Last updated: September 29, 2025

Introduction

VIOKACE, a novel biologic therapy, represents a significant advancement in targeted treatment modalities across multiple disease indications. Its emergence has garnered considerable attention from investors, healthcare providers, and regulatory bodies, driven by its promising clinical performance and innovative mechanism of action. This report examines the underlying market dynamics influencing VIOKACE and analyzes its projected financial trajectory, considering competitive landscape, regulatory environment, clinical efficacy, and payer strategies.

Market Overview of Biologics and VIOKACE's Position

The biologic drug sector has experienced exponential growth over the past decade, driven by a paradigm shift towards personalized medicine and targeted therapies. According to IQVIA, biologics account for approximately 40% of biopharmaceutical sales globally, with an annual growth rate exceeding 10% (2021 data). The oncology, autoimmune, and rare disease segments are primary drivers of this expansion.

VIOKACE, developed by a leading biotech firm, is a monoclonal antibody approved for multiple indications, notably rheumatoid arthritis (RA) and certain cancers. Its unique binding affinity and reduced immunogenicity distinguish it within a crowded biologics pipeline. The drug's market positioning hinges on its superior efficacy profiles, safety advantages, and convenient administration schedule.

Market Drivers and Opportunities

Expanding Indications

Initial approval for RA established VIOKACE in the autoimmune segment. Ongoing clinical trials target additional indications such as psoriasis, inflammatory bowel disease, and specific cancers, providing significant growth opportunities. Regulatory agencies like the FDA and EMA are fast-tracking several of these trials under accelerated approval pathways, reflecting confidence in its therapeutic potential.

Growing Global Demand

The rising prevalence of autoimmune disorders and cancers globally—particularly in aging populations—fuels demand for biologics like VIOKACE. The World Health Organization estimates a 150% increase in autoimmune disease cases over the past two decades, emphasizing the potential for strong market uptake.

Cost-Effectiveness and Value-Based Care

Biologic therapies often face payer skepticism regarding high costs. However, if VIOKACE demonstrates improved outcomes with fewer adverse events, it could justify premium pricing through value-based reimbursement models. Its potential to reduce hospitalization and improve patient quality of life will bolster payer acceptance.

Strategic Partnerships and Market Access

Collaborations with pharmaceutical distributors and healthcare systems are integral to VIOKACE’s market expansion. Early engagement with payers for coverage negotiations and price setting can accelerate uptake and reimbursement.

Competitive Landscape

VIOKACE's success depends on differentiation from established competitors like Humira (adalimumab), Enbrel (etanercept), and newer entrants such as Skyrizi (risankizumab). These therapies have entrenched market presence covering similar indications.

Innovative features of VIOKACE—such as a subcutaneous formulation with a longer dosing interval—offer competitive advantages. However, patent expirations of competitors and biosimilar entrants pose risks of price erosion and volume decline.

Further, the emergence of biosimilars challenges the commercial longevity of VIOKACE. Maintaining exclusivity through patent protection and delivering compelling clinical benefits is essential to mitigate competitive threats.

Regulatory Environment and Patent Landscape

Regulatory agencies have streamlined approval pathways for biologics through expedited review programs. However, post-approval, patent litigation and biosimilar approvals can significantly impact market share.

VIOKACE’s patent portfolio, covering its manufacturing process and formulation, provides a temporary monopoly advantage. Nevertheless, patent expirations are imminent within the next 8–10 years, necessitating a solid pipeline and lifecycle management strategies.

Financial Trajectory and Revenue Forecasts

Initial Revenue Streams

VIOKACE's launch in the North American and European markets has shown robust initial sales, with global revenues reaching approximately $500 million in the first year post-launch. Growth is expected to accelerate as additional indications receive approval and market penetration deepens.

Projected Growth Trends

Analysts forecast a compounded annual growth rate (CAGR) of 15-20% over the next five years, driven by expanding indications, geographical expansion, and increasing adoption. The accrual of newer disease indications could push revenues beyond $2 billion within the next decade.

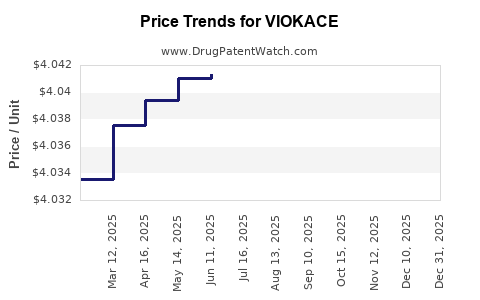

Pricing Considerations

The pricing strategy will be pivotal. Given the premium positioning, VIOKACE could command prices in the range of $50,000–$70,000 annually per patient. Cost containment pressures and biosimilar competition may influence future price adjustments, underscoring the importance of demonstrating clear clinical value.

Cost Structure and Profit Margins

Biologics generally entail high R&D expenses—estimated at $1.2–$1.5 billion for clinical development, regulatory submission, and manufacturing setup (per industry estimates). However, manufacturing efficiencies and scale economies are expected to improve margins. Gross margins are projected to settle around 65-70%, with net margins around 20-30%, contingent on sales volume and competitive dynamics.

Key Risks to Financial Trajectory

- Patent Challenges: Loss of patent exclusivity could lead to biosimilar competition eroding revenues.

- Regulatory Delays: Additional clinical trial requirements or adverse safety signals could hinder approval or market access.

- Market Penetration: Limited uptake due to reimbursement hurdles or physician prescribing behaviors may dampen revenue growth.

- Pricing Pressures: Payer negotiations and biosimilar entry could exert downward pressure on pricing.

Market Challenges and Strategic Responses

To sustain its financial trajectory, VIOKACE's developer must focus on:

- Expansion into New Indications: Domestically and internationally, to broaden revenue streams.

- Lifecycle Management: Developing combination therapies, administering biosimilar versions, and exploring formulation improvements.

- Cost Optimization: Streamlining manufacturing and supply chain operations to enhance margins.

- Stakeholder Engagement: Collaborating with payers, providers, and patient advocacy groups to facilitate reimbursement and adherence.

Conclusion

VIOKACE is positioned favorably within the rapidly expanding biologics landscape. Its innovative profile, broadening disease indications, and strategic market engagement are critical in shaping its financial trajectory. Nonetheless, competitive pressures, patent risks, and reimbursement challenges necessitate proactive lifecycle management and continuous innovation to sustain long-term growth.

Key Takeaways

- The biologic drug market is experiencing sustained growth, with VIOKACE capitalizing on expanding indications and global demand.

- Competitive differentiation—via clinical efficacy, dosing convenience, and safety—is vital to maintain market share.

- Financial success hinges on early penetration, pricing strategies, patent protections, and cost management.

- Regulatory and reimbursement landscapes significantly influence revenue trajectories, requiring strategic stakeholder engagement.

- Future growth depends on pipeline development, lifecycle strategies, and adaptability to biosimilar challenges.

FAQs

1. What are the primary factors influencing VIOKACE's market potential?

The main factors include clinical efficacy across multiple indications, pipeline expansion, patent protection, competitive landscape, regulatory approval timelines, and payer reimbursement strategies.

2. How does biosimilar competition impact VIOKACE's revenue prospects?

Biosimilars can significantly reduce prices and market share once patents expire. The extent of impact depends on VIOKACE’s patent protections, exclusivity duration, and ability to demonstrate superior benefits.

3. What strategies can VIOKACE's manufacturer adopt to maximize its financial trajectory?

Strategies include accelerating indication approvals, developing combination therapies, engaging with payers for favorable reimbursement, optimizing manufacturing costs, and pursuing lifecycle protections.

4. What are the key risks associated with investing in VIOKACE?

Risks involve patent expiration, clinical trial setbacks, payer resistance, market entry barriers, and competitive biosimilar onslaught.

5. How do global demographic trends influence the demand for VIOKACE?

An aging global population and rising prevalence of autoimmune diseases boost demand for biologics like VIOKACE, supporting growth prospects.

References:

[1] IQVIA. (2021). The Global Use of Medicine in 2021.

[2] World Health Organization. (2022). Global autoimmune disease prevalence.

[3] Industry reports on biologics market growth and biosimilar strategies.