Last updated: September 19, 2025

Introduction

REPATHA (evolocumab) is a monoclonal antibody developed by Amgen Inc., designed to lower low-density lipoprotein cholesterol (LDL-C). Approved by the U.S. Food and Drug Administration (FDA) in 2015, REPATHA targets PCSK9—a key regulator of LDL receptor degradation—offering a significant advance in lipid management. As one of a class of PCSK9 inhibitors, REPATHA occupies a crucial position within the expanding biologic therapeutics landscape, driven by rising cardiovascular disease prevalence, evolving treatment guidelines, and the ongoing push for personalized medicine.

This analysis examines the intricate market dynamics influencing REPATHA's commercial trajectory and projects its financial outlook amid competitive, regulatory, and innovation-related factors.

Market Overview and Growth Drivers

Epidemiology and Unmet Need

Cardiovascular disease (CVD) remains the leading cause of mortality globally, affecting over 180 million individuals in the U.S. alone. Despite widespread use of statins, a subset of patients exhibits residual risk due to statin intolerance, familial hypercholesterolemia (FH), or inadequate LDL-C reduction. These unmet needs create a robust foundation for biologics like REPATHA, which offer potent LDL-C lowering, especially in high-risk cohorts.

Regulatory Approvals and Label Expansion

REPATHA's initial approval targeted individuals with heterozygous FH and clinical atherosclerotic cardiovascular disease (ASCVD). Subsequent label expansions have included indication for homozygous FH and in combination with other lipid-lowering therapies, broadening its potential patient base. Real-world evidence and studies demonstrating reductions in major adverse cardiovascular events (MACEs) further reinforce its clinical utility.

Treatment Guidelines and Physician Adoption

Leading guidelines, including the American College of Cardiology/American Heart Association (ACC/AHA), have incorporated PCSK9 inhibitors as adjunctive therapy for patients not reaching LDL-C goals. This endorsement fuels physician adoption, especially among high-risk patients inadequately managed on statins alone.

Pricing, Reimbursement, and Market Penetration

REPATHA's premium pricing (~$14,100 annually in the U.S.) has posed reimbursement challenges. However, tiered value-based contracting and patient assistance programs mitigate barriers. The drug’s high efficacy attracts payers seeking cost-effective reductions in cardiovascular events, which could enhance coverage in the long term.

Market Dynamics

Competitive Landscape

REPATHA's primary competitors include Sanofi and Regeneron’s Praluent (alirocumab), the first FDA-approved PCSK9 inhibitor. While both drugs share mechanisms and target profiles, REPATHA’s higher dosing flexibility and demonstrated efficacy have supported its market dominance. However, newer agents and biosimilars threaten to intensify competition, potentially impacting market share.

Emerging Therapeutic Alternatives

- Inclisiran (Leqvio): A small interfering RNA (siRNA) agent with biannual dosing, approved in 2020, offering improved patient adherence and convenience.

- Gene Therapy: Long-term solutions under clinical development aim to provide durable LDL-C reductions, which could disrupt current biologic market dynamics.

Market Penetration and Adoption Trends

Since launch, REPATHA’s adoption has grown gradually, driven by clinical evidence and guideline recommendations. In 2022, Amgen reported approximately $2.7 billion in global sales, representing a steady growth trajectory (amassing ~25% CAGR since 2019). Growth momentum correlates with expanded indications, improved reimbursement, and increasing awareness.

Pricing Strategies and Reimbursement Policies

REPATHA’s revenue potential hinges on effective payer negotiation. The use of prior authorization and utilization management limits access, but combined with demonstrated cost savings from reduced cardiovascular events, it strengthens payer willingness to cover the drug.

Financial Trajectory and Projections

Revenue Forecasts

Based on current market penetration, epidemiological data, and competitive positioning, REPATHA is projected to sustain a compound annual growth rate (CAGR) of approximately 8-10% over the next five years. This projection accounts for:

- Increased indication approvals.

- Growing treatment rates among high-risk populations.

- Entry of alternative therapies (e.g., inclisiran) influencing market share dynamics.

Market Expansion Opportunities

- Global Expansion: Regulatory approvals in Europe, Asia-Pacific, and emerging markets are expected to increase access and revenues.

- Private Payors and Out-of-Pocket Spending: Growing awareness among patients, especially wealthier demographics, might lead to increased out-of-pocket use, partially offsetting reimbursement barriers.

- Combination Therapies: Use alongside other lipid-lowering agents may augment market size, especially in refractory cases.

Cost and Pricing Pressure

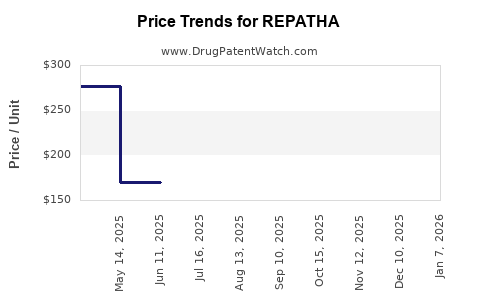

Patent expiration (expected around 2029), potential biosimilar entries, and increasing healthcare cost containment pressures could induce pricing concessions, potentially tempering revenue growth.

Research and Development Investment

Amgen’s ongoing R&D efforts, including development of next-generation PCSK9 inhibitors or alternative targets, might influence future financial outcomes through pipeline contributions, label expansions, or competitive shifts.

Regulatory and Policy Environment

Regulatory agencies’ endorsement, alongside evolving healthcare policies emphasizing value-based care, will influence REPATHA’s market penetration and profitability. The shift toward more personalized medicine and biomarker-guided therapy enhances the drug’s positioning. Moreover, regulatory incentives for biologics, such as orphan drug status for certain patient subsets, could fortify market exclusivity.

Key Market Risks

- Pricing and Payer Restrictions: Reimbursement hurdles remain formidable, potentially limiting access.

- Competitive Innovations: Inclisiran and future gene therapies pose substantial threats.

- Patent Challenges: Pending or potential patent litigations could impact exclusivity.

- Market Saturation: Increasing penetration can lead to diminishing returns.

Conclusion

REPATHA stands at the cusp of sustained growth, buoyed by high clinical efficacy, supporting guidelines, and expanding indications. However, its trajectory must navigate competitive pressures, pricing constraints, and evolving technological landscapes. Executing strategic market access initiatives and advancing pipeline innovations are pivotal for maximizing its long-term financial impact.

Key Takeaways

- Market Opportunity: The significant unmet need for potent LDL-C lowering therapies sustains REPATHA’s growth potential, particularly among high-risk populations.

- Growth Drivers: Evolving clinical guidelines, expanding indications, and global market expansion underpin revenue prospects.

- Competitive Landscape: While REPATHA maintains a leadership position, intensifying competition from agents like inclisiran may influence future market share.

- Financial Outlook: Amgen’s revenues from REPATHA are expected to grow at a CAGR of 8-10%, contingent on successful reimbursement strategies and pipeline development.

- Risks and Challenges: Pricing pressures, patent expiries, and emerging therapies pose threats that require proactive strategic responses.

FAQs

1. How does REPATHA compare to other LDL-C lowering therapies?

REPATHA offers superior LDL-C reduction (~60%) in high-risk patients, especially those intolerant to statins, with convenience in its subcutaneous dosing. Its efficacy surpasses traditional therapies but comes at a premium price point.

2. What are the primary factors influencing REPATHA’s market share?

Physician prescribing habits, reimbursement policies, patient adherence, and competitive entries like inclisiran significantly impact its market share.

3. How might upcoming biosimilars or biosimilar-like products affect REPATHA?

The entry of biosimilars could reduce pricing and reimbursement success, exerting downward pressure on revenues. However, current patent protections extend competitive threat timelines.

4. What are the key regulatory considerations for REPATHA’s future?

Regulatory agencies focus on efficacy, safety, and cost-effectiveness. Expanded approvals based on new evidence can enhance market potential, while patent litigations and biosimilar approvals can influence competitive positioning.

5. What strategic moves can enhance REPATHA’s financial trajectory?

Broadening indications, optimizing payer negotiations, developing complementary therapies, and investing in pipeline innovations are critical strategies for sustained growth.

References:

[1] Amgen Inc. Quarterly Reports, 2022.

[2] U.S. Food and Drug Administration (FDA). REPATHA (evolocumab) Approval Letter, 2015.

[3] American College of Cardiology/American Heart Association Guidelines, 2018.

[4] IQVIA. Global Cardiovascular Market Statistics, 2022.

[5] ClinicalTrials.gov. Ongoing studies on PCSK9 inhibitors and gene therapies.