Last updated: September 19, 2025

Introduction

OVIDREL (Choriogonadotropin alfa injection) is a recombinant human chorionic gonadotropin (hCG) used primarily in fertility treatments, notably for trigger injections in assisted reproductive technology (ART). As a biologic with specific niche applications, its market trajectory is influenced by technological advancements, regulatory shifts, competitive landscape, and evolving fertility treatment protocols. This analysis explores the current market dynamics, projected financial trends, and strategic considerations for stakeholders involved with OVIDREL.

Market Overview

Biologic Drugs in Fertility Treatments

Biologics constitute a significant segment within reproductive medicine, driven by increasing infertility prevalence and personalized treatment approaches. OVIDREL, approved by the FDA and various global regulatory agencies, benefits from its recombinant technology, offering a reliable alternative to urinary-derived hCG products.

Demand Drivers

- Rising Infertility Rates: According to the World Health Organization, infertility affects approximately 15% of couples globally, creating a steady demand for ART services that utilize drugs like OVIDREL [1].

- Advancements in ART: Innovations such as in-vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and embryo freezing protocols elevate the utilization of trigger agents.

- Reimbursement Policies: Governmental and insurance reimbursement strategies significantly influence accessibility and market expansion.

Competitive Landscape

OVIDREL's primary competitors include other recombinant hCG products (e.g., Ovitrelle by Merck Serono, Becogest by IBSA) and urinary-derived hCG formulations from various manufacturers. While recombinant versions offer advantages in purity and consistency, price competition remains a critical factor.

Market Dynamics

Regulatory Environment

Global regulatory policies impact OVIDREL’s market expansion. The drug has received approvals in key markets like North America, Europe, and Asia-Pacific. Regulatory delays or stricter biosimilar regulations may influence future entry and pricing strategies.

Pricing Strategies and Reimbursement

- Premium pricing is justified by the recombinant technology, but reimbursement pressures lead manufacturers to adopt differential pricing or bundling strategies.

- Market access varies among regions; countries with universal healthcare systems tend to adopt cost-effective biologics rapidly.

Technological and Product Innovation

- Biosimilars Development: The entry of biosimilars poses a competitive threat, potentially reducing prices and eroding margins.

- Formulation Enhancements: Advances in delivery mechanisms, stability, and dosing reduce treatment burden and improve patient compliance.

Market Penetration and Growth Opportunities

- Emerging Markets: Growing healthcare infrastructure and increasing infertility awareness create potential for market penetration, especially in Asia, Latin America, and parts of the Middle East.

- Combination Therapies: Integration with other fertility agents offers cross-selling opportunities and expanded indications.

Financial Trajectory and Revenue Projections

Historical Financial Performance

While specific revenue figures for OVIDREL are proprietary, industry estimates approximate its global sales at several hundred million USD annually, reflecting its status as a leading recombinant hCG product (2020-2022 data). Growth has been steady, bolstered by increased ART cycles and favorable reimbursement.

Forecasting Factors

- Market Growth Rate: The ART market is projected to grow at a CAGR of approximately 8-10% through 2030, driven by demographic trends and technological adoption [2].

- Drug Adoption Rate: As clinical guidelines increasingly favor recombinant products, a higher adoption rate of OVIDREL is expected.

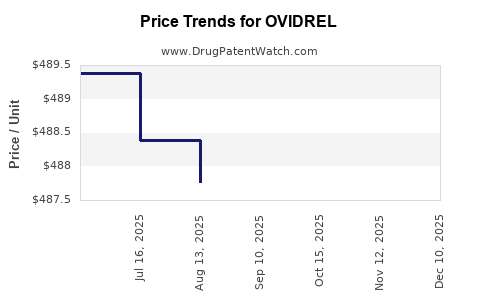

- Price Trends: Competitive pressures and biosimilar entries could induce price erosion, particularly in cost-sensitive emerging markets.

Revenue Outlook (2023-2028)

- Base Case Scenario: Sustained growth at 6-8% annually, reaching approximately $0.8 billion by 2028.

- Best-Case Scenario: Accelerated adoption in new markets and technological upgrades could push revenues beyond $1 billion.

- Downside Risks: Price wars, regulatory setbacks, or decreased ART demand could impede growth.

Strategic Considerations

Market Expansion

Entering underserved regions with increasing infertility rates represents a primary growth avenue. Strategic partnerships with local healthcare providers and insurance companies can facilitate market penetration.

Portfolio Diversification

Launching biosimilar versions or formulation variants provides avenues for revenue stabilization amid pricing pressures. Investing in innovations like long-acting formulations could also distinguish OVIDREL from competitors.

Regulatory Navigation

Proactive engagement with regulatory authorities aids in faster approvals and adherence to evolving biosimilar standards, ensuring continued market access.

Key Challenges

- Intense Competition: Biosimilar entries threaten profit margins.

- Pricing Pressures: Reimbursement policies drive down prices, especially in mature markets.

- Regulatory Uncertainty: Variability in approval pathways across regions increases operational complexity.

- Market Saturation: In developed markets, growth slows as the market matures.

Conclusion

OVIDREL's market dynamics are shaped by a confluence of technological advancements, demographic trends, and competitive pressures. Its financial trajectory hinges on strategic positioning within an expanding ART market that is increasingly global, innovative, and cost-conscious. While growth prospects are promising, particularly in emerging markets, stakeholders must navigate regulatory uncertainties and pricing challenges to maximize value.

Key Takeaways

- The global ART market's robust growth underpins steady demand for biologic trigger agents like OVIDREL.

- Technological innovations and biosimilar proliferation present both opportunities and competitive threats.

- Market expansion in emerging economies offers substantial growth prospects, contingent upon strategic local partnerships.

- Regulatory landscapes necessitate proactive compliance strategies to sustain market access and revenue streams.

- Price moderation and reimbursement policies could impact profitability; innovation and diversification remain critical.

FAQs

1. What are the primary clinical advantages of OVIDREL over urinary-derived hCG?

Recombinant OVIDREL offers superior purity, batch-to-batch consistency, and lower immunogenicity compared to urinary-derived formulations, resulting in enhanced safety and efficacy profiles.

2. How does the entry of biosimilars affect OVIDREL’s market share?

Biosimilars introduce price competition, potentially reducing OVIDREL’s market share and margins. However, brand recognition, clinical familiarity, and regulatory barriers may delay biosimilar penetration in certain regions.

3. What regions represent the most promising growth opportunities for OVIDREL?

Emerging markets in Asia-Pacific, Latin America, and parts of the Middle East demonstrate significant growth potential due to rising infertility rates and expanding healthcare infrastructure.

4. How might regulatory changes influence OVIDREL’s future revenue?

Stricter biosimilar regulations or increased approval costs could challenge profitability. Conversely, streamlined pathways and supportive policies could accelerate market entry and expansion.

5. What strategic moves should stakeholders prioritize to sustain OVIDREL’s growth?

Investing in formulation innovations, expanding into new markets, forming strategic alliances, and engaging proactively with regulators are essential to maintaining competitive advantage.

References

[1] World Health Organization. (2018). Infertility: A Multidimensional Approach. WHO.

[2] Grand View Research. (2022). Fertility Services Market Size, Share & Trends Analysis Report.

This comprehensive analysis aims to inform stakeholders on the strategic, regulatory, and economic facets shaping OVIDREL’s market trajectory, enabling data-driven decisions in a competitive landscape.