Last updated: September 26, 2025

Introduction

RETACRIT, a biologic therapeutic recombinant erythropoietin, has established itself as a pivotal treatment in anemia management related to chronic kidney disease (CKD), chemotherapy, and other conditions. As a biosimilar or branded product, RETACRIT's market trajectory is shaped by evolving regulatory landscapes, competitive positioning, and healthcare trends. This analysis examines the key market drivers, competitive dynamics, regulatory influences, and financial prospects for RETACRIT over the coming years.

Market Overview and Therapeutic Positioning

RETACRIT, a recombinant human erythropoietin (rHuEPO), stimulates erythropoiesis, addressing anemia in CKD, chemotherapy, and surgical patients. The global market for erythropoietin-stimulating agents (ESAs), including RETACRIT, is projected to grow at a compound annual growth rate (CAGR) of approximately 4–6% through 2030 [1].

The drug’s segment is characterized by mature markets in North America and Europe, where ESAs are widely adopted. Emerging markets in Asia-Pacific and Latin America are experiencing rapid adoption, driven by rising CKD prevalence and expanding healthcare infrastructure. The increasing prevalence of CKD, driven by diabetes and hypertension, sustains demand for erythropoietin therapies.

Market Dynamics Influencing RETACRIT

1. Epidemiological Drivers

CKD-related anemia remains a primary driver, with an estimated 37 million adults affected in the U.S. alone, and global prevalence rising proportionately [2]. The expanded use of RETACRIT in dialysis centers and non-dialysis CKD management sustains consistent demand.

2. Regulatory and Reimbursement Frameworks

In many markets, regulatory approvals hinge upon demonstrating biosimilarity or efficacy and safety equivalence. The entry of biosimilars like RETACRIT has intensified price competition, leading to reduced costs and increased access—particularly in price-sensitive regions.

Reimbursement policies significantly influence adoption rates, with countries adopting different reimbursement mechanisms affecting product accessibility and market penetration. Governments’ push towards cost-effective biosimilars to contain healthcare expenditure amplifies the impact.

3. Competitive Landscape

The ESA market includes major players such as Amgen (Epogen, Aranesp), Johnson & Johnson (Procrit), and biosimilars like Retacrit (biological clone of Epogen/Procrit). The entry of biosimilars reduces prices by 20-30%, compelling brand manufacturers to innovate or negotiate price reductions.

RETACRIT's differentiation relies on pricing strategies, manufacturing efficiency, and formulary positioning. The availability of biosimilar options exerts downward pressure on prices, challenging traditional revenue streams.

4. Physician and Patient Preferences

Clinicians tend to prefer well-established brands with long-term safety data; however, biosimilars like RETACRIT are gaining acceptance due to cost advantages. Patient access improves where biosmilars are reimbursed or mandated by health authorities.

5. Technological Advancements and Digital Trends

There is growing interest in personalized dosing strategies and remote patient monitoring, which could influence treatment adherence and efficacy. Innovations in syringe and delivery device technology also impact patient convenience and adherence.

Financial Trajectory of RETACRIT

1. Revenue Projections

Forecasts estimate the global erythropoietin market reaching over USD 8 billion by 2030, with biosimilars accounting for a significant share. RETACRIT is positioned to benefit from rising demand, particularly in emerging markets where affordability is crucial. Revenues are expected to stabilize or slightly decline in mature markets due to biosimilar competition but may be offset by volume increases.

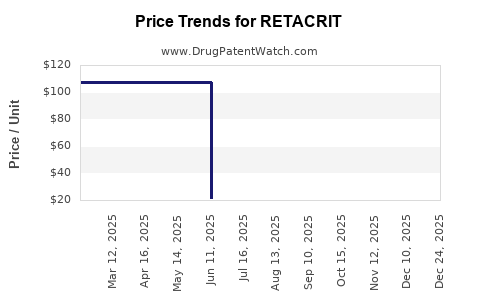

2. Pricing and Market Share

In markets where biosimilar penetration is high, price erosion is expected to reduce per-unit revenue. However, increased treatment access and expanded indications can bolster overall sales volume. Pricing strategies that balance competitiveness with innovation investments are vital for sustained profitability.

3. Research and Development Investment

Innovations such as longer-acting formulations and improved delivery mechanisms (e.g., subcutaneous administration) promise premium pricing opportunities and expanded indications (e.g., anemia in cancer patients). Investment in biosimilar development and next-generation versions is critical to market relevance.

4. Regulatory and Policy Impact

Stringent regulations on biosimilar interchangeability and substitution policies influence market share. Countries adopting substitution policies may accelerate biosimilar uptake, impacting revenue streams negatively for originator brands but positively for biosimilars like RETACRIT if positioned effectively.

5. Market Risks

Price reductions due to biosimilars, patent expirations of originator products, and evolving regulatory standards pose inherent risks. Additionally, safety concerns or adverse event reports could impact market confidence, emphasizing the value of post-market surveillance.

Strategic Opportunities and Challenges

Opportunities:

- Expansion into emerging markets with high CKD prevalence.

- Development of longer-acting formulations to reduce administration frequency.

- Strategic partnerships with healthcare providers to facilitate biosimilar adoption.

- Leveraging digital health tools for patient management.

Challenges:

- Intense price competition from biosimilars.

- Stringent regulatory requirements for biosimilar interchangeability.

- Maintaining product differentiation amid commoditization pressures.

- Variability in reimbursement and formulary policies across regions.

Conclusion

RETACRIT's market trajectory is intricately linked to the dynamic landscape of biosimilars, regulatory policies, and healthcare needs. While competitive pressures constrain pricing, expanding indications, technological enhancements, and market access strategies can sustain revenue streams. Its financial outlook hinges on balancing affordability, innovation, and regulatory compliance amidst an increasingly competitive environment.

Key Takeaways

- Epidemiological growth in CKD and anemia drives sustained demand for RETACRIT, especially in emerging markets.

- Biosimilar competition profoundly influences pricing, market share, and revenue forecasts, necessitating strategic positioning.

- Regulatory and reimbursement policies are critical, with country-specific variations impacting access and profitability.

- Innovation in formulation and delivery can create premium offerings, offsetting biosimilar price erosion.

- Global expansion into high-growth markets and digital health integration present significant revenue opportunities.

FAQs

1. How does biosimilar competition affect RETACRIT’s market share?

Biosimilars like RETACRIT introduce price competition that can erode margins and market share of originator biologics. However, biosimilars can also expand overall market volume by improving access. Strategic differentiation and formulary positioning are crucial for maintaining competitiveness.

2. What regulatory factors influence RETACRIT’s market expansion?

Regulatory approval hinges on demonstrating biosimilarity, safety, and efficacy, with policies varying by country. Interchangeability and substitution regulations significantly impact uptake, especially in markets favoring automatic substitution.

3. Which regions offer the most growth potential for RETACRIT?

Emerging markets in Asia-Pacific, Latin America, and Africa exhibit high growth potential due to increasing CKD prevalence, expanding healthcare infrastructure, and cost-sensitive reimbursement environments favoring biosimilars.

4. What technological innovations could impact RETACRIT’s financial trajectory?

Longer-acting formulations, subcutaneous delivery devices, and digital patient management tools offer opportunities for premium pricing and increased adherence, potentially boosting revenues despite biosimilar competition.

5. How do healthcare policies influence the annual revenue of RETACRIT?

Reimbursement policies, pricing negotiations, and formulary placements heavily influence sales. Policies promoting biosimilar substitution can diminish revenues of originator products, requiring proactive strategies to retain market relevance.

References

[1] Grand View Research, "Erythropoietin Market Size, Share & Trends Analysis Report," 2022.

[2] National Kidney Foundation, "CKD Prevalence & Impact," 2021.