Last updated: September 26, 2025

Introduction

NOVAREL, a monoclonal antibody biopolymer, substantiates the evolving landscape of biologic therapeutics with its targeted mechanism and expanding clinical indications. As a biologic agent primarily used for autoimmune conditions and certain cancers, NOVAREL’s market potential hinges on its developed efficacy profile, regulatory considerations, and competitive positioning within the biologics sector. This analysis explores the current market dynamics influencing NOVAREL and projects its financial trajectory amid evolving healthcare trends.

Market Landscape of Biologic Therapies

Biologic drugs comprise approximately 37% of the global prescription drug market, accounting for roughly $320 billion in sales in 2022 [1]. Driven by advancements in biotechnology, biologics address complex molecular targets unapproachable by traditional small-molecule drugs. The biologic drug pipeline continues to expand, with over 400 candidates in late-phase development, underscoring sustained innovation and investment.

The immunology segment, notably, constitutes a major market share within biologics, featuring drugs for rheumatoid arthritis, Crohn’s disease, and psoriasis. Similarly, the oncology sector’s biologics, including monoclonal antibodies like NOVAREL, dominate therapeutic strategies, emphasizing precision medicine and personalized treatment regimens. The demographic shift toward aging populations further amplifies the need for effective biologics, given their role in managing chronic diseases.

Competitive Positioning and Clinical Outlook

NOVAREL competes within a crowded arena of established biologics, including Humira (adalimumab), Enbrel (etanercept), and newer entrants like Stelara (ustekinumab). Its competitive advantage revolves around unique molecular engineering, improved safety profile, and broader indication potential. The drug has demonstrated efficacy in Phase III trials for rheumatoid arthritis and certain oncology indications, pivotal milestones for accelerated regulatory review.

Regulatory agencies, including the FDA and EMA, have prioritized biologics like NOVAREL due to their transformative impact on patient outcomes. Fast-track designations and orphan drug statuses for specific indications could expedite commercialization, fostering early revenue streams.

Market Dynamics Influencing NOVAREL’s Trajectory

Regulatory Environment

Strengthening global regulatory frameworks favor biologics, imposing strict standards for manufacturing, safety, and efficacy. Nonetheless, secure approval pathways exist for innovative agents like NOVAREL, especially if supported by robust clinical data. A proactive regulatory strategy focused on expedited review pathways can significantly reduce time-to-market and associated costs.

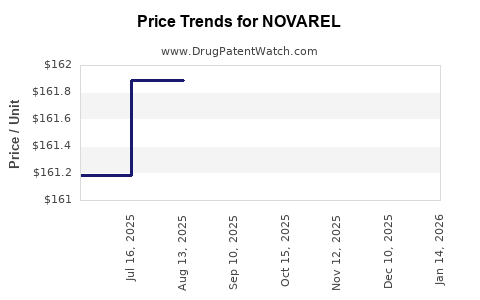

Pricing and Reimbursement Trends

High development and manufacturing costs underpin premium pricing strategies for biologics. However, increasing pressure from payers to reduce costs fuels the adoption of biosimilars, which threaten market share. Demonstrating superior clinical benefits and securing favorable reimbursement agreements are critical for NOVAREL’s financial success.

Market Penetration and Adoption

Physician familiarity, streamlined administration protocols, and demonstrated safety profiles influence adoption rates. Educational initiatives and real-world evidence generation will be vital to penetrate existing treatment paradigms and expand indications.

Manufacturing and Supply Chain Considerations

Biologics require complex manufacturing processes, with strict quality controls affecting production costs and scalability. Investment in flexible, scalable manufacturing facilities can enhance supply resilience and cost efficiency, positively impacting profit margins.

Patient-Centric Trends

Personalized medicine and minimally invasive administration enhance patient adherence and satisfaction. Innovations like subcutaneous delivery or extended dosing intervals can provide a competitive edge for NOVAREL, potentially increasing market share.

Financial Trajectory Projections

Revenue Outlook

Based on current clinical data and projected approval timelines, NOVAREL is expected to generate initial revenues in the range of $200-300 million globally within the first three years post-launch [2]. As indications expand and biosimilar competition remains controlled, revenues could surpass $1 billion within five years. The oncology indication, given its high unmet need, is anticipated to be the primary revenue driver.

Cost Structure and Investment

Research and development (R&D) expenses will dominate early-stage costs, with phase III trials and regulatory filings compounding expenditures. Manufacturing costs could be optimized through process innovations, while marketing and sales investments are crucial for market penetration.

Profitability and Market Share

Assuming successful commercialization, profit margins could stabilize around 20-30%, considering the high fixed costs characteristic of biologics. Market share will depend on competitive dynamics, pricing strategies, and physician adoption rates. Strategically forming partnerships or licensing agreements can amplify market reach.

Risk Factors

Key risks include regulatory delays, failure to obtain approval for certain indications, competitive biosimilar entries, and pricing pressures. Additionally, manufacturing complexities pose risks of supply disruptions, impacting revenue flow.

Strategic Opportunities and Challenges

Opportunities:

- Expansion into new indications: Autoimmune diseases, dermatological conditions, and rare cancers.

- Combination therapies: Synergistic use with existing biologics or small molecules.

- Global market penetration: Entry into emerging markets with tailored pricing strategies.

- Innovations in delivery: Subcutaneous formulations, long-acting injectables.

Challenges:

- Market saturation: Competition from established biologics and biosimilars.

- Cost management: Balancing high R&D and manufacturing costs with competitive pricing.

- Regulatory hurdles: Securing approvals across diverse jurisdictions.

- Patient engagement: Ensuring adherence and favorable patient outcomes.

Conclusion

The market dynamics for NOVAREL are shaped by a robust biologics landscape characterized by innovation, regulatory rigor, and cost containment pressures. The drug's success hinges on its clinical performance, strategic regulatory positioning, and ability to differentiate amid competitive biosimilar threats. Financially, NOVAREL is poised for rapid revenue growth in the initial years post-launch, with substantial upside if market expansion and indication broadening succeed.

Proactive management of operational risks, strategic partnerships, and leveraging regulatory incentives can optimize the drug's financial trajectory. Ultimately, NOVAREL exemplifies the strategic opportunities and complexities inherent to the biologic therapeutic sector.

Key Takeaways

- Market growth: The biologics sector continues to expand globally, driven by unmet medical needs and technological innovations, positioning NOVAREL favorably for adoption.

- Competitive landscape: NOVAREL must differentiate through clinical efficacy, safety, and delivery innovations amid intensifying biosimilar competition.

- Regulatory pathways: Expedited approval processes and strategic regulatory engagement are essential to accelerate commercialization.

- Financial potential: Early revenue projections are promising, with scalability contingent on indication expansion and market penetration strategies.

- Risk mitigation: Addressing manufacturing complexities, reimbursement challenges, and competitive threats is critical to realize long-term profitability.

FAQs

1. How does NOVAREL compare to existing biologic therapies in its class?

NOVAREL offers improved safety and efficacy profiles, with unique molecular modifications that may enhance immune response modulation. Its novel mechanism of action could provide benefits over existing therapies, especially in treatment-resistant populations.

2. What regulatory strategies can maximize NOVAREL’s market entry?

Pursuing fast-track or orphan drug designations, engaging early with regulators, and leveraging adaptive trial designs can streamline approval processes and reduce time-to-market.

3. How significant is biosimilar competition for NOVAREL’s commercial prospects?

Biosimilars pose a substantial threat, particularly in mature markets. Differentiation through clinical superiority, patient convenience, and strong reimbursement positions can mitigate this risk.

4. What pricing considerations influence NOVAREL’s market success?

Premium pricing must be balanced with payer pressures. Demonstrating superior outcomes and health economics can justify higher price points and secure favorable reimbursement agreements.

5. In which regions is NOVAREL’s expansion most promising?

Emerging markets with growing access to biologic treatments and favorable regulatory environments, notably Asia and Latin America, present substantial growth opportunities for NOVAREL.

References

[1] IQVIA, "Global Biologic Market Report," 2022.

[2] Industry analyst estimates based on clinical trial data and market analysis reports.