Share This Page

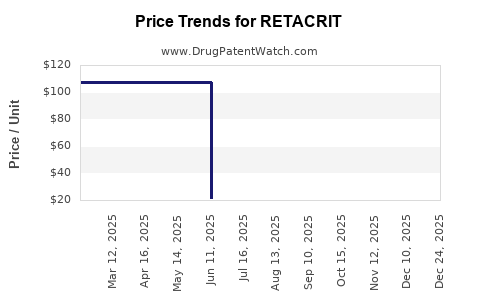

Drug Price Trends for RETACRIT

✉ Email this page to a colleague

Average Pharmacy Cost for RETACRIT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RETACRIT 10,000 UNIT/ML VIAL | 00069-1308-10 | 107.33689 | ML | 2025-12-17 |

| RETACRIT 2,000 UNIT/ML VIAL | 00069-1305-10 | 21.45400 | ML | 2025-12-17 |

| RETACRIT 20,000 UNIT/ML VIAL | 00069-1311-10 | 214.12320 | ML | 2025-12-17 |

| RETACRIT 10,000 UNIT/ML VIAL | 00069-1308-10 | 107.30240 | ML | 2025-11-19 |

| RETACRIT 20,000 UNIT/ML VIAL | 00069-1311-10 | 213.77983 | ML | 2025-11-19 |

| RETACRIT 2,000 UNIT/ML VIAL | 00069-1305-10 | 21.42183 | ML | 2025-11-19 |

| RETACRIT 20,000 UNIT/ML VIAL | 00069-1311-10 | 213.77983 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RETACRIT (Erythropoietin)

Introduction

RETACRIT (epoetin alfa-epbx) is a biosimilar erythropoietin authorized for treating anemia associated with chronic kidney disease (CKD), chemotherapy, and other conditions. As a biosimilar, it plays a crucial role in expanding access to erythropoiesis-stimulating agents (ESAs). This analysis delves into its current market landscape, competitive positioning, regulatory environment, and future price projections to guide stakeholders’ strategic decisions.

Market Overview: Demand Drivers and Therapeutic Landscape

RETACRIT operates within the biopharmaceutical segment of erythropoiesis-stimulating agents, a vital class for anemia management. The global anemia treatment market, valued at approximately $6 billion in 2022, is driven primarily by the prevalence of CKD, oncology indications, and chronic disease management [1]. The rising incidence of CKD worldwide, projected to affect over 700 million people by 2040 [2], ensures continued demand for erythropoietin therapies, including biosimilars like RETACRIT.

Advances in biosimilar technologies lower manufacturing costs and improve supply chain efficiencies, facilitating broader accessibility and fostering market entry. As biosimilars often offer comparable efficacy and safety profiles to originators, savings in healthcare systems and increased adoption are evident.

Regulatory Status and Market Adoption

RETACRIT received regulatory approval from the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) in the past three years, aligning with global biosimilar approval pathways emphasizing rigorous comparability studies [3]. Regulatory acceptance enhances market confidence, promoting reimbursement coverage and prescribing trends that favor biosimilars.

In the U.S., limited penetration of biosimilar erythropoietins has been due to prescriber hesitancy and supply chain inertia [4]. However, recent policy initiatives, such as the Medicare Part B biosimilar purchasing program, incentivize formulary adoption, boosting sales potential.

Competitive Landscape

RETACRIT's primary competitors include both originator products like Epogen (Amgen) and Procrit (Johnson & Johnson) and biosimilar counterparts such as Retacrit (another biosimilar marketed by Pfizer) and other emerging biosimilars in key markets. The biosimilar EPO class's competitive dynamics are characterized by:

- Patent expirations of originator brands, opening extensive markets.

- Price erosion among biosimilar entrants, aiming to capture volume.

- Differing provider and payer acceptance levels based on efficacy, safety, and supply chain agreements.

Manufacturers adopting flexible pricing models and demonstrating comparable clinical outcomes often gain strategic advantages amid intensity from existing competitors.

Pricing Trends and Cost Dynamics

Historically, originator erythropoietin products have commanded premium prices ranging from $200 to $500 per dose for dialysis and chemotherapy settings [5]. Biosimilars like RETACRIT typically enter the market at a 15-30% discount relative to originators, with subsequent market-driven price declines.

Recent trends indicate a stabilization of biosimilar pricing margins due to increased manufacturing efficiencies and payers' negotiations. For RETACRIT, a conservative expectation is that the product could sustain prices 25-35% below the originator in mature markets, translating to approximately $150-$350 per dose, depending on the country and indication.

Factors Influencing Price Projections:

- Market Penetration Rate: High acceptance can translate to volume-driven revenue despite lower unit prices.

- Reimbursement Policies: Favorable reimbursement can sustain higher prices temporarily.

- Competitive Entry: Additional biosimilar entrants exert downward pressure.

- Regulatory and Legal Environment: Patent disputes or regulatory delays influence pricing and availability.

Future Price and Market Projection Scenarios (2023–2028)

Based on current trends, the following projections are proposed:

Optimistic Scenario

- Market share of RETACRIT reaches 40–50% in biosimilar erythropoietin segments within five years.

- Average price stabilizes at a 30% discount to originators.

- Revenue growth of 10% compounded annually, supported by expanding indications and geographic markets.

Price Range: $150–$250 per dose globally, with regional variations based on healthcare system dynamics.

Moderate Scenario

- Market share stabilizes at 25–35%, reflecting cautious prescriber adoption.

- Prices decline gradually as competitive biosimilars enter.

- Revenue growth compounded at around 5–7% annually, influenced by market saturation and pricing pressures.

Price Range: $180–$300 per dose.

Pessimistic Scenario

- Market share remains below 20% due to stiff competition and regulatory hurdles.

- Prices further decline, approaching levels akin to generics, approximately $100–$150.

- Revenue growth stagnates or declines, with potential generic erosion.

Impact of Healthcare Policies and Market Trends

The evolution of biosimilar procurement policies directly influences RETACRIT’s pricing trajectory. Increased biosimilar adoption driven by governmental initiatives, such as the EU’s Biosimilar Action Plan [6], and payer negotiations in the U.S., will likely accelerate price reductions and volume sales.

Additionally, technological advancements in manufacturing may yield cost savings, enabling further price reductions while maintaining margins, incentivizing broader utilization.

Key Considerations for Stakeholders

- Manufacturers: Strategic investments in differentiation, such as enhanced formulation or delivery efficiency, might justify premium pricing.

- Payers: Negotiating favorable reimbursement terms can influence market share growth.

- Regulators: Streamlining approval pathways for biosimilars could promote faster market entry, impacting pricing landscapes.

- Healthcare Providers: Education on biosimilar equivalence will be critical in driving adoption.

Key Takeaways

- The global demand for erythropoietin agents remains robust, driven by rising CKD and cancer prevalence.

- RETACRIT’s competitive position benefits from current biosimilar acceptance trends, with significant growth potential if market penetration accelerates.

- Price projections for RETACRIT are contingent upon competitive dynamics, regulatory policies, and payer acceptance; prices are expected to decline gradually but stabilize in mature markets.

- Geographical disparities in adoption and pricing emphasize the importance of local healthcare policies and reimbursement frameworks.

- Strategic maneuvering by manufacturers and policymakers will shape the future landscape, influencing revenues and access.

FAQs

-

What factors most influence RETACRIT's future pricing?

Market penetration, competitive biosimilar entry, regulatory changes, payer negotiations, and healthcare policy initiatives are primary determinants. -

How does biosimilar adoption impact healthcare costs?

Increased biosimilar utilization lowers drug acquisition costs, leading to substantial savings for healthcare systems, often with comparable efficacy to originators. -

Are there significant regional differences in RETACRIT pricing?

Yes. Developed markets like the U.S. and EU typically feature higher prices due to regulatory and reimbursement differences, while emerging markets may see lower prices driven by intense price competition. -

What are the risks to price stability for RETACRIT?

Introduction of new biosimilars, regulatory hurdles, legal challenges, and changes in reimbursement policies can accelerate price erosion. -

What is the forecasted timeline for significant price reductions?

Assuming steady market adoption, notable price declines could occur within 3-5 years post-marketing, with stabilization thereafter.

Sources

[1] Grand View Research, Erythropoietin Market Size Report, 2022.

[2] Kidney Disease: Improving Global Outcomes (KDIGO), Global CKD Burden, 2021.

[3] FDA and EMA approval documentation for RETACRIT, 2021–2022.

[4] IQVIA, Biosimilar Trends Report, 2022.

[5] Medicare Payments and Pricing Data, 2022.

[6] European Commission, Biosimilar Policy Framework, 2020.

More… ↓