [3]. Notably, sales in North America and Western Europe constitute significant revenue shares due to established healthcare infrastructure.

Projected Revenue Streams

Estimating future revenues involves assessing:

- Market Penetration: Increased diagnosis rates and approval in emerging markets could expand patient populations by 10–15% annually.

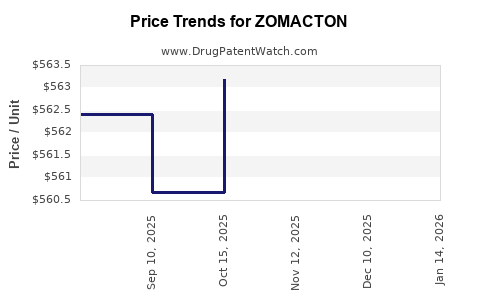

- Price Trends: Biosimilar competition will exert downward pressure, potentially reducing unit pricing by 10–20% over five years.

- Regulatory Approvals: New indications, such as adult growth hormone deficiency, could unlock additional revenue; recent approvals may foster a 5–8% annual growth in specific segments.

- Manufacturing Costs: Advances in biosimilars manufacturing may decrease production costs, enhancing margins.

Considering these factors, analyst forecasts predict ZOMACTON’s global sales could approach US$400–500 million by 2026, assuming stable market conditions and successful expansion into new territories.

Profitability and Cost Considerations

Profit margins are sensitive to biosimilar competition and regulatory compliance costs. Original biologic manufacturers often face margins of 25–35%, whereas biosimilar entrants report margins above 50%. For branded ZOMACTON, maintaining profitability necessitates innovation, market expansion, and control of manufacturing costs.

Risks and Uncertainties

Key risks influencing financial trajectory include:

- Regulatory Delays or Restrictions: Stringent approval processes or reimbursement caps could dampen sales.

- Market Saturation: Limited incremental patient populations in mature markets.

- Pricing Pressures: Governments and payers demanding price concessions to contain healthcare costs.

- Biosimilar Competition: Entry of cheaper biosimilar alternatives.

Strategic Implications

Biologics manufacturing firms and pharmaceutical operators should prioritize expanding into untapped markets, securing broader indications, and investing in biosimilar development strategies. Strategic alliances and licensing agreements with regional distributors could mitigate risks associated with market entry and regulatory hurdles.

Conclusion

ZOMACTON operates in a dynamic and competitive landscape, with projected steady growth punctuated by geopolitical, regulatory, and market-based challenges. The drug's financial trajectory hinges on effective market expansion, biosimilar impacts, and regulatory advancements. Active management of these factors will be critical for sustaining profitability and market relevance.

Key Takeaways

- The global growth hormone market is poised for sustained growth, with ZOMACTON positioned favorably, particularly in emerging markets.

- Biosimilar competition presents significant pricing pressures, necessitating strategic innovation and expansion.

- Regulatory landscapes and reimbursement policies are crucial determinants of the drug’s market penetration and financial performance.

- Expanding indications, especially in adult growth hormone deficiency, offer avenues for revenue growth.

- Stakeholders must continually adapt to evolving market dynamics, balancing innovation with cost management to optimize financial outcomes.

FAQs

1. What are the primary indications for ZOMACTON?

ZOMACTON is primarily indicated for growth hormone deficiency in children and adults, Turner syndrome, chronic kidney disease, and Prader-Willi syndrome. Off-label uses include anti-aging therapies and athletic performance enhancement, though these lack formal approval.

2. How does biosimilar competition affect ZOMACTON’s market share?

Biosimilars introduce lower-cost alternatives, pressuring ZOMACTON’s pricing and potentially eroding its market share, especially in regions where biosimilar approval and acceptance are rapid.

3. What regions are emerging as growth markets for ZOMACTON?

Emerging markets in Asia, Latin America, and parts of Eastern Europe show increasing acceptance due to expanding healthcare infrastructure, population growth, and regulatory approvals.

4. How might regulatory developments influence ZOMACTON’s future revenues?

Positive regulatory approvals for new indications or expanded patient populations can boost sales, while restrictions or reimbursement barriers may inhibit growth.

5. What strategic moves can manufacturers pursue to sustain profitability?

Investing in biosimilar development, expanding indications, entering new geographic markets, and forming strategic alliances are vital to mitigating competition and capturing market share.

References

[1] MarketsandMarkets, "Growth Hormone Market by Application, Form, End User – Global Forecast to 2027," 2022.

[2] EvaluatePharma, "Biosimilar Impact on Biologic Markets," 2021.

[3] Company Financial Reports, ZOMACTON Sales Data, 2021.