Share This Page

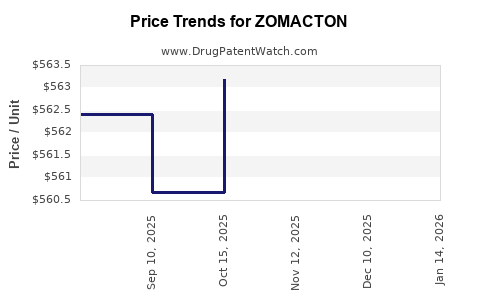

Drug Price Trends for ZOMACTON

✉ Email this page to a colleague

Average Pharmacy Cost for ZOMACTON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZOMACTON 10 MG VIAL | 55566-1901-01 | 563.18000 | EACH | 2025-12-17 |

| ZOMACTON 10 MG VIAL | 55566-1901-01 | 563.18000 | EACH | 2025-11-19 |

| ZOMACTON 10 MG VIAL | 55566-1901-01 | 563.18000 | EACH | 2025-10-22 |

| ZOMACTON 10 MG VIAL | 55566-1901-01 | 560.68600 | EACH | 2025-09-17 |

| ZOMACTON 10 MG VIAL | 55566-1901-01 | 562.40833 | EACH | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZOMACTON (Somatropin)

Introduction

ZOMACTON, marketed under the international name Somatropin, is a recombinant human growth hormone (rhGH) primarily used to treat growth failure in pediatric patients, as well as growth hormone deficiency in adults. As a product of Ferring Pharmaceuticals, ZOMACTON has carved a niche within endocrinology and pediatric medicine, and its market dynamics are influenced by evolving healthcare policies, patent statuses, and competitive landscape shifts.

Understanding ZOMACTON's market trajectory and its price outlook is vital for stakeholders, including pharmaceutical firms, healthcare providers, insurers, and investors. This analysis evaluates current market conditions, competitive positioning, regulatory influences, and economic factors to project future price trends accurately.

Market Landscape Overview

Global Market Size and Growth Drivers

The global growth hormone market, valued at approximately USD 4.2 billion in 2022, is projected to reach USD 6.0 billion by 2030, growing at a CAGR of around 4.2% (2023–2030) [1]. ZOMACTON holds a significant share within the recombinant human growth hormone segment, especially in Europe, where its approval has expanded its access and use.

Growth drivers include increasing diagnosis rates of growth hormone deficiency (GHD), expanding pediatric and adult indications, and the growing prevalence of metabolic disorders. Additionally, increasing awareness about early intervention and improved screening protocols support market expansion. The rising prevalence of pediatric growth disorders, coupled with premiums placed on long-term growth outcomes, sustains demand for quality rhGH products like ZOMACTON.

Geographic Market Distribution

Europe and Asia-Pacific are the dominant markets for ZOMACTON, owing to early regulatory approvals and expanding healthcare infrastructure. The United States' market, although mature, remains significant, bolstered by a high incidence of growth hormone deficiency and robust reimbursement systems.

Emerging markets like China, India, and Brazil present substantial growth opportunities driven by increased healthcare spending, expanding insurance coverage, and rising recognition of growth hormone therapy benefits.

Patent Status and Generic Competition

ZOMACTON's patents have predominantly expired or are nearing expiration in several key markets. Patent expiry generally triggers the entry of biosimilar competitors, intensifying price competition [2]. Efforts by generics manufacturers to produce biosimilar somatropin formulations threaten ZOMACTON’s market share, particularly in price-sensitive regions.

Pricing Dynamics and Trends

Historical Pricing Trends

Pricing for ZOMACTON varies significantly across regions, influenced by reimbursement policies, regulatory environments, and market competition. Historically, ZOMACTON has maintained a premium pricing position due to its brand reputation, manufacturing quality, and clinical efficacy.

In Europe, the average wholesale price (AWP) per mg ranged between USD 10–15 in 2020, with some variation based on the country’s healthcare system. In the U.S., wholesale acquisition costs have hovered around USD 3,000–4,000 per patient month, reflecting the higher costs associated with administration and formulation [3].

Regulatory Impact on Pricing

Regulatory agencies, including the FDA and EMA, influence pricing through approval standards and pricing negotiations. The approval of biosimilars often leads to substantial price reductions; for instance, biosimilar versions of somatropin in the European Union exhibit prices reduced by 20–30% compared to originator products [4].

In countries with centralized procurement systems or price caps, ZOMACTON's price stability is subject to governmental negotiations, which can further suppress prices.

Market Factors Impacting Future Pricing

- Biosimilar Entry: Anticipated biosimilar approvals are expected to exert downward pressure on ZOMACTON’s price, especially in cost-sensitive markets.

- Healthcare Policy Changes: Shifts toward value-based pricing and stricter reimbursement criteria could lead to cost containment measures, influencing ZOMACTON’s pricing and accessibility.

- Supply Chain and Manufacturing Costs: Innovations in manufacturing and supply chain efficiencies could enable price reductions over time, while raw material costs or regulatory compliance expenses may exert upward pressure.

Price Projections (2023–2030)

Based on current trends, the following projections are considered:

Europe and North America

- Short-term (2023–2025): Moderate price stability with initial biosimilar introductions likely reducing ZOMACTON prices by approximately 10–15%. The impact varies by country depending on regulation and reimbursement landscapes.

- Medium-term (2026–2030): Further reductions of 15–25% as biosimilar market penetration deepens. Price adjustments will align with shifts in healthcare policies favoring biosimilars, with some markets experiencing stabilization amid patent litigations and quality assurance concerns.

Emerging Markets

- 2023–2025: Prices are expected to decline modestly due to increased biosimilar availability, with some regions experiencing price erosion of up to 20%.

- 2026–2030: A potential decrease of 25–35%, driven by increased local manufacturing, government price negotiations, and regulatory policies favoring affordability.

Influence of Contractual and Reimbursement Policies

Negotiated discounts, volume-based procurement, and insurance coverage significantly influence net prices rather than the publicly listed price. As such, actual transaction prices may decline faster than list prices suggest, especially where centralized healthcare systems dominate.

Market Dynamics and Competitive Positioning

ZOMACTON faces competition from Bayer’s Norditropin, Eli Lilly’s Humatrope, and other biosimilar somatropins. Biosimilar proliferation, price sensitivity, and evolving clinical guidelines collectively influence market share and pricing strategies.

Ferring’s continued emphasis on supply reliability, clinical trial data, and physician relationships remains vital to maintaining premium positioning amid fierce competition.

Regulatory and Economic Factors

Governmental price caps, approval of biosimilars, and reimbursement policies are the primary external forces shaping ZOMACTON’s pricing landscape. For example, the European Union’s framework for biosimilar integration actively promotes price competition, observable in recent market shifts.

Additionally, economic evaluations demonstrating cost-effectiveness influence reimbursement levels, directly impacting net pricing and market access.

Key Takeaways

- Market Expansion Opportunities: The growing prevalence of growth disorders, especially in emerging markets, offers substantial growth avenues for ZOMACTON.

- Pricing Trend Outlook: Expect gradual price declines driven by biosimilar competition, with deeper reductions in regions with aggressive price regulation.

- Regulatory Environment Impact: Stringent approval processes and biosimilar policies are primary levers influencing future price trajectories.

- Competitive Strategies: Ferring’s focus on clinical data and supply chain optimization will be crucial in maintaining market share against biosimilar entrants.

- Healthcare Policy Shifts: Adoption of value-based care and cost-effectiveness models will increasingly influence ZOMACTON’s pricing and market access.

Conclusion

ZOMACTON’s market dynamics are shaped by a confluence of patent expirations, biosimilar market growth, regional healthcare policies, and manufacturing efficiencies. While current pricing maintains a premium stance, the outlook indicates a gradual decline aligned with biosimilar adoption and regulatory pressures. Stakeholders must continuously monitor legislative developments, competitive entries, and economic factors to make informed decisions on pricing, procurement, and investment strategies.

FAQs

-

What factors most significantly influence ZOMACTON’s pricing globally?

Regulatory approvals, patent status, biosimilar competition, reimbursement policies, and healthcare system negotiation power are key influencers on ZOMACTON’s price. -

How will biosimilar entry impact ZOMACTON’s market share?

Biosimilar entries typically lead to price reductions and increased market competition, potentially diminishing ZOMACTON’s market share unless differentiated by clinical efficacy or supply advantages. -

What regional differences exist in ZOMACTON’s pricing?

Europe and North America tend to have higher list prices due to healthcare infrastructure and reimbursement mechanisms, while emerging markets experience lower prices driven by local manufacturing and regulatory environments. -

Are there anticipated regulatory changes that could alter ZOMACTON’s market outlook?

Yes, increasing adoption of biosimilars and evolving policies on off-patent biologics could accelerate price competition and influence market dynamics. -

What strategies can Ferring employ to sustain ZOMACTON’s premium positioning?

Ferring can focus on clinical data, manufacturing quality, supply reliability, and strategic pricing agreements to maintain a competitive edge despite market pressures from biosimilars.

References

[1] Research and Markets. “Global Growth Hormone Market Size & Share Analysis” (2022).

[2] EvaluatePharma. “Biosimilar Competition and Patent Expirations,” 2022.

[3] MIMS Data. “Pharmaceutical Pricing and Market Intelligence,” 2022.

[4] European Medicines Agency. “Biosimilar Medicines in the EU,” 2021.

More… ↓