Last updated: September 23, 2025

Introduction

NOVOLIN N, a biosimilar insulin glargine, has garnered significant attention within the global diabetes management landscape. As an injectable long-acting insulin analog, NOVOLIN N positions itself as a more affordable alternative to originator brands like Lantus (Sanofi). Its trajectory is influenced by evolving market dynamics that encompass regulatory developments, competitive pressures, healthcare provider adoption, and patient preferences. This analysis explores the current market environment and forecasts the financial trajectory of NOVOLIN N based on underlying industry trends.

Market Landscape and Growth Drivers

Global Diabetes Epidemic and Insulin Demand

The rising prevalence of diabetes—particularly type 2 diabetes—serves as the fundamental market driver for insulin products. The International Diabetes Federation estimates over 537 million adults affected globally, with projections exceeding 700 million by 2045 [1]. This trend guarantees sustained demand for insulin therapies, creating considerable opportunities for biosimilar entrants such as NOVOLIN N.

Biosimilars as Market Disruptors

Biosimilars have disrupted traditional pharmaceutical paradigms by offering cost-effective alternatives to branded biologics. The entry of biosimilar insulin products like NOVOLIN N is propelled by patent expirations of blockbuster insulins, with Eli Lilly’s Basaglar and Sanofi’s Lantus leading the competitive effort. Regulatory bodies have increasingly facilitated biosimilar approvals, especially in the European Union and emerging markets, reducing barriers to entry [2].

Pricing and Access Advantages

Cost reduction remains a defining factor. Biosimilars typically retail at 15-30% lower prices, significantly enhancing access in middle- and low-income countries. Governments and healthcare systems incentivize biosimilar adoption—via formulary preferences and prescribing guidelines—further driving uptake [3].

Emerging Markets' Role

Emerging economies, notably India, China, and Brazil, are pivotal for NOVOLIN N's growth. These markets face burgeoning diabetes prevalence coupled with limited healthcare budgets, making affordable biosimilars attractive. The Indian pharmaceutical industry, with its robust manufacturing infrastructure, is a key regional hub for biosimilar insulin production [4].

Market Challenges and Competitive Dynamics

Regulatory and Reimbursement Hurdles

Despite favorable trends, biosimilars face complex regulatory landscapes. Approval processes demand extensive comparability data, and reimbursement policies differ significantly across countries, often delaying commercialization. For NOVOLIN N, gaining acceptance within payers' formularies remains critical.

Brand Loyalty and Physician Perceptions

Physician confidence in biosimilars hinges on clinical equivalence, safety, and a well-established track record. Some prescribers remain cautious about switching stable patients from originators to biosimilars, affecting initial uptake [5].

Manufacturing and Supply Chain Considerations

Ensuring consistent quality and supply chain robustness is vital. Production complexity and quality assurance influence market penetration, especially in countries with stringent regulatory standards.

Pricing Competition

The biosimilar insulin market is highly price-competitive: Sanofi’s Lantus and Lilly’s Basaglar compete aggressively, with notable price cuts in mature markets. To succeed, NOVOLIN N must differentiate via pricing strategies, quality assurance, and strategic partnerships.

Financial Trajectory and Revenue Forecasts

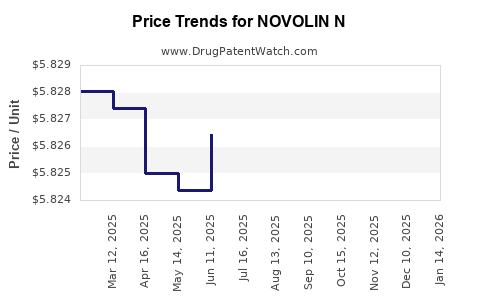

Short-term Outlook (2023-2025)

In the immediate future, NOVOLIN N's revenues will likely experience gradual growth. Market penetration depends on initial acceptance in key markets like India, China, and Latin America. Early commercial success hinges on securing formulary inclusion, clinician acceptance, and patient affordability programs.

Key Strategies for Growth

- Market Penetration: Focus on volume-based growth in price-sensitive markets.

- Partnerships: Collaborations with local distributors bolster distribution networks.

- Regulatory Approvals: Accelerated approvals in emerging markets can boost revenue streams.

- Differentiation: Emphasizing manufacturing quality and safety profile enhances prescriber confidence.

Medium to Long-term Outlook (2026-2030)

Projected revenues are expected to grow substantially with expanded market penetration, especially as biosimilar insulin adoption accelerates globally. Based on industry trends and estimates from market research firms [6], the biosimilar insulin market could compound at a CAGR of 11-13% over this period.

Under conservative assumptions, NOVOLIN N could capture a 5-7% share of the global insulin market by 2030, translating into several hundred million USD in annual revenues. A hypothetical scenario emphasizes:

- Market Share Expansion: Ascending from initial niche to mainstream adoption.

- Geographical Diversification: Penetration in Western countries, where biosimilar acceptance is increasing.

- Pricing Dynamics: Competitive pricing strategies to sustain volume growth.

Profitability and Investment Outlook

Given the high R&D and regulatory compliance costs, profit margins will initially be modest. However, economies of scale, manufacturing efficiencies, and increased market acceptance will improve profitability over time. Strategic investments in manufacturing capacity and clinician education are essential for sustainable growth.

Impact of Regulatory and Policy Developments

Global regulatory agencies' endorsements, such as the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA), will influence NOVOLIN N's trajectory. Evolving policies favoring biosimilars' substitution and prescribing facilitate rapid market expansion.

Policy shifts, including incentivization for biosimilar use and reduced reimbursement barriers, particularly in Europe and Asia, will bolster revenues.

Conclusion

The financial trajectory of NOVOLIN N is aligned with the broader biosimilar insulin market's evolution—marked by growth, competitive pricing, and increased acceptance. While challenges persist, especially regarding regulatory approval and prescriber confidence, strategic positioning in emerging markets coupled with ongoing approvals will drive revenue expansion over the next decade.

Key Takeaways

- Growing Demand: Rising global diabetes prevalence fuels sustained demand for insulin, notably biosimilars like NOVOLIN N.

- Market Penetration: Initial success depends on regulatory approvals, formulary inclusion, and physician trust.

- Pricing Advantage: Cost-effective biosimilars facilitate access in emerging economies, propelling revenue growth.

- Competitive Landscape: Differentiation through quality, supply chain robustness, and strategic partnerships are critical.

- Forecasted Growth: With increased acceptance and geographical expansion, NOVOLIN N could achieve significant revenue milestones, bolstered by favorable policies and market trends.

FAQs

1. How does NOVOLIN N compare to other biosimilar insulins in terms of market share?

NOVOLIN N is a relatively new entrant, competing mainly on price and regional presence. It currently commands a smaller share compared to established biosimilars like Basaglar, but strategic expansion in emerging markets could enhance its market position.

2. What regulatory factors influence NOVOLIN N’s adoption?

Regulatory approval processes, guidelines overseeing biosimilar interchangeability, and reimbursement policies determine market entry speed and adoption rates. Favorable policies accelerate commercialization, especially in Asia and Latin America.

3. How significant are pricing strategies for NOVOLIN N’s success?

Pricing is crucial. Competitive pricing improves affordability and accelerates market penetration, especially where healthcare budgets are constrained. Economies of scale and cost efficiencies are essential to sustain low prices while maintaining margins.

4. What role do healthcare provider perceptions play?

Physician confidence in biosimilar efficacy and safety directly impacts prescription rates. Education campaigns and clinical data demonstrating equivalence are vital for building trust.

5. What are the long-term revenue prospects for NOVOLIN N?

Assuming steady regulatory approvals, market expansion, and favorable policies, NOVOLIN N has the potential for significant long-term revenue growth, aligning with the projected CAGR of the biosimilar insulin market.

References

[1] International Diabetes Federation. (2022). IDF Diabetes Atlas, 10th Edition.

[2] European Medicines Agency. (2022). Biosimilars: Overview.

[3] IMS Institute for Healthcare Informatics. (2021). The Impact of Biosimilars on Market Access and Pricing.

[4] Indian Department of Pharmaceuticals. (2022). Biosimilars Industry Overview.

[5] FDA. (2021). Biosimilar Drug Development: Guidance and Best Practices.

[6] MarketsandMarkets. (2022). Biosimilar Insulin Market Forecast, 2022-2030.